Getting Paid: Calculating Wages, Overtime, Penalty rates and more

Summary

TLDRThe script explains various methods of employee compensation, focusing on wages, overtime, penalty rates, and allowances. It illustrates how wages are calculated by the hour, with overtime pay at 'time and a half' or double time. Penalty rates vary by day and shift, with higher rates for casual employees and public holidays. Allowances, such as vehicle usage, are additional payments for extra job responsibilities. The script uses examples to demonstrate calculations for each type of pay, emphasizing the importance of systematic approach and understanding pay structures.

Takeaways

- 💼 Wages are typically paid by the hour, and can be calculated by multiplying the hours worked by the hourly rate.

- 🕒 Overtime pay is given for work exceeding regular hours, often at a rate of 'time and a half' or double the regular rate.

- 🕰 The example of Bob shows that overtime pay can significantly increase total earnings, especially when it includes both time and a half and double time rates.

- 📊 Understanding the calculation of regular pay, time and a half, and double time is crucial for determining total pay for overtime work.

- 🏢 Penalty rates vary by location and employment status, with different rates for full-time and casual employees, as well as for specific times and days like public holidays.

- 📈 The script uses Alice's example to illustrate how penalty rates can affect earnings, especially when working late nights, on Sundays, or public holidays.

- 🔢 Systematic calculation is necessary for accurately determining pay with penalty rates, considering different rates for different time periods within a shift.

- 🚗 Allowances are additional payments for specific job requirements, such as using one's own vehicle for work, and are shown in Richard's example.

- 📝 Richard's scenario demonstrates how allowances can be incorporated into total pay, by calculating base pay plus the additional amount for hours worked using his own vehicle.

- 📋 The importance of reading and understanding pay tables is highlighted, as they help in systematically calculating earnings with various rates and allowances.

- 💰 The script covers a comprehensive overview of how wages, overtime, penalty rates, and allowances contribute to an employee's total pay.

Q & A

What is the basic concept of wages as described in the script?

-Wages are a form of payment where an employee is paid by the hour. For example, if Bob works seven hours at $15 per hour, his total pay is calculated by multiplying the hours worked (7) by his hourly rate ($15), resulting in a total pay of $105.

What is overtime and how is it typically compensated?

-Overtime refers to the hours worked beyond the regular amount of time an employee is expected to work in a day. It is typically compensated at a higher rate, such as 'time and a half' or 'double time'. For instance, if Bob's base pay is $12 per hour, for overtime, he would earn $18 per hour (time and a half) and $24 per hour (double time).

How does the script calculate the total pay for someone working with regular, time and a half, and double time rates?

-The total pay is calculated by summing the pay for regular hours, time and a half hours, and double time hours. For example, if an employee works 8 hours at $12 per hour, 3 hours at time and a half ($18 per hour), and 2 hours at double time ($24 per hour), the total pay is obtained by adding the pay for each category.

What are penalty rates and how do they differ between full-time and casual employees?

-Penalty rates are additional rates of pay for working outside of regular hours or on certain days, such as Sundays or public holidays. They differ between full-time and casual employees, with casual employees typically receiving higher rates due to the lack of job security and the unpredictability of their work hours.

How does the script describe the calculation of pay for Alice who worked different shifts with varying penalty rates?

-Alice's pay is calculated by considering the different penalty rates for each shift. For example, if she worked late night shifts, she would receive an additional 10% for hours worked from 10 p.m. to midnight, and an additional 15% for hours worked past midnight. On Sundays, if she was a casual employee, she would receive a 150% penalty rate for the hours worked.

What is an allowance and how is it incorporated into an employee's pay?

-An allowance is an additional payment made to an employee for performing tasks that go above and beyond their regular job duties. For example, Richard receives an extra $7 per hour when using his own vehicle for work, due to the wear and tear on his car. This allowance is added to his base hourly rate for the hours he worked using his own vehicle.

How does the script illustrate the calculation of Richard's total pay for a week where he used his own vehicle for part of the time?

-Richard's total pay is calculated by adding the pay for the hours he worked at his base rate ($28 per hour) to the pay for the hours he worked using his own vehicle ($35 per hour, which includes the base rate plus the allowance). The total pay is found by multiplying the number of hours in each category by their respective rates and summing the results.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

2 Payroll Orientation Part 2

8) CHRA Set I Drills. Compensation Administration by Zarate. Chapter I. HREAP Reviewer. HR terms.

4) CHRA by HREAP Reviewer. Drills for Philippine Labor Code & HR Laws. SET II. Book 3 - COE

Biaya Tenaga Kerja Dlm Akuntansi Biaya

Payroll Orientation Part 1

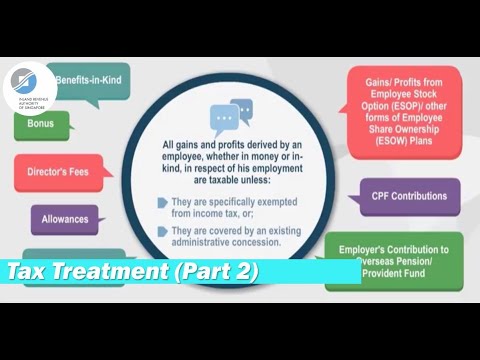

Tax Treatment of Remuneration Components (Part 2)

5.0 / 5 (0 votes)