2022 ICT Mentorship Episode 18

Summary

TLDRThis video provides a comprehensive, step-by-step guide to professional trading using multi-timeframe analysis. The instructor demonstrates setting up daily, hourly, 15-minute, and 5-minute charts, identifying fair value gaps, imbalances, and valid order blocks, and using these to structure entries, exits, and stop-losses. Emphasis is placed on trading within New York session kill zones, risk management, and avoiding overly tight stops. Viewers are guided to create a study journal, annotate charts, and backtest trades to recognize recurring price action patterns. The approach is practical, indicator-free, and adaptable across FX, bonds, and indices, fostering consistent, high-probability trading decisions.

Takeaways

- 📊 Use multiple time frames (daily, hourly, 15-minute, and 5-minute) to gain a comprehensive view of the market and manage trades effectively.

- ✏️ Annotate your charts with key levels, imbalances, fair value gaps, and order blocks to create a study journal for backtesting and reference.

- ⚖️ Focus on the parent (higher) time frame imbalances first, as they govern the structure and behavior of lower time frame setups.

- 📌 The 15-minute time frame often serves as the 'bellwether' chart for intraday bias and fine-tuning entries.

- 🛑 Proper risk management is crucial: set stop-loss levels based on swing highs, imbalances, or order blocks rather than ultra-tight thresholds.

- 🔁 Consistency in logging trades and observing price action daily helps develop pattern recognition and psychological resilience.

- 📈 An order block is valid only when it aligns with a preceding imbalance; it does not require trading into the last up-close candle before the move down.

- ⏰ Use 'kill zones' (specific market sessions like the New York session) to determine optimal entry points and order placements.

- 📖 Studying price action in hindsight builds a trader’s own technical analysis framework, eliminating reliance on external indicators or books.

- 💡 Focus on repeatable patterns in the market, recognizing similarities without expecting exact replication, to improve trade decision-making.

- 🖥️ A single-monitor setup can work with careful chart linking and annotations, avoiding unnecessary complexity or equipment.

- ⚠️ Avoid being swayed by oversimplified strategies or misleading information from other sources; always verify concepts like order blocks with proper rules.

Q & A

What is the recommended chart setup for trading with a single monitor?

-The speaker recommends using a layout with the daily chart in the upper left, the hourly chart in the lower left, and the 15-minute chart on the right as the primary bellwether chart. Annotations from higher time frames are transposed to lower ones to maintain context.

Why does the 15-minute chart serve as the bellwether chart?

-The 15-minute chart provides intraday information crucial for managing positions, hunting for new trade setups, and validating the intraday bias derived from higher time frames.

How does the speaker suggest marking the start of a new trading day?

-A vertical line should be placed at midnight New York local time to denote the start of a new day, with the opening price of that candle used as a reference point for trade setups.

What is the significance of fair value gaps in this trading approach?

-Fair value gaps indicate imbalances in price action. Higher time frame gaps act as 'parent' imbalances that influence lower time frame setups, guiding traders to minimum target levels and entry points.

How should a trader determine the proper stop-loss level?

-Stop-loss levels should be set above relevant highs or imbalances, not necessarily based on the last up-close candle. This accounts for higher time frame influences and reduces the risk of over-leveraging.

What is the speaker's definition of an order block?

-An order block is defined as a zone where the market's algorithm changes its state of delivery, typically identified by consecutive candles that lead to an imbalance and a subsequent directional move.

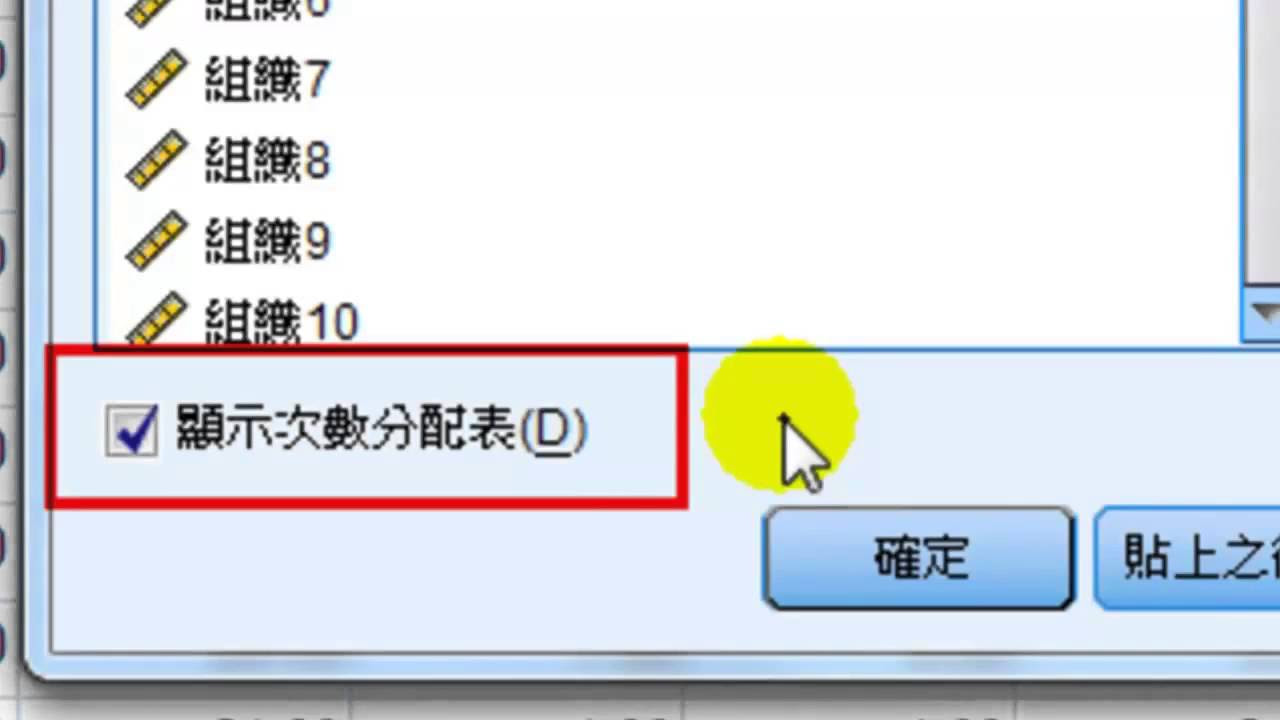

Why is it important to annotate charts and keep a study journal?

-Annotation and journaling help traders track repeating price action patterns, evaluate trade setups in hindsight, and build a personalized technical analysis library that enhances long-term skill and market intuition.

Why does the speaker caution against using ultra-short stop losses?

-Ultra-short stop losses create high stress and a greater likelihood of being stopped out, especially when trading with larger position sizes. The focus should be on letting trades reach favorable levels rather than trying to micro-manage risk.

How should traders approach entering trades during kill zones?

-Traders should have their limit orders set based on setups that form within the kill zone window. If an entry cannot be clearly defined during that time, it is better to wait for the next opportunity rather than taking unnecessary risk.

What is the speaker's stance on using indicators versus pure price action?

-The speaker advocates for relying solely on price action, highlighting key levels such as fair value gaps and order blocks, instead of using indicators like moving averages or oscillators, which can create a 'religious' trading style detached from actual market behavior.

How does the speaker suggest learning and improving as a trader?

-Traders should consistently annotate charts, log observations, and analyze past price action in hindsight. Over time, this builds an intuitive understanding of repeating market signatures, allowing for better recognition of trade setups and risk management.

Why does the speaker prefer certain markets like forex and index futures over gold?

-Gold is event-driven and highly manipulated, making it less suitable for consistent short-term trading. Forex and index futures provide clearer, more predictable price action patterns, which align better with the study and application of fair value gaps and order blocks.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

UT BOOTCAMP EP 14 : STRATEGI ENTRY DI M1, MODAL 300K KE 5-6 JUTA HANYA 2 MINGGU AJA!!

Photon Solana Tutorial: How To Use Photon Sol (2024)

TEKNIKAL ANALISIS DARI NOL SAMPAI MAHIR | TRADING MASTERCLASS

FVG Trading Strategy Explained (Fair Value Gaps)

How to Start Forex Trading as a BEGINNER in 2025 (Full Guide)

一夜。統計學:敘述統計

5.0 / 5 (0 votes)