Debits and Credits for Beginners

Summary

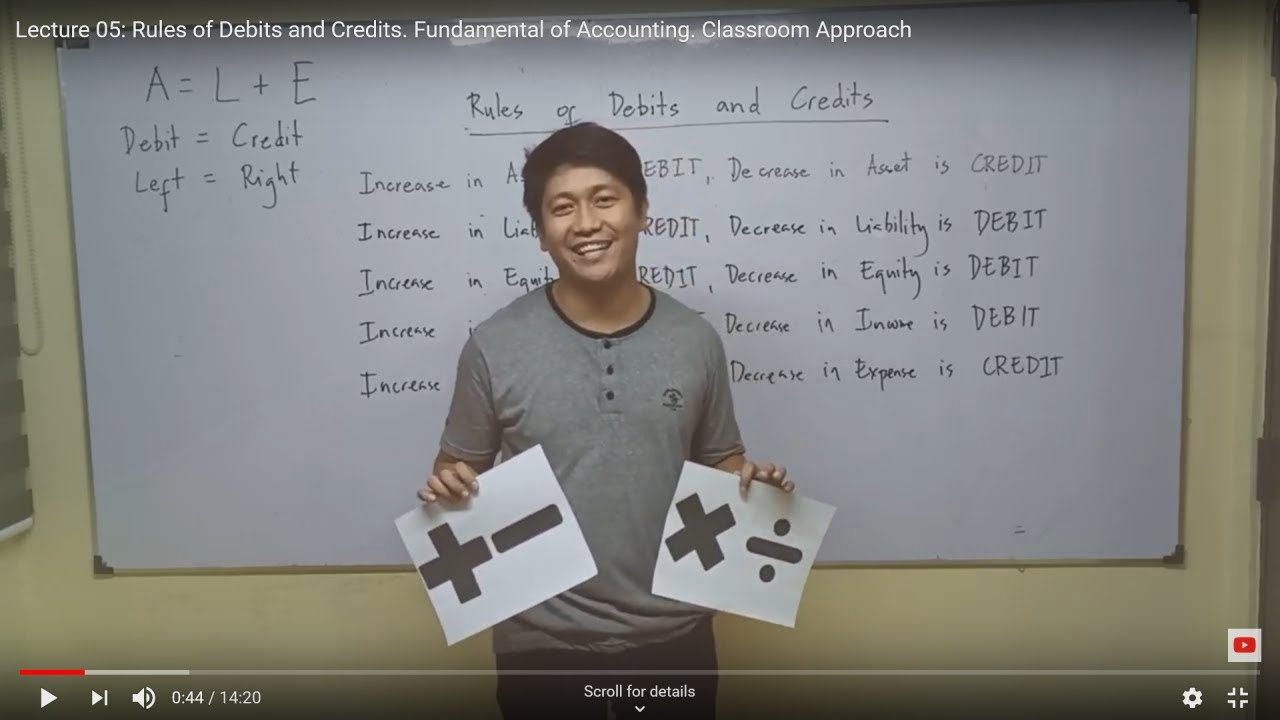

TLDRThis video introduces the foundational concepts of debits and credits in accounting, emphasizing their impact on the accounting equation (Assets = Liabilities + Equity). It explains how debits and credits affect different accounts like assets, expenses, dividends, liabilities, equity, and revenue. Using simple acronyms like 'DEAD' (Debit Expenses, Assets, Dividends) and 'CLEAR' (Credit Liabilities, Equity, Revenue), the video walks through examples of transactions, highlighting how to classify and record changes in these accounts. The key takeaway is that debits and credits must always balance in every transaction.

Takeaways

- 😀 The accounting equation is crucial: Assets = Liabilities + Equity. This equation should be remembered and applied in all transactions.

- 😀 Debits and credits are key terms in accounting that affect accounts in different ways depending on the type of account.

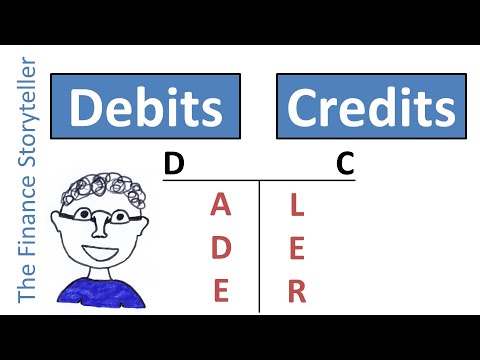

- 😀 Use the acronym DEAD to remember which accounts increase with a debit: Expenses, Assets, and Dividends.

- 😀 To increase an asset account, debit it. For example, buying supplies increases the supplies account, so it is debited.

- 😀 If an asset decreases, such as when cash is used to buy supplies, you must credit the asset account (in this case, cash).

- 😀 To increase liability, revenue, or equity accounts, credit them. For example, taking on debt increases liabilities, so they are credited.

- 😀 Credits and debits must always balance in every transaction. This is the core principle of double-entry accounting.

- 😀 An expense account increases with a debit. For example, when you purchase advertising, the advertising expense account is debited.

- 😀 Liabilities, revenues, and equity accounts increase with a credit. For example, issuing stock increases equity, which is credited.

- 😀 The acronyms DEAD (debits increase Expenses, Assets, Dividends) and C.L.E.R. (credits increase Liabilities, Equity, and Revenue) help remember how to apply debits and credits.

- 😀 Practice is essential to mastering debits and credits. Repetition through homework, note cards, and reviewing videos will solidify your understanding.

Q & A

What is the fundamental accounting equation that must always balance?

-The accounting equation is: Assets = Liabilities + Equity. This equation must always be in balance for accurate accounting.

What does the acronym 'DEAD' represent in accounting?

-'DEAD' stands for Debit, Expenses, Assets, and Dividends. This means that when these accounts increase, they are debited.

If you purchase supplies with cash, what happens to the accounts involved?

-When you buy supplies with cash, supplies (an asset) increases, so you debit supplies. Cash (another asset) decreases, so you credit cash.

What does the acronym 'CLER' stand for and how is it used?

-'CLER' stands for Credit, Liabilities, Equity, and Revenue. When these accounts increase, they are credited.

How does a debit affect an expense account?

-When an expense account increases, you debit it. This is because expenses are increased with debits.

How would you record the issuance of stock and its effect on accounts?

-When stock is issued, equity increases, so you credit equity. If cash is received for the stock, cash (an asset) increases, so you debit cash.

What is the relationship between debits and credits in accounting transactions?

-In every accounting transaction, the total amount of debits must equal the total amount of credits to maintain balance.

What happens when a liability account increases?

-When a liability account increases, it is credited. Liabilities increase with credits.

How does the accounting treatment differ for asset accounts compared to liability accounts?

-Asset accounts increase with debits, while liability accounts increase with credits. This is a key distinction in accounting entries.

What should you do if you're unsure whether to debit or credit a specific account?

-You can use the acronyms 'DEAD' for debits (Expenses, Assets, and Dividends) and 'CLER' for credits (Liabilities, Equity, and Revenue) to guide your decision-making on whether to debit or credit an account.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)