UPI - Unified Payments Interface - A Primer

Summary

TLDRThis video provides a comprehensive primer on India's Unified Payments Interface (UPI), exploring its significance in revolutionizing real-time payments. It covers a brief history of previous payment systems like NEFT and IMPS, the evolution to UPI, and key terminologies involved. The video delves into the customer registration process, how UPI handles secure transactions, and the roles of different parties like payer and payee PSPs, beneficiary, and remitter banks. Key concepts like Virtual Payment Address (VPA) and transaction flows are explained, with a focus on UPI’s impact on ease of transactions and enhanced security features.

Takeaways

- 😀 UPI (Unified Payments Interface) is a real-time payment system launched by the National Payments Corporation of India (NPCI), allowing users to transfer money instantly using mobile numbers or Virtual Payment Addresses (VPAs).

- 😀 UPI revolutionized the traditional banking payment systems by breaking the connection between a payment method and a specific bank or scheme, providing flexibility for users to link multiple bank accounts to a single UPI app.

- 😀 UPI introduced intelligent two-factor authentication where the device used by the customer becomes the first factor and the UPI PIN becomes the second factor, unlike traditional OTP-based authentication.

- 😀 UPI supports Peer-to-Peer (P2P) and Peer-to-Merchant (P2M) transactions, offering both push and pull payment mechanisms. It also supports recurring payments in UPI 2.0.

- 😀 UPI has experienced exponential growth, with the total transaction volume reaching five lakh four thousand eight hundred crores.

- 😀 Before UPI, India used EFT (Electronic Fund Transfer) and IMPS (Immediate Payment Service) for transferring funds. IMPS was real-time, but users had to remember account details or MMID numbers for transactions.

- 😀 IMPS was the first real-time payment system in India but had limitations such as requiring the user to remember beneficiary mobile numbers or MMID details and authentication through OTP.

- 😀 UPI introduces the concept of Virtual Payment Address (VPA), which serves as a unique identifier for a user, allowing multiple UPI handles to be linked to a single bank account.

- 😀 The customer registration process in UPI involves four steps: downloading a PSP app, binding the device for authentication, adding a bank account, and generating the UPI PIN.

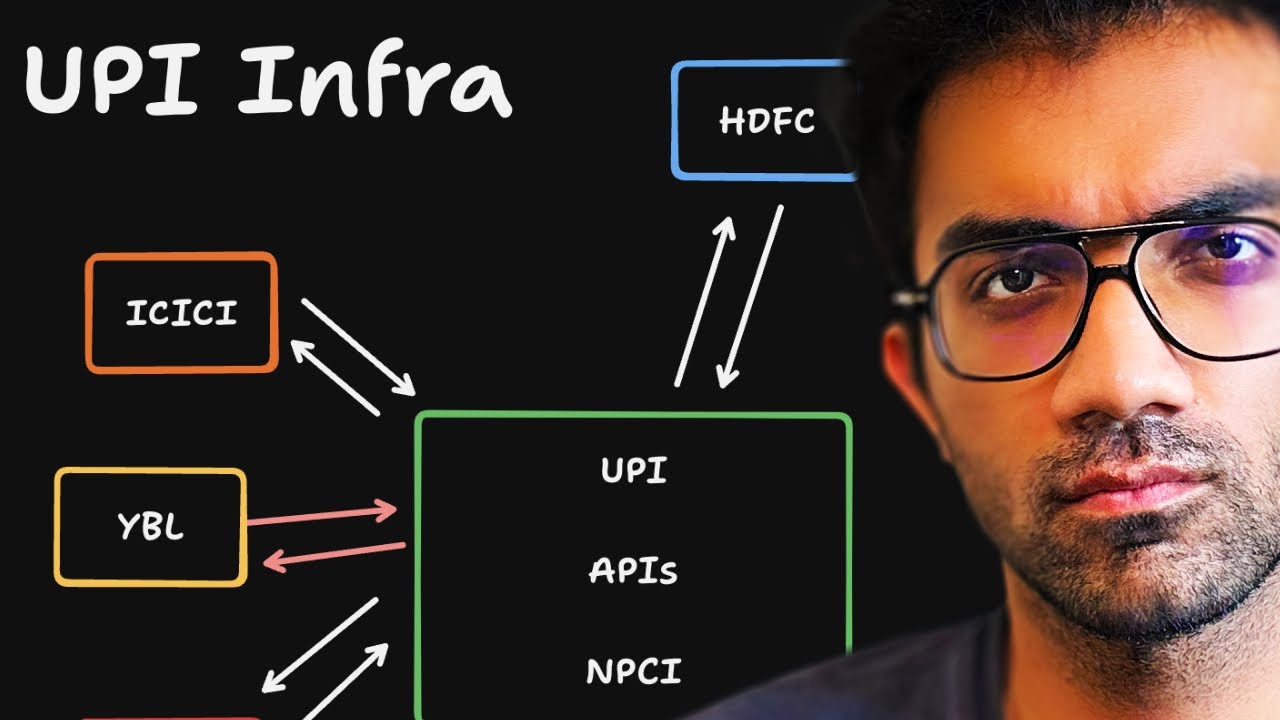

- 😀 UPI transactions involve multiple parties: the payer's PSP (Payment Service Provider), the payee's PSP, the remitter bank (payer's bank), and the beneficiary bank (payee's bank), ensuring smooth transaction flows between them.

Q & A

What is the Unified Payments Interface (UPI)?

-UPI stands for Unified Payments Interface, a real-time payment system introduced by the National Payments Corporation of India (NPCI). It allows users to make instant bank transfers using a mobile number or Virtual Payment Address (VPA), irrespective of the bank or payment app being used.

How does UPI differ from traditional real-time payment systems?

-Traditional real-time payment systems were often tied to a specific bank or payment scheme, limiting the customer's freedom to use different accounts. UPI, however, allows users to link multiple bank accounts with a single mobile app, enabling seamless transactions across different banks and apps.

What are the main types of transactions supported by UPI?

-UPI supports Peer-to-Peer (P2P) and Peer-to-Merchant (P2M) transactions, as well as both push and pull payments. Push payments involve transferring money to another person or entity, while pull payments allow funds to be collected from a payer by a payee.

What is a Virtual Payment Address (VPA)?

-A VPA is a unique identifier associated with a user's bank account that is used for UPI transactions. It is typically in the format 'name@psp' and allows users to send and receive money without using account numbers or IFSC codes.

What role do Payment System Providers (PSPs) play in UPI transactions?

-PSPs are entities that provide the front-end mobile apps or platforms through which users interact with UPI. They work closely with NPCI and banks to facilitate transactions, ensuring the secure processing of payments.

How does the UPI customer registration process work?

-The registration process involves four steps: downloading the PSP app, device fingerprinting (for authentication), adding a bank account, and setting up a UPI PIN. The customer registers their mobile number, adds a linked bank account, and creates a secure PIN for transactions.

What is device fingerprinting in UPI registration?

-Device fingerprinting is the process where the user's mobile device is tied to their UPI account during registration. It acts as the first factor of authentication, ensuring that future transactions are securely tied to the registered device.

What is the significance of the two-factor authentication in UPI?

-UPI uses a two-factor authentication system, where the first factor is the device used for transactions (via device fingerprinting), and the second factor is the customer's UPI PIN. This enhances the security of the payment process.

How does the transaction flow in a typical UPI push transaction work?

-In a push transaction, the payer initiates a payment via their PSP app, which forwards the transaction to NPCI. NPCI sends the transaction to the payee PSP, debits the payer's bank, and credits the payee's account. The payer is notified with the transaction status.

What are the responsibilities of the different parties involved in UPI transactions?

-The payer PSP is responsible for onboarding the customer and authenticating the device, while the payee PSP facilitates merchant transactions. The remitter bank debits the payer's account and verifies the UPI PIN, while the beneficiary bank credits the payee's account.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

India's Fintech Success: Unified Payments Interface

UPI QR Code & Bharat QR Code Kya hai |Bharat QR kaise Istemal kare

How UPI's Bold Business STRATEGY will KILL VISA and MASTERCARD? : UPI CREDIT LINKING EXPLAINED

How does UPI really work?

The future of money: three ways to go cashless

🇬🇧 Does Indian Sim, UPI, OTP, Mobile Banking Work In UK? 🤔

5.0 / 5 (0 votes)