Staying on the CORRECT side of the market - ICT orderflow

Summary

TLDRIn this video, the presenter explains a simple three-step criteria to determine order flow in the market, aimed at simplifying a typically complex subject. The criteria involve recognizing key market signatures: respecting up candles, sweeping highs, and maintaining bullish ranges in a bearish trend. Using a real-world example with USD/JPY, the video illustrates how these signatures play out across different time frames. It concludes with a focus on identifying potential changes in order flow, emphasizing the importance of combining this analysis with higher-timeframe liquidity targets for successful trading.

Takeaways

- 😀 Order flow is a crucial concept in trading, and there are specific signatures to look for to identify it.

- 😀 There is no one fixed method for defining order flow, but certain patterns or signatures can be consistently identified.

- 😀 In a bearish trend, three key signatures are used to confirm order flow: up candles, highs being swept, and bullish ranges being respected.

- 😀 'Up candles' refer to candles that close higher than the previous ones, indicating bullish order flow when respected during a bearish trend.

- 😀 A high being swept refers to the market moving past a previous high, indicating manipulation in the market to gather liquidity for a price move.

- 😀 Bullish ranges refer to a series of up candles where price is expected to respect this range before continuing the bearish trend.

- 😀 Using the example of USD/JPY, the concept of order flow is demonstrated across various timeframes, from monthly to daily charts.

- 😀 The concept is fractal, meaning it applies to both high-timeframe and low-timeframe charts, providing evidence of its effectiveness.

- 😀 The key to identifying a shift in order flow is recognizing when old ranges (bullish or bearish) are disrespected, signifying a potential change.

- 😀 When bearish order flow is respected (e.g., up candles or bullish ranges), it indicates continued selling pressure until liquidity is met.

- 😀 Price action, including manipulation of lows and highs, must be monitored closely to understand if the order flow is changing direction or continuing.

- 😀 Ultimately, combining these order flow principles with higher time-frame liquidity targets helps create a clearer trading plan, ensuring that one doesn't solely rely on order flow alone.

Q & A

What is the main topic of the video?

-The video focuses on explaining the concept of order flow and provides a three-step criteria to help identify and understand it in the market.

Why does the speaker believe order flow can be a difficult concept to understand?

-The speaker points out that many people have different methods of defining order flow, making it a touchy and complex subject to grasp. There is no fixed method, only common signatures that can be identified.

What are the three key signatures for determining bearish order flow?

-The three key signatures for bearish order flow are: 1) Up candles being respected, 2) Highs being swept (manipulation), and 3) Bullish ranges being respected.

How is a bearish order flow example demonstrated in the video using the USD/JPY chart?

-The speaker shows that after running above old highs on the monthly time frame, the market begins to shift lower. Key bearish order flow signs like up candles and bullish ranges being respected help identify the shift in order flow.

What is the significance of 'up candles' and 'bullish ranges' in identifying order flow?

-Up candles and bullish ranges are important because they represent areas where the market showed strength in the past. If these are respected after price retraces into them, they provide confirmation of a bearish continuation in the market.

What does it mean when 'highs are swept' in the context of order flow?

-'Highs being swept' refers to the market pushing above previous highs to manipulate or test liquidity. This is seen as a signature of market manipulation, often occurring before the market shifts direction.

What does the speaker mean by 'bullish ranges being respected'?

-The speaker refers to a range of up candles or bullish price action being respected when the market retraces into it. This can help confirm a shift in order flow, in this case, to bearish, if the range is not violated.

What happens when a bearish order flow shifts to bullish order flow?

-When bearish order flow shifts to bullish, the market may start respecting bearish ranges and down candles, indicating a potential change in direction. This is confirmed when lows are swept and the market moves upwards.

How does the speaker suggest confirming a change in order flow?

-To confirm a change in order flow, the speaker recommends observing if bearish ranges (down candles) are no longer respected and if highs are swept or price action deviates from previous trends.

What role does liquidity play in determining order flow?

-Liquidity is critical in identifying potential reversals or continuations in order flow. When price sweeps highs or lows to grab liquidity, it manipulates the market, which often results in shifts in the overall trend.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

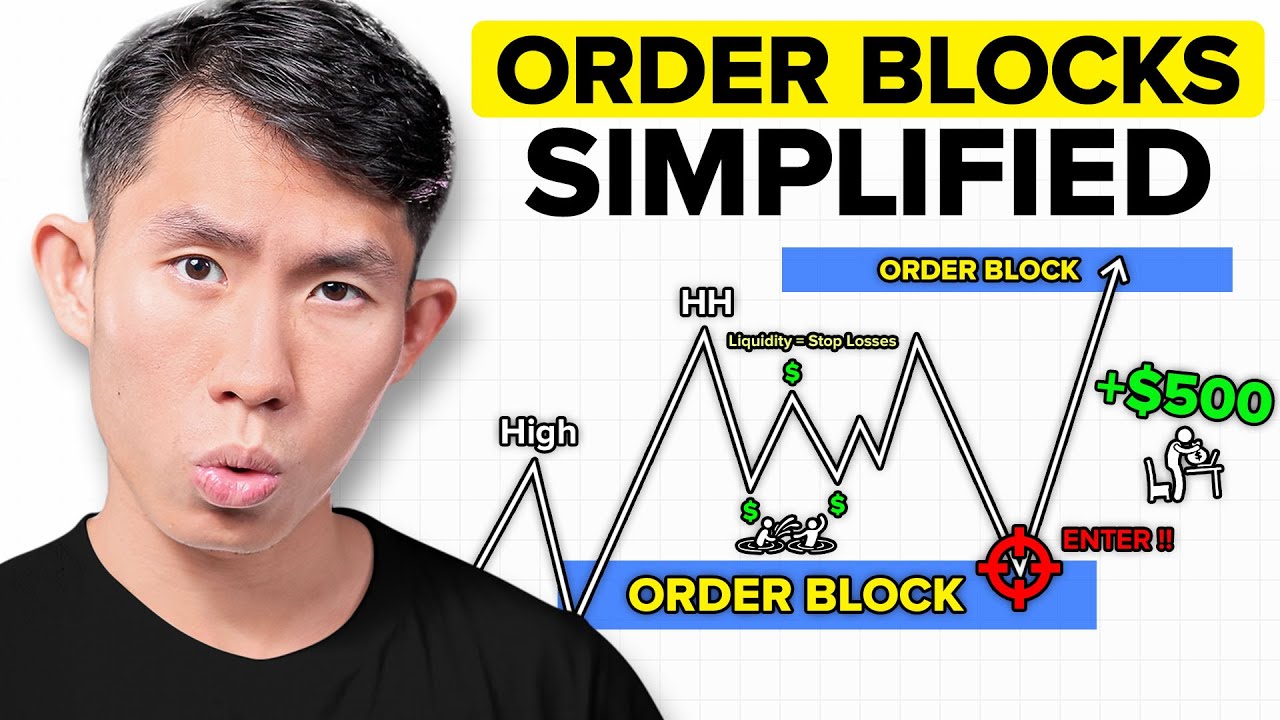

Master Order Blocks to Trade like Banks (no bs guide)

KALORIMETER : Menghitung Perubahan Entalpi dengan Kalorimetri - Kimia kelas XI

Cara mudah menentukan hasil faktorial. Materi dasar FAKTORIAL

Trading Against Order Flow Using MMSM (Trade Breakdown)

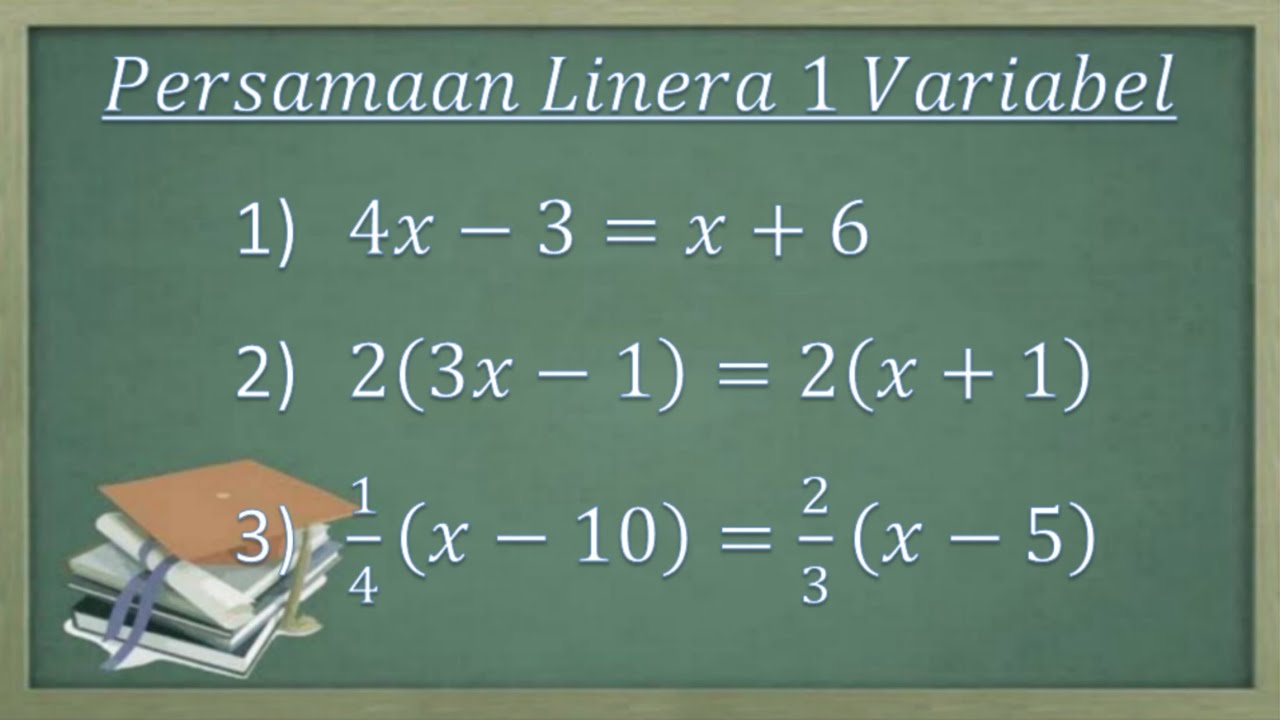

Sistem persamaan Linear satu variabel. Cara menentukan himpunan penyelesaiannya

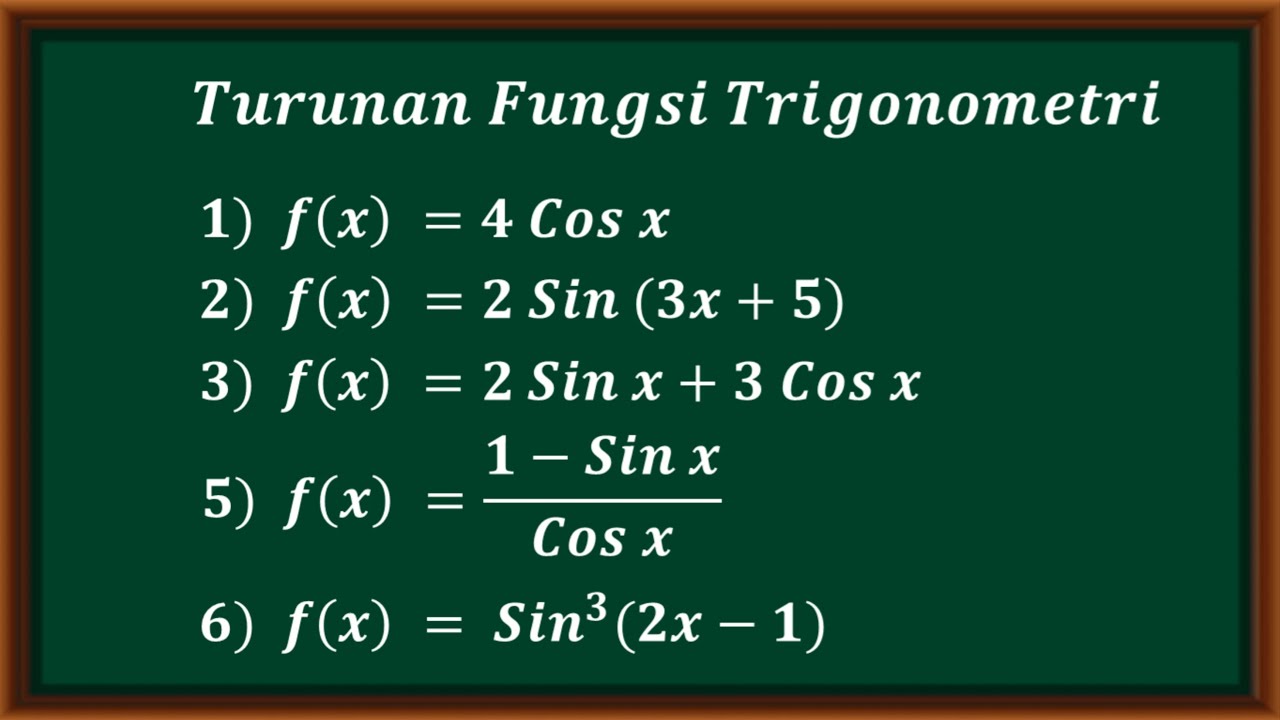

Turunan fungsi trigonometri

5.0 / 5 (0 votes)