CLASS-43||SAP MM Invoice Verification||LIV ||Credit Memo || Subsequent Entries ||SAP MM FREE COURSE|

Summary

TLDRThis video script provides a detailed tutorial on how to handle various scenarios related to credit and debit memos in accounting. It covers the process of creating credit memos when goods or quantities are received incorrectly or damaged, and explains how to handle pricing discrepancies with vendors through subsequent credit or debit memos. The script also walks through practical examples of using these tools within a purchase order system, with emphasis on inventory management, and offers tips for handling vendor-related issues efficiently. Aimed at users looking to improve their invoicing and inventory management skills, the video offers clear, actionable insights.

Takeaways

- 😀 Credit Memo is used when there's an excess quantity or price in an invoice that needs to be reduced.

- 😀 A Credit Memo can be created when the vendor sends fewer items than expected, allowing for adjustments in future transactions.

- 😀 In the example, a vendor sends 8 items instead of 10, and the Credit Memo adjusts for the 2 missing items.

- 😀 The Credit Memo can also be used when the vendor doesn't send the agreed quantity within the promised time frame.

- 😀 The creation of Credit Memos helps ensure accurate financial records and enables the buyer to adjust payment accordingly.

- 😀 The process involves selecting a purchase order, entering the correct quantity and price, and ensuring the adjustments match the original agreement.

- 😀 The transaction can also involve tracking payment blocks and resolving them manually to allow the payment process to proceed.

- 😀 If the vendor doesn't replace returned items, a Credit Memo can be created to adjust the amount owed.

- 😀 Credit Memos and Debit Memos are used to handle price or quantity changes, but Credit Memos typically decrease the amount owed, while Debit Memos increase it.

- 😀 Subsequence Debit and Credit Memos deal with situations where the price or quantity changes after the original invoice is processed, affecting future payments.

- 😀 The key difference between Credit Memos and Subsequence Credit Memos is that Credit Memos adjust both price and quantity, while Subsequence Credit Memos only adjust the price.

Q & A

What is the primary purpose of creating a Credit Memo?

-A Credit Memo is created to adjust an invoice when there is a discrepancy in quantity or price. For example, if a vendor delivers fewer items than what was invoiced or if the price needs to be corrected, a Credit Memo can be used to make the necessary adjustments.

How can a Credit Memo be used in a scenario where the vendor delivers fewer items than invoiced?

-In a situation where a vendor delivers fewer items than originally invoiced, a Credit Memo can be created to account for the difference in quantity. The memo will reduce the total amount owed based on the missing items.

What happens when a vendor does not fulfill their promise regarding item delivery after confirming a delay?

-If the vendor does not fulfill the promised delivery, a Credit Memo can be issued to adjust the invoice. This serves as a record of the amount to be credited back for the undelivered items.

What steps are involved in creating a Credit Memo in the system?

-To create a Credit Memo, you typically go to the relevant section in the system, enter the required details such as purchase order number, item quantity, and price adjustments, and then save or post the document for further processing.

What is a Subsequence Debit Memo, and when is it used?

-A Subsequence Debit Memo is used when the vendor increases the price of an item after an initial agreement. This document adjusts the amount owed to the vendor to reflect the price increase, while the quantity remains unchanged.

How does the process of creating a Subsequence Debit Memo differ from a Credit Memo?

-A Subsequence Debit Memo is created when the price increases for the same quantity of goods. In contrast, a Credit Memo is used when the price or quantity decreases. In both cases, the document adjusts the financial amounts to reflect the new terms.

How does a Credit Memo help when a product is returned to a vendor?

-When a product is returned to a vendor, a Credit Memo can be issued to adjust the invoice for the returned items. This helps maintain an accurate record of inventory and financial transactions, ensuring the vendor is credited appropriately.

What is the difference between a Credit Memo and a Subsequence Credit Memo?

-A Credit Memo typically adjusts both the price and the quantity of items, reducing the invoice amount, while a Subsequence Credit Memo is used when the price of an item decreases, but the quantity remains the same. It adjusts the invoice to reflect the new, lower price.

What should be done if a vendor increases the price of an item after the order has been placed?

-If a vendor increases the price of an item, a Subsequence Debit Memo can be created to adjust the amount owed. This ensures that the new, higher price is reflected in the payment due to the vendor.

Can a Subsequence Credit Memo be issued if the vendor reduces the price of an item after the order is placed?

-Yes, if the vendor reduces the price of an item after the order, a Subsequence Credit Memo can be issued to reflect the new, lower price and adjust the total amount owed accordingly.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Mengelola Dokumen Transaksi#Akuntansi#Part1#SMKTarakanita

Macam - macam Bukti Transaksi

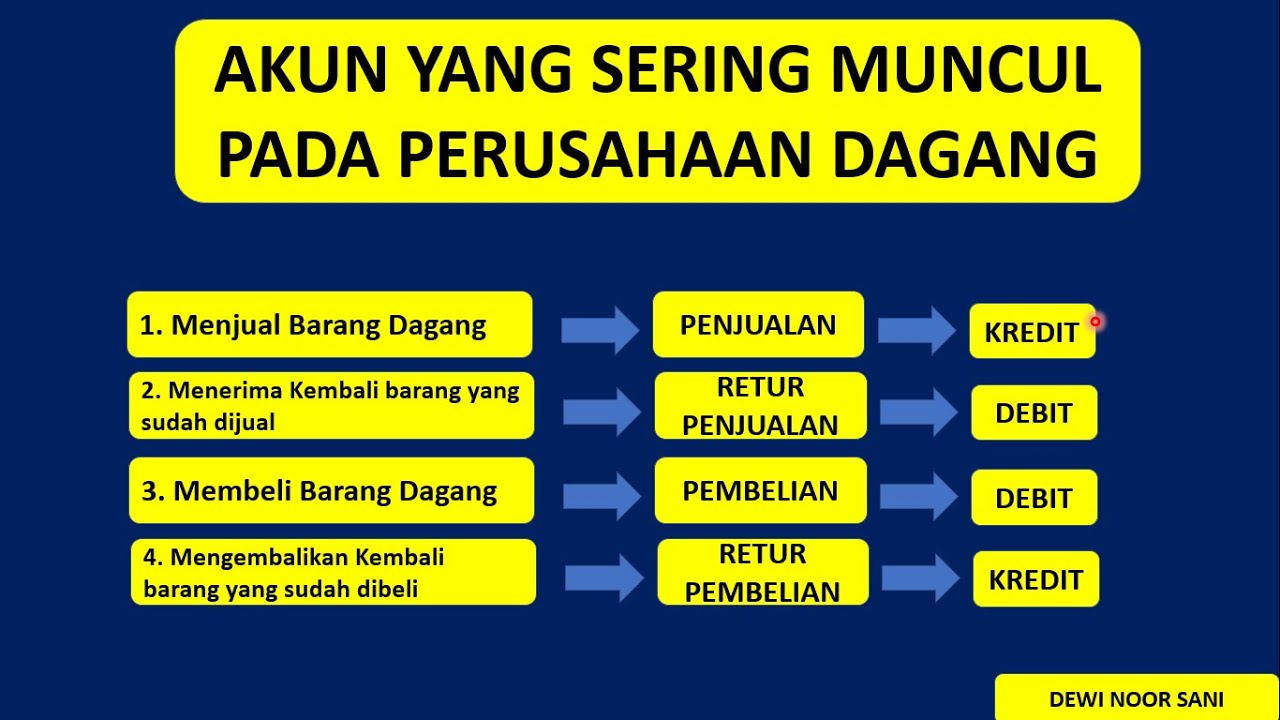

JURNAL UMUM PERUSAHAAN DAGANG (tips & trik menganalisis Posisi Debit Kredit pada Perusahaan Dagang)

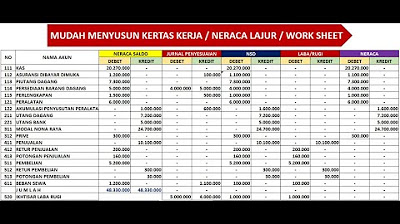

KERTAS KERJA - NERACA LAJUR - WORK SHEET - PERUSAHAAN DAGANG

TIPOS DE LANÇAMENTOS CONTÁBEIS | ENTENDA A DIFERENÇA ENTRE SIMPLES, COMPOSTOS E COMPLEXOS

MyInvois Portal User Guide (Chapter 3) - Document Issuance

5.0 / 5 (0 votes)