Cara Menghitung Penyusutan dengan metode garis lurus - Fungsi SLN pada excel Pelajaran Spreadsheet

Summary

TLDRIn this tutorial, the process of calculating depreciation using the straight-line method is explained step-by-step. The presenter demonstrates how to apply the formula in Excel, starting with the cost of acquisition, the economic lifespan, and the residual value. Key steps involve using specific Excel functions like SLN for straight-line depreciation, fixing certain values with F4, and calculating accumulated depreciation each year. The method ensures that depreciation remains consistent across the years, with all calculations laid out clearly, making it easy for viewers to replicate the process themselves.

Takeaways

- 😀 The video explains how to calculate depreciation using the straight-line method.

- 😀 The acquisition cost is 120,000,000, with a useful life of 5 years and a residual value of 20,151,028.

- 😀 The depreciation formula used is SLN, which is (Acquisition Cost - Residual Value) / Useful Life.

- 😀 The residual value should be locked with F4 in Excel to prevent it from changing during calculations.

- 😀 The useful life value is also locked with F4 to maintain accuracy in calculations across all years.

- 😀 Depreciation for each year remains the same since the straight-line method distributes depreciation evenly over time.

- 😀 The manual method involves subtracting the residual value from the acquisition cost and dividing by the useful life.

- 😀 The Excel formula used for accumulation is to add depreciation from the previous year to the current year's depreciation.

- 😀 In Excel, you should use F4 to lock cells like the acquisition cost, residual value, and useful life to maintain consistency.

- 😀 By applying the formula, depreciation values can be dragged down to fill the years of the asset's useful life.

- 😀 The calculated depreciation for each year, as well as the remaining value after depreciation, should match the expected results based on the straight-line method.

Q & A

What method is being used for depreciation in the script?

-The method being used is the straight-line method of depreciation.

What is the acquisition cost mentioned in the script?

-The acquisition cost mentioned is 120,000,000.

How long is the useful life of the asset in the example?

-The asset's useful life is 5 years.

What is the residual value of the asset according to the script?

-The residual value of the asset is 20,151,028.

What formula is used to calculate depreciation in the straight-line method?

-The formula used is SLN (acquisition cost - residual value) / useful life.

How is the acquisition cost entered in the formula?

-The acquisition cost is entered directly in the formula and is locked using F4 or SnF4 to prevent it from moving in the calculation.

What is the purpose of using F4 or SnF4 in the calculation?

-F4 or SnF4 is used to lock specific cell references (such as acquisition cost or residual value) so they do not change when dragging the formula down.

How are accumulated depreciation and the residual value calculated for each year?

-Accumulated depreciation for each year is calculated by adding the depreciation for that year to the previous year's accumulated depreciation. The residual value is then calculated by subtracting the accumulated depreciation from the acquisition cost.

Why is the depreciation value the same each year in the straight-line method?

-In the straight-line method, the depreciation value is the same each year because the same amount is subtracted from the asset's value annually, determined by dividing the difference between acquisition cost and residual value by the useful life.

What does the script suggest about setting up formulas in Excel or similar software?

-The script suggests using standard Excel formulas and locking necessary references with F4 or SnF4 to ensure the correct values are used throughout the calculations.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

MENGOLAH DATA MENGGUNAKAN FUNGSI FINANSIAL | SPREADSHEET | METODE PENYUSUTAN

Pokok Bahasan 4 - Depresiasi "PT Fancy Lova"

Penyusutan Metode Garis Lurus, Saldo Menurun Ganda, Jumlah Angka Tahun, Dan Unit Produksi.

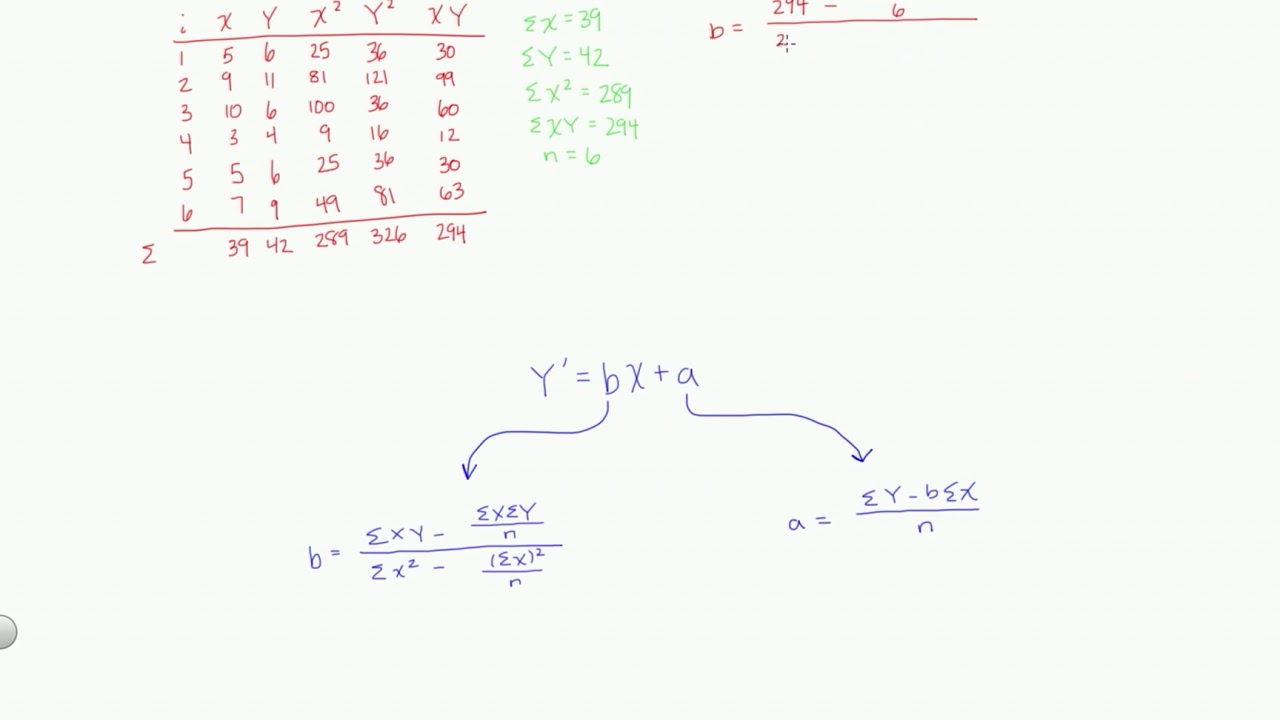

How to Calculate a Simple Linear Regression by Hand

Statistika • Part 17: Cara Membuat Tabel Distribusi Frekuensi

Lesson 021 - Adjusting Entries 5: Straight-Line Depreciation

5.0 / 5 (0 votes)