How Rich People Use Debt to Build Wealth (...and YOU can, too!)

Summary

TLDRThis video script explores the strategic use of debt as a wealth-building tool, contrary to common misconceptions. It argues that leveraging debt to acquire appreciating assets can accelerate wealth creation, as demonstrated through real estate investment examples. The script emphasizes the importance of education, control over assets, and smart financial management to mitigate risks and achieve financial freedom more rapidly than traditional savings methods.

Takeaways

- 💰 **Wealth Creation Through Debt**: The script emphasizes that debt, when used correctly, can be a powerful tool for wealth creation, contrary to the common belief that it is inherently risky.

- 🛍️ **Consumer Spending and Debt**: It highlights the difference between the unproductive use of debt for consumer spending and the strategic use of debt for wealth accumulation.

- 🏦 **Debt as a Leveraging Tool**: The speaker explains that leveraging debt allows individuals to control large assets with a small portion of their own resources, which can lead to higher returns.

- 📈 **Asset Appreciation and Debt**: The script discusses how assets can appreciate over time, and when financed with debt, this appreciation can significantly increase one's equity position.

- 📊 **Inflation and Debt Management**: It points out that inflation can work in favor of those with debt, as the real value of debt decreases over time while income generally increases.

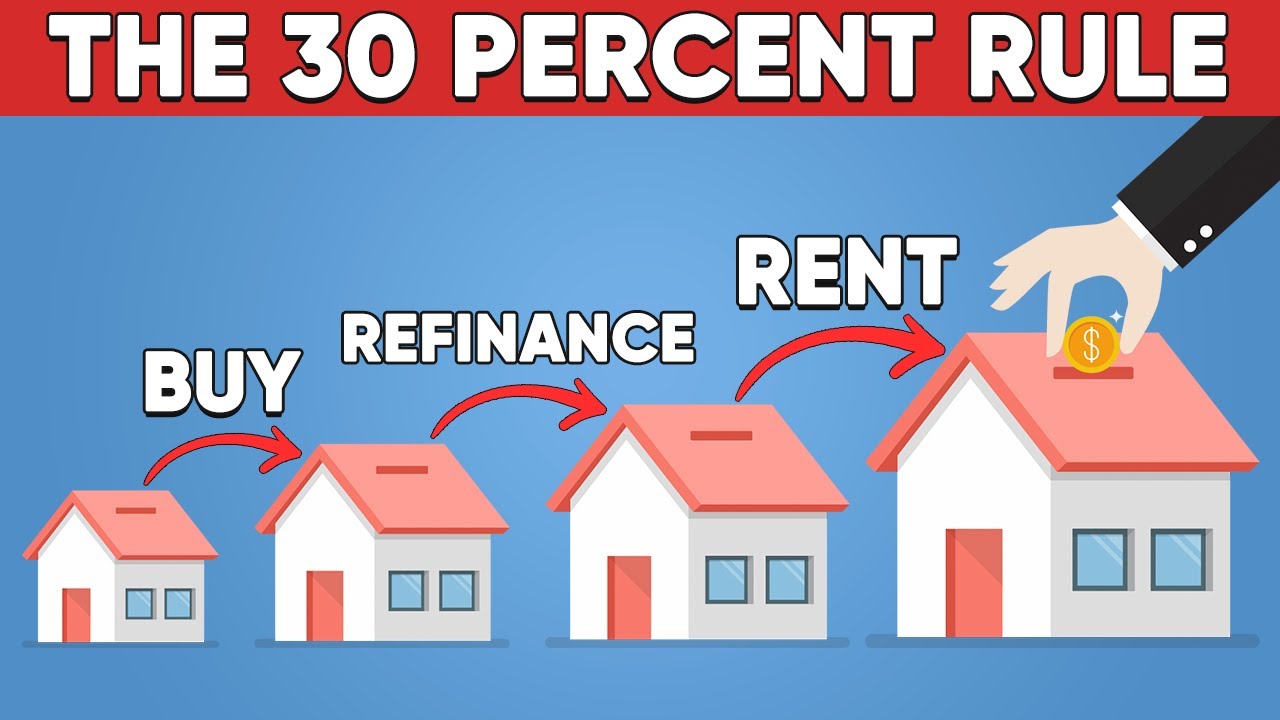

- 🏘️ **Real Estate as a Wealth Builder**: The speaker uses real estate as an example to illustrate how leveraging debt can lead to substantial wealth creation in a relatively short period.

- 📝 **Risk Management in Debt Use**: The importance of understanding and managing risks associated with debt is underscored, including the need for education and careful planning.

- 💼 **Investing in Controllable Assets**: The script suggests focusing on assets that one can control, such as education, business, and real estate, as they offer more direct paths to wealth creation.

- 📚 **Education as a Key to Wealth**: It stresses the importance of self-education and becoming competent in the management of the assets one plans to leverage with debt.

- 🤝 **Network and Associations**: Building a strong network and associating with the right mentors and groups can enhance one's ability to use debt effectively for wealth creation.

- 🔢 **Mathematics of Leveraged Wealth**: The script provides a simplified mathematical example to demonstrate how leveraging debt can exponentially increase one's wealth through property investment.

Q & A

What is the main point of the video script discussing?

-The main point of the video script is to explain how debt, when used correctly, can be a powerful tool for wealth creation, particularly through real estate investment.

Why does the speaker believe that debt gets a bad reputation?

-The speaker believes debt gets a bad reputation because most people misuse it by spending on things they don't need and accumulating debt they can't manage, leading to a cycle of debt and interest payments.

What is the speaker's view on the use of debt in wealth creation?

-The speaker views debt as a tool that, when used correctly, can accelerate wealth creation by allowing individuals to leverage a small amount of their own resources to acquire a large portion of someone else's assets.

How does the speaker define 'good debt'?

-The speaker defines 'good debt' as debt used to acquire income-producing, appreciating assets that can be controlled by the borrower, which over time, can generate more income than the cost of the debt.

What are the three controllable assets the speaker suggests using debt for?

-The three controllable assets suggested by the speaker are: 1) investing in oneself through education and training, 2) investing in one's business to improve revenue and value, and 3) investing in real estate as a means to create significant wealth.

Why does the speaker emphasize the importance of leveraging debt in real estate?

-The speaker emphasizes leveraging debt in real estate because it allows the average person to acquire assets that appreciate over time and generate income, while also benefiting from tax advantages and inflation.

What is the role of inflation in the context of debt discussed in the script?

-Inflation plays a role in debt management by reducing the real value of the debt over time. As incomes generally rise with inflation, the fixed debt payments become easier to manage, effectively paying down the debt with cheaper money.

How does the speaker propose to mitigate the risks associated with using debt?

-The speaker suggests mitigating risks by investing in one's own financial education, staying involved in the management of the assets, buying with equity in place, and ensuring the asset will produce more income than the debt costs.

What is the potential return on investment (ROI) the speaker illustrates with the real estate example?

-The speaker illustrates a potential ROI of turning an initial investment of $16,000 into $490,000 in equity over a period of less than 10 years through leveraging debt in real estate.

What advice does the speaker give to those who want to become wealthy safely using debt?

-The speaker advises to invest in one's own financial education, stay involved in the operations and management of the asset class, buy with equity in place, and ensure the asset will generate more income than the debt costs.

How does the speaker differentiate between 'good' and 'bad' debt?

-The speaker differentiates 'good' debt as debt used to acquire appreciating, income-producing assets that one can control, while 'bad' debt is debt incurred for consumption on things that do not generate income or appreciate in value.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Want To Be Rich? DON'T Start a Business.

Zenginler Nasıl Borçla Servet Kazanıyor? Bu 5 Yolu Öğrenin!

5 Ways Rich People Make Money With Debt

VOCÊ TÁ DEIXANDO DE GANHAR DINHEIRO POR NÃO SABER ISSO..(Primo Pobre)

Why EVERYTHING Changes After $20,000

How the 1% Think: 25 Machiavellian Wealth Tactics Millionaires Use (That Broke People Ignore)

5.0 / 5 (0 votes)