Boot Camp Day 35: Daily Bias pt. 2

Summary

TLDRIn this video, the speaker walks through the process of identifying and executing trades based on the daily bias in the market. They emphasize analyzing higher time frames like the weekly and daily charts to determine market direction, followed by identifying key zones such as liquidity sweeps, order blocks, and fair value gaps. The speaker discusses adapting strategies on smaller time frames to pinpoint the best entry points and risk management techniques, focusing on a balance between market structure, trend analysis, and real-time trade execution. The session aims to teach traders how to make informed, timely decisions based on their analysis.

Takeaways

- 😀 Start with the weekly time frame to determine the overall market direction before making any trades.

- 😀 The S&P 500 is currently breaking structure to the upside, which is surprising, and there's skepticism about it being truly bullish.

- 😀 Focus on daily market structure to confirm the direction of the trend. If it's bullish, look for long trades, but focus on retracements, not short pullbacks.

- 😀 Daily bias helps in determining trade direction. Don't let personal biases or fundamentals dictate trades; follow the market structure instead.

- 😀 Always use liquidity zones, order blocks, and fair value gaps as high-confluence areas to identify potential trade setups.

- 😀 When analyzing the daily time frame, confirm bias through lower time frames (15-minute, 5-minute) to find sniper entries.

- 😀 For bearish bias, use building blocks like liquidity sweeps, break of structure, and order block entries to find strong short opportunities.

- 😀 If the market retraces in a bullish trend, identify key price zones for potential entries, then scale down to lower time frames for confirmation.

- 😀 In markets like gold, even if the trend is bearish, focus on retracements and look for imbalances to guide your trades.

- 😀 Always scale down to lower time frames to find more precise entries and ensure confirmation from smaller market movements before entering a trade.

Q & A

What is the first step in determining your daily bias for trading?

-The first step is to analyze the weekly time frame to determine the overall market direction. This helps you understand the broader trend, whether it’s bullish or bearish, which will guide your daily bias.

Why is it important to start with the weekly time frame when determining your daily bias?

-Starting with the weekly time frame gives you an overarching view of the market's overall direction. This helps you avoid getting lost in short-term market fluctuations and sets the foundation for more accurate predictions on smaller time frames.

How do you use the daily time frame in your trading analysis?

-On the daily time frame, you assess market structure and trends. If the market is in an uptrend but in a retracement, you're more likely to look for long opportunities. Conversely, if the market is in a downtrend, you'll look for short setups.

What role does liquidity play in your trading decisions?

-Liquidity is crucial as it indicates where the market participants are likely to move prices. By identifying areas where liquidity is resting, you can predict where the market might go next, helping you find optimal entry points.

What is an order block, and why is it important for trading?

-An order block is a price zone where institutions or large traders have placed significant buy or sell orders. These zones often act as areas of strong support or resistance, making them critical for identifying potential reversals or continuations in the market.

How do you scale down to lower time frames for more precise entries?

-Once you've identified a potential setup on a higher time frame, you scale down to lower time frames (like the 15-minute or 5-minute charts) to look for confirmation signals like break of structure or liquidity sweeps. This allows you to pinpoint the best entry with more precision.

Why do you prefer the 15-minute and 5-minute time frames for trade entries?

-The 15-minute and 5-minute time frames allow for more precise entries in the market, helping you capture smaller, high-probability moves. These shorter time frames help refine your strategy and maximize your risk-reward ratio.

What are fair value gaps, and how do they factor into your analysis?

-A fair value gap is a price area where the market moved too quickly, leaving behind an imbalance in supply and demand. These gaps often act as a target for future price movement, as the market tends to fill them in later, making them key areas to watch for potential trades.

How do you use confluence areas to increase the probability of a successful trade?

-Confluence areas are price zones where multiple technical factors align, such as order blocks, liquidity sweeps, and fair value gaps. When these factors all come together at the same price level, it increases the probability of a successful trade by providing more confirmation for the trade setup.

What is your approach to trading during news events?

-During news events, I recommend waiting until the news has been released and the market has settled before entering trades. High-impact news can cause sudden price movements, making it harder to predict the market direction. After the news settles, look for clearer setups based on your analysis.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

The 4 Steps Behind My Trading Strategy (Bias to Entry)

Boot Camp Day 32: Execution pt.2

The Only ICT Daily Bias Video You'll Ever Need

ICT Silver Bullet Strategy Simplified For Beginners (FULL TRADING PLAN)

HOW TO USE ICT's LRLR (LOW RESISTANCE LIQUIDITY)

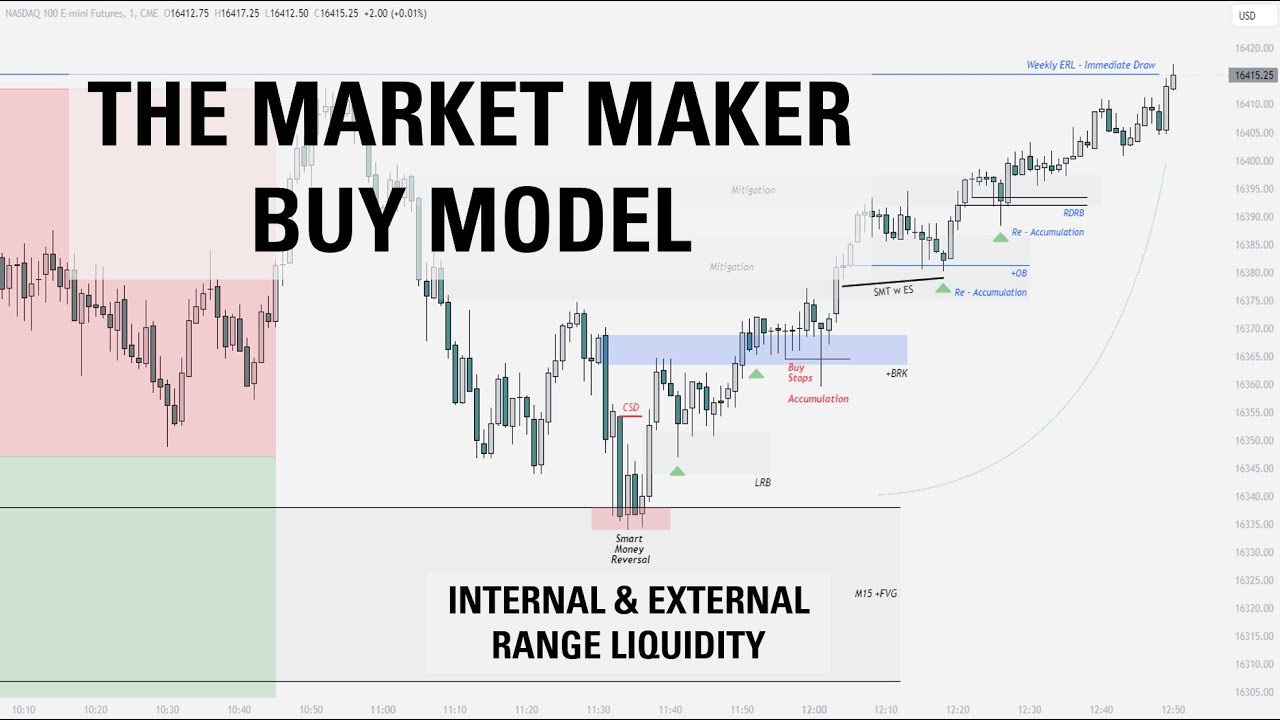

The Market Maker Buy Model | Full Trade Breakdown $NQ

5.0 / 5 (0 votes)