Mengenal Transaksi Perbankan Sederhana - Manajemen Perkantoran - Pengelolaan Keuangan Sederhana

Summary

TLDRThis video provides an overview of basic banking transactions, including cash deposits, withdrawals, transfers, and bill payments. It introduces banking services like savings, checking, and deposit accounts, highlighting their uses and differences. The video explains the procedures for conducting transactions through ATMs, bank tellers, internet banking, and mobile banking apps, as well as using e-wallets for digital payments. It also emphasizes the importance of transaction security, offering tips on maintaining privacy, checking balances regularly, and using official banking channels to prevent fraud.

Takeaways

- 😀 Simple banking transactions involve depositing cash, withdrawing cash, transferring between accounts, and paying bills.

- 😀 Understanding basic banking transactions helps students learn essential procedures for handling banking operations.

- 😀 A bank is a financial institution that provides services like storing money, issuing credit, and conducting financial transactions.

- 😀 Different types of accounts in banking include savings, checking, and deposit accounts, each with distinct purposes and characteristics.

- 😀 Savings accounts are for long-term deposits with higher interest rates, while checking accounts are used for daily transactions and have low or no interest.

- 😀 Deposit accounts offer higher interest rates and are suitable for short, medium, or long-term investments but cannot be withdrawn before maturity.

- 😀 The main banking services include cash deposits (store tunai), cash withdrawals (tarik tunai), money transfers, and bill payments.

- 😀 A cash deposit involves bringing money to the bank, filling out a deposit form, and providing the funds to the teller or using an ATM.

- 😀 Withdrawals can be made using an ATM or by visiting a bank teller, where the transaction is verified with a passbook or ATM slip.

- 😀 Bill payments can be made through ATMs, internet banking, or mobile banking, with the importance of saving proof of payment for future reference.

Q & A

What is the purpose of this video?

-The video aims to explain the basic banking transactions, including cash deposits, withdrawals, transfers, bill payments, and the usage of mobile banking and e-wallets. It is designed to help students understand the procedures for conducting these transactions safely and confidently.

What is a bank, and what services does it provide?

-A bank is a financial institution that provides services such as storing money, issuing loans, and conducting various financial transactions. Banks offer different types of accounts, such as savings, checking, and deposit accounts.

What are the key differences between savings, checking, and deposit accounts?

-A savings account is intended for long-term saving with higher interest rates but limited withdrawals. A checking account is used for daily transactions with low or no interest and allows flexible withdrawals, including through checks. A deposit account is used for short, medium, or long-term saving, offering higher interest rates but with restrictions on early withdrawals.

What is the process for a cash deposit (store tunai) in a bank?

-To make a cash deposit, you need to bring cash to the bank, fill out a deposit form with the account number and deposit amount, and then submit the cash to the teller or use a Cash Deposit Machine (CDM).

How can you withdraw money from your bank account?

-Money can be withdrawn using an ATM by entering your PIN, selecting the withdrawal option, and specifying the amount. Alternatively, you can visit a bank teller, present your passbook, and request the withdrawal.

What is the procedure for transferring money between accounts?

-To transfer money within the same bank, you can use an ATM or internet banking. For transfers between different banks, you can use services like RTGS (Real-Time Gross Settlement) or BIFAS, and you may need to account for possible transfer fees.

What are RTGS and BIFAS, and how do they differ?

-RTGS is a service for real-time large-value transactions within a bank, usually during business hours. BIFAS, on the other hand, supports instant transactions 24/7, but it is typically used for smaller amounts. RTGS has higher fees and is used for larger transactions, while BIFAS offers lower fees for smaller transactions.

How can you pay bills through a bank?

-You can pay bills through an ATM, internet banking, or mobile banking. The process typically involves entering a customer ID or bill code, confirming the payment amount, and saving the proof of transaction for future reference.

What is mobile banking, and how do you use it?

-Mobile banking allows users to perform banking transactions such as checking balances, transferring money, and paying bills via a smartphone app. To use it, you need to install the bank's mobile app, log in with your ID or PIN, and select the desired transaction.

What are e-wallets, and how are they different from mobile banking?

-E-wallets, or digital wallets, are applications that store digital money for making online transactions. Unlike mobile banking, which directly interacts with a bank account, e-wallets allow for online purchases and even cash withdrawals at certain locations. Popular e-wallets include GoPay, OVO, and Dana.

What security measures should be taken when conducting banking transactions?

-To ensure security, always keep your PIN and passwords confidential, avoid sharing them with anyone, even those claiming to represent your bank. Use official banking channels like ATMs and mobile apps, and regularly monitor your account for suspicious activities.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Maximum Cash Limit to Avoid Income Tax Notice in 2025 || UPI Limit to Avoid Notice

TUTORIAL LENGKAP: MENGGUNAKAN APLIKASI SIBMT UNTUK TRANSAKSI SYARIAH-Shilvia Karisma Nur Anissa-ES.I

Checking & Savings Accounts Explained in 3 Minutes

[FABM2] Lesson 041 - Bank Transactions

Perbankan Dasar Kelas 10 AKL (1/3) | Pengertian Bank - SMK Doa Bangsa | Andriansyah, S.E.

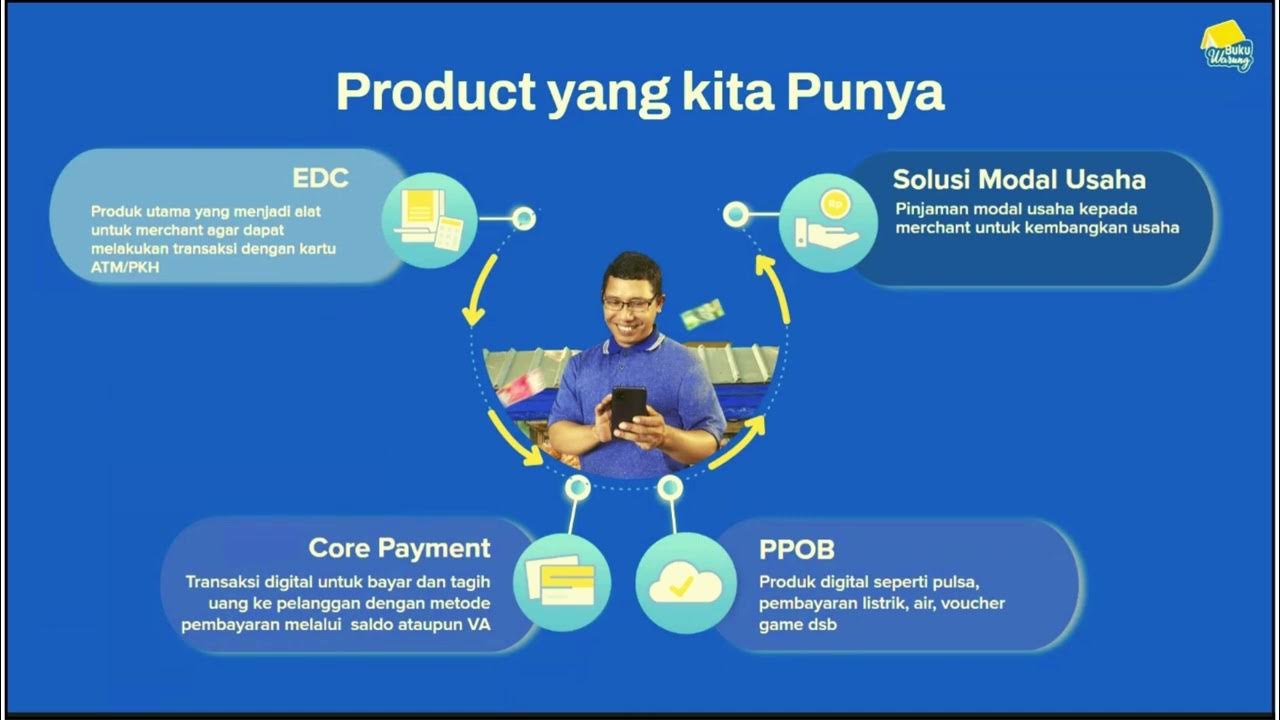

BukuWarung Introduction

5.0 / 5 (0 votes)