PPN 12% Bikin Tambah Miskin?

Summary

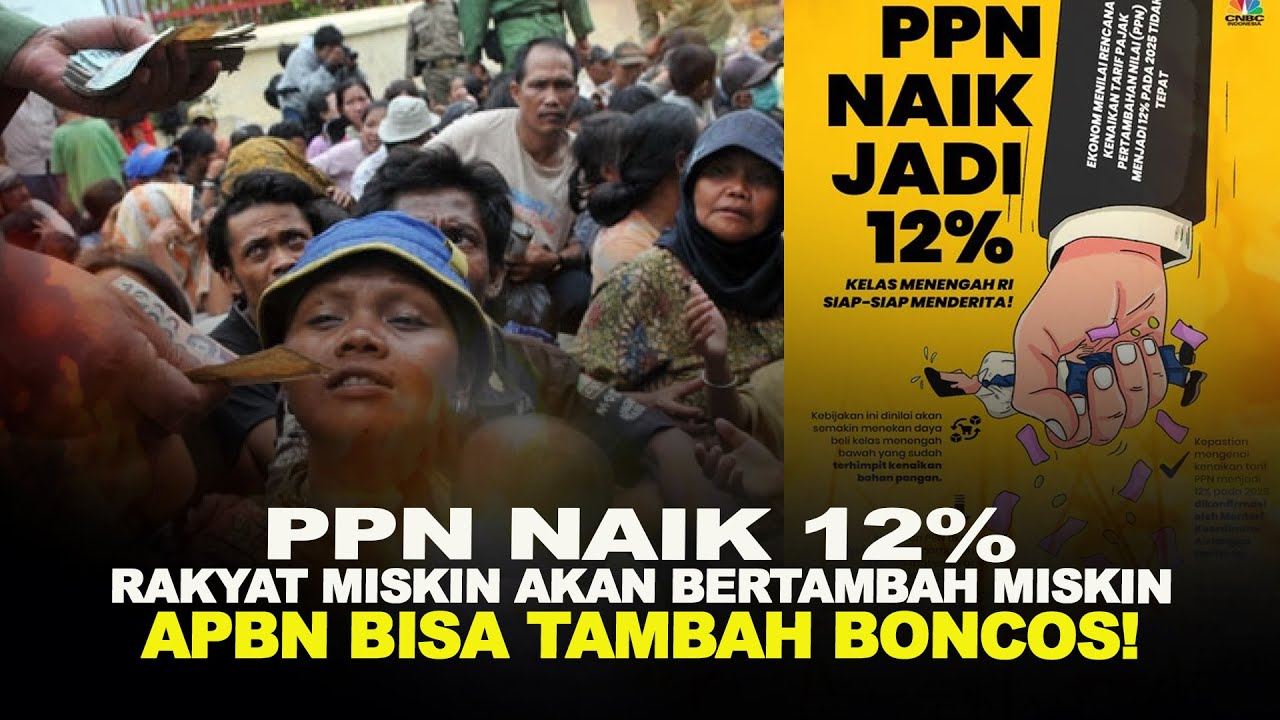

TLDRThe speaker critiques Indonesia's proposed 12% VAT hike, arguing that it will disproportionately affect the poor, vulnerable, and middle class, exacerbating economic inequalities. Highlighting the country's economic weaknesses, including deindustrialization and a growing informal workforce, the speaker warns that the policy could lead to reduced consumption, job losses, and economic stagnation. Instead of the VAT hike, the speaker suggests alternative revenue sources, such as wealth and windfall taxes, and a carbon tax. These proposals aim to increase state revenue without burdening the most vulnerable sectors of society, promoting fairness and long-term economic stability.

Takeaways

- 😀 The proposed increase of VAT (PPN) to 12% will make Indonesia's VAT the highest in ASEAN, above the Philippines, Malaysia, Singapore, and Thailand.

- 😀 The increase in VAT will disproportionately affect vulnerable groups, with the poorest households facing an additional monthly burden of IDR 11,880.

- 😀 The middle class will also suffer, with an estimated additional burden of IDR 354,293 per month.

- 😀 The policy is criticized for being introduced at a time when Indonesia's economy is already weak, with declining industrial output and rising unemployment.

- 😀 Manufacturing's contribution to GDP has dropped from 23.56% in 2014 to just 19.28% in 2024, signaling economic decline and job losses in the sector.

- 😀 Informal labor, now making up over half of the workforce, will face severe challenges as small businesses struggle to cope with the increased VAT.

- 😀 The middle class is shrinking, with 9.48 million people falling out of the category in the last five years, worsening social inequality.

- 😀 Household savings have significantly decreased, from 6.3% of income to just 4.28%, forcing people to either reduce consumption or go into debt.

- 😀 The VAT increase is expected to lead to inflation (around 4.11%), driving up prices and reducing household consumption, further slowing the economy.

- 😀 Alternative tax measures are proposed, such as a wealth tax targeting the rich, a windfall tax on the mining sector, and a carbon tax to both generate revenue and address environmental concerns.

Q & A

What is the main concern raised about the 12% PPN increase?

-The main concern is that the 12% PPN increase, while intended to boost state revenue, will disproportionately burden vulnerable groups, including the poor, the informal labor sector, and the shrinking middle class. This could exacerbate economic hardship at a time when the economy is already weakening.

How does the 12% PPN increase affect different income groups?

-For the poorest families, the PPN hike adds an extra burden of IDR 11,880 per month. Vulnerable groups could face an increase of IDR 153,871, while the middle class might see an additional IDR 354,293 in expenses. This affects their purchasing power, forcing many to either reduce consumption, deplete savings, or take on debt.

What does the speaker mean by 'economic fragility' in the context of the PPN increase?

-Economic fragility refers to the current weakness in Indonesia's economy, highlighted by early deindustrialization. With the manufacturing sector shrinking, factory closures, and job losses, the economy is already under stress. The 12% PPN increase exacerbates this situation by reducing consumer spending, further slowing economic activity.

What impact does the informal labor market have on the PPN increase?

-The informal labor sector, which accounts for over half of Indonesia’s workforce, is highly vulnerable to the PPN increase. Small businesses will suffer as people cannot afford to buy goods, potentially leading to business closures and job losses in the informal economy. This is a significant risk given the limited social protection for workers in this sector.

How has the middle class been affected in recent years?

-In the past five years, 9.48 million people have fallen out of the middle class, which has shrunk from 57.33 million in 2019 to 47.17 million today. This shift reflects growing economic inequality, with more people struggling to meet basic needs and facing difficult choices between essentials like food and debt repayment.

What is the link between the PPN increase and rising inequality?

-The PPN increase is likely to exacerbate inequality, as it disproportionately affects the poor and the middle class. As the middle class weakens and more people fall into poverty, the Gini index (a measure of income inequality) has risen from 0.30 to 0.385. This growing divide could lead to social unrest and instability.

What does the decline in savings capacity signify?

-The decline in savings capacity, as reported by Bank Indonesia, indicates that households are spending nearly all of their income on consumption, leaving little room for savings or investments. This is a concerning trend, as it suggests that people are using their savings to survive rather than investing in future opportunities or preparing for emergencies.

How will the 12% PPN increase impact inflation and overall economic output?

-The 12% PPN increase is expected to trigger inflation, with prices rising by 9%. This will reduce household consumption by IDR 40.68 trillion and lead to a significant decrease in economic output by IDR 79.71 trillion, lowering growth projections from 5.1% to just 4.03%. The retail, manufacturing, and services sectors are likely to be the hardest hit.

What alternative revenue generation methods does the speaker propose?

-The speaker suggests alternative ways to increase government revenue without burdening the population. These include a wealth tax targeting the affluent, which could raise IDR 81.6 trillion, a windfall tax on the mining and palm oil sectors with a potential of IDR 300 trillion, and a carbon tax that could both generate revenue and help protect the environment.

What is the speaker’s broader message regarding the role of the government?

-The speaker emphasizes that the government’s role is to protect its citizens, particularly the most vulnerable, and ensure social justice. The country should seek policies that promote fairness and long-term prosperity, rather than imposing burdens that risk economic stagnation and social unrest.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

TVR 120 - DPR RI : Minta Pemerintah Tunda Kenaikan PPN 12%

Anggaran Tekor, PPN Capai Rekor

Why Indonesia Keeps Raising Taxes | Value Added Tax (VAT)

PPN 12 Persen Berlaku Mulai 2025, Analis: Kelas Menengah Paling Terpukul

PPN NAIK 12%, RAKYAT MISKIN AKAN BERTAMBAH MISKIN. APBN BISA TAMBAH BONCOS!

How Reagan Ruined Everything

5.0 / 5 (0 votes)