TUTORIAL LENGKAP: MENGGUNAKAN APLIKASI SIBMT UNTUK TRANSAKSI SYARIAH-Shilvia Karisma Nur Anissa-ES.I

Summary

TLDRThis tutorial provides a comprehensive guide on how to use the CBMT digital banking application. It covers essential tasks such as logging in, creating and managing customer accounts, opening savings and fixed deposit accounts, handling cash deposits and withdrawals, transferring funds between accounts, and generating reports. Additionally, the tutorial explains how to manage loans and financing transactions, including collateral management and loan disbursements. Each step is detailed clearly, ensuring users can efficiently navigate and utilize the system for various banking operations.

Takeaways

- 😀 Ensure to log in to the CBMT application using the correct username (with spaces) and password (without spaces).

- 😀 The main menu of CBMT includes four sections: File (for managing customer data), Transaction (for banking actions), Reports (for generating reports), and Utility (for system settings).

- 😀 To create a new customer account, go to the 'File' section and select 'Add Register Nasabah'. Fill in all required details, then save the customer data.

- 😀 A new bank account (savings) can be opened by selecting 'Tabungan' under the Transaction menu and entering the customer’s details.

- 😀 Cash deposits can be made by selecting 'Setor Tunai' under the Transaction menu, entering the customer’s account number, and specifying the amount to be deposited.

- 😀 For cash withdrawals, choose 'Penarikan Tunai' from the Transaction menu, enter the customer’s account number, and specify the withdrawal amount.

- 😀 To transfer funds between accounts, select 'Antarrekening' from the Transaction menu, choose both the sending and receiving accounts, and specify the amount to transfer.

- 😀 Reports can be generated for various banking activities, such as checking the 'Master Register Nasabah' or 'Tabungan' reports, by selecting the appropriate option in the Reports menu.

- 😀 To create a deposit account, navigate to 'Deposito' under the Transaction menu, fill out the required deposit details, and save the information.

- 😀 Loan-related transactions, such as binding collateral ('Pengikatan Jaminan') or processing loan disbursements ('Realisasi Pembiayaan'), are managed through the 'Pembiayaan' section in the Transaction menu.

Q & A

What is the first step to use the CBMT application?

-The first step is to open a browser (e.g., Chrome) and navigate to the website cbmtit.co.id. Then, you need to log in using your bank username and password.

How do you log in to the CBMT application?

-To log in, you need to enter your bank username in lowercase letters with a space, and your password is the same as the username but without spaces.

What are the four main menus in the CBMT application?

-The four main menus are: File, Transaction, Report, and Utility.

What can you do in the 'File' menu?

-In the 'File' menu, you can manage customer data, such as adding or editing customer accounts, and handle various file operations.

How do you create a new customer account in CBMT?

-To create a new customer account, go to the 'File' menu, select 'Master Register,' and then click 'Add Register Nasabah.' Afterward, fill in the required customer details and click 'Save.'

What information is required when creating a customer account?

-You need to provide the customer's name, birth year and month, address, phone number, email, and other relevant details. However, sensitive information like the customer’s ID number should not be entered.

How do you open a new savings account for a customer?

-To open a savings account, go to the 'Transaction' menu, select 'Tabungan,' then 'Pembukaan Rekening Tabungan.' After that, enter the customer’s registration code, select the type of account, and click 'Save.'

How can a customer deposit money into their savings account?

-To deposit money, go to the 'Transaction' menu and select 'Setoran Tunai.' Enter the customer’s account code, specify the deposit amount, and click 'Save' to complete the transaction.

What is the process for making a withdrawal from a savings account?

-To make a withdrawal, go to 'Transaction' and select 'Penarikan Tunai.' Enter the customer’s account code and the amount to withdraw, then click 'Save' to finalize the withdrawal.

How do you transfer money between accounts in CBMT?

-To transfer money, go to 'Transaction,' select 'Tabungan,' and then 'Transaksi Antarening.' Select the source and destination accounts, enter the transfer amount, and click 'Save' to complete the transfer.

How can you generate reports in the CBMT application?

-To generate reports, go to the 'Report' menu and select the type of report you want (e.g., 'Master Register Nasabah Report' or 'Tabungan Report'). Click 'Review' to view the report.

How do you create a deposit account for a customer?

-To create a deposit account, go to 'Transaction,' select 'Deposito,' and click 'Register Deposito.' Enter the customer’s registration code, choose the deposit type, and click 'Save' to complete the registration.

What are the steps to withdraw from a deposit account?

-To withdraw from a deposit account, go to 'Transaction,' select 'Teller,' then choose 'Pencairan Deposito.' Enter the necessary details and click 'Save' to complete the withdrawal.

What is the process for managing collateral in the CBMT system?

-To manage collateral, go to 'Transaction,' select 'Pembiayaan,' and then 'Pengikatan Jaminan.' Enter the customer’s details and select the type of collateral (e.g., motor vehicle). After completing the form, click 'Save.'

How do you handle financing and loan disbursement in CBMT?

-To handle financing, go to 'Transaction,' select 'Pembiayaan,' then choose 'Realisasi Pembiayaan.' Fill in the necessary information, such as loan details and repayment schedule, then click 'Save.'

What should you do if there is an error in a customer's account information?

-If there's an error, you can go to the 'File' menu, select 'Master Register,' and then either edit or delete the customer’s account by selecting 'Edit' or 'Delist Nasabah.'

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

PLC OMRON #1 - Memahami Hardware Secara Detail dan Memahami Terminal I/O PLC OMRON CP1L

S01E01 - BELAJAR ALAT UKUR MULTIMETER

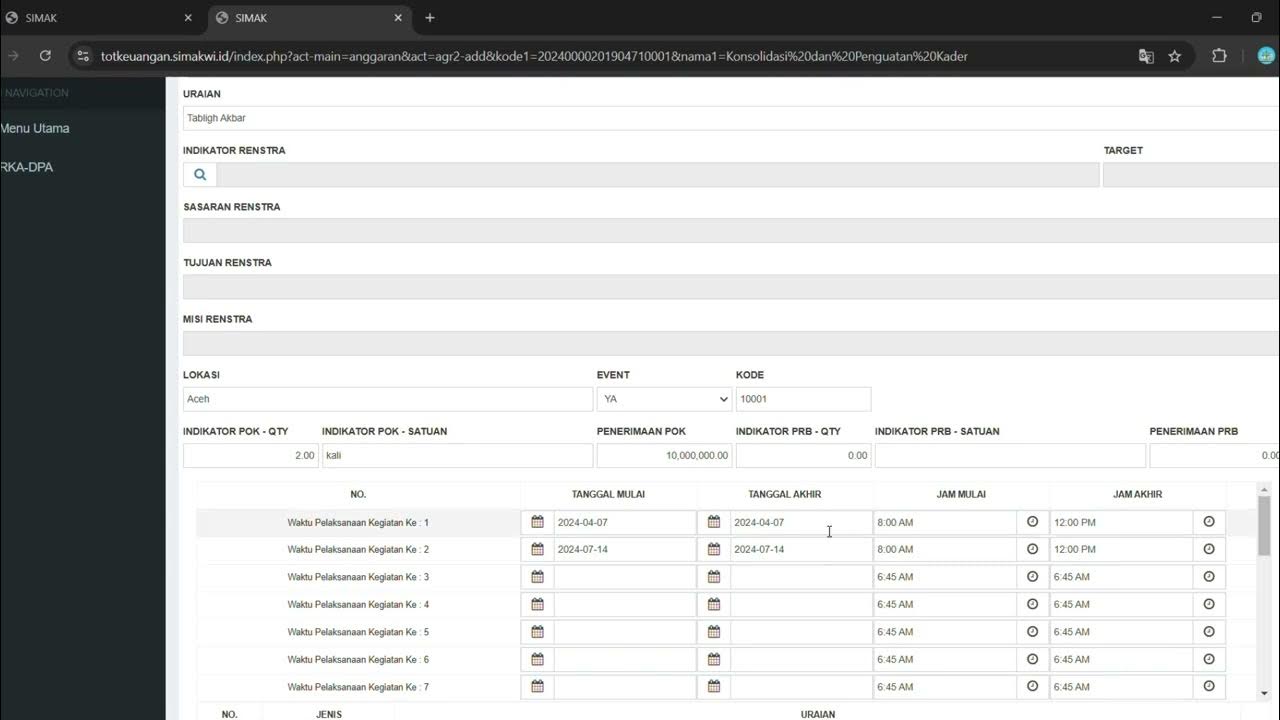

LOGIN SIMAK DAN PENGINPUTAN RKA DAERAH

Belajar Cara Menggunakan Oscilloscope Digital | Cara Kalibrasi Oscilloscope Digital

Working with Visual Studio .NET | C#.NET Tutorial | Mr. Bangar Raju

Self-Host Next.js 15 on VPS in 8 Minutes (EASY!)

5.0 / 5 (0 votes)