Effectiveness of Monetary Policy in IS LM Model #Macroeconomics, #ISLM, #monetarypolicy

Summary

TLDRThe transcript is a highly fragmented and complex mixture of topics, including references to private investments, policies, economic terms, and various unrelated subjects such as Bollywood, technology, and social matters. It touches on issues like investment strategies, rising demand for money, challenges in various sectors, and social concerns related to investment in modern markets. The text includes disjointed phrases and concepts about financial planning, interest rates, public policy, and consumer behavior, along with some references to Indian culture, sports, and other activities. The overall message appears to emphasize trends in investment and market dynamics.

Takeaways

- 😀 The transcript discusses private investment, market policies, and their potential impact on the economy.

- 😀 There are mentions of various financial terms like interest rates, inflation, and private investments.

- 😀 Several phrases refer to the demand for specific goods, like the need for clean water, and the role of investment in addressing these demands.

- 😀 The text contains references to monitoring systems, which may relate to tracking financial or investment trends.

- 😀 There's mention of significant events and people, like Bollywood, the Supreme Court, and investment consultants.

- 😀 The impact of investment in different sectors is discussed, suggesting a positive effect on growth and development.

- 😀 Some sections talk about government policies and their relation to investment strategies, such as interest rate adjustments.

- 😀 The transcript includes vague references to technology, such as video calling, smartphones, and online platforms.

- 😀 Throughout the text, the importance of financial awareness and making informed decisions is emphasized.

- 😀 The text also touches on societal issues like corruption, consumer demands, and the impact of global events on local economies.

Q & A

What is the main focus of the transcript?

-The transcript primarily revolves around themes like private investments, market trends, interest rates, and investment policies, though the narrative is fragmented and lacks clear structure.

How does the transcript address private investment?

-Private investment is frequently mentioned in the transcript, particularly in relation to its rise and the impact on various markets and sectors. The content suggests a focus on investment opportunities and market dynamics.

What role does interest rate play in the context of the transcript?

-Interest rates are highlighted as a critical factor influencing investments, market trends, and financial decisions. There are mentions of rising or fluctuating interest rates affecting private investments and other economic factors.

Are there any specific industries or sectors mentioned in the transcript?

-The transcript includes references to several sectors, including technology (e.g., investments in software), real estate (e.g., property investments), and private investments in various domains. However, these references are not clearly defined.

What are some of the recurring themes in the transcript?

-Recurring themes include private investment, market conditions, policy changes, and interest rates. However, the transcript is fragmented, making it difficult to draw coherent conclusions on these themes.

What is the transcript's stance on investment policy?

-The transcript seems to indicate that investment policies are key to market trends, with mentions of the effect of interest rates, investment returns, and various financial instruments. However, details on specific policies are vague.

How does the transcript relate to financial consulting?

-There are mentions of financial consulting in the context of advising on private investments and managing market risks. However, these points are fragmented, with no clear structure or elaboration.

What is the connection between private investment and market confidence in the transcript?

-Private investment is suggested to contribute to market confidence, with positive results predicted from rising investments. This connection is made in the context of managing financial policies and investment trends.

How is the concept of market trends addressed?

-Market trends are briefly referenced, with the script suggesting that they are influenced by factors such as interest rates and private investments. However, due to the fragmented nature, there is no clear analysis of how these trends evolve.

What challenges or difficulties are highlighted in the transcript?

-Challenges such as the impact of fluctuating interest rates, market volatility, and the complexity of investment policies are mentioned. The script suggests that these challenges can affect the outcomes of private investments and financial strategies.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

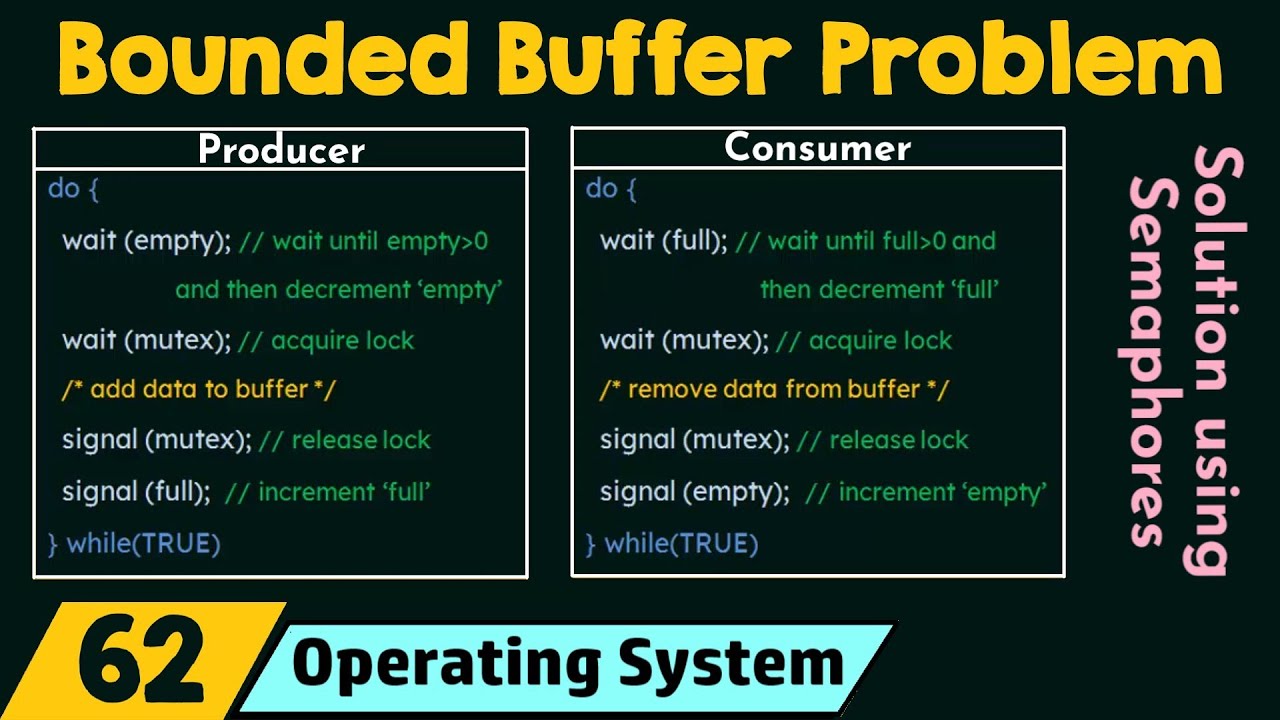

The Bounded Buffer Problem

Keberhasilan dan Kegagalan Pemerintahan Barack Obama - Liputan Berita VOA

BEST TEST HACK for the Rhetorical Analysis Essay

ஒரு டம்ளர் அரிசி இருந்தால் 100 வடாம் ரெடி|Beetroot vadaam|Palak vadaam|Arisi vadaam

SISTEM KLASIFIKASI MAKHLUK HIDUP DAN BINOMIAL NOMENKLATUR #ipakelas7smp #klasifikasimakhlukhidup

Whiskey Rebellion

5.0 / 5 (0 votes)