Prestação de SERVIÇOS para o EXTERIOR | Saiba como PAGAR MENOS IMPOSTOS na prática!

Summary

TLDRThis video explains how companies that provide services to foreign clients can benefit from tax exemptions in Brazil. Pedro, a specialist accountant, highlights how businesses can reduce their tax burden by taking advantage of government incentives for service exports. He demonstrates the difference in taxes paid by companies that export services versus those that provide services domestically. Through a clear example, the video shows how much businesses can save monthly on taxes. Pedro invites viewers to contact his office for personalized advice and assistance on navigating tax regulations related to service exports.

Takeaways

- 😀 Companies providing services to foreign clients can benefit from tax exemptions on certain taxes in Brazil.

- 😀 The Brazilian government offers tax incentives for companies exporting services, reducing their tax burden.

- 😀 These incentives can help businesses save money by eliminating taxes like COFINS, PIS, and ISS when exporting services.

- 😀 Pedro, the accountant in the video, specializes in helping businesses that offer services abroad navigate these tax benefits.

- 😀 The tax benefits are available for various types of service exporters, including digital marketing, software development, and design services.

- 😀 Whether a company is under Simples Nacional, Lucro Presumido, or Lucro Real, the export tax benefits apply to the same core set of taxes.

- 😀 The export of services to foreign clients typically results in a lower tax burden compared to providing services domestically within Brazil.

- 😀 By checking their Simples Nacional tax forms, businesses can verify if they are already taking advantage of these tax benefits.

- 😀 A comparison of tax forms shows that a company exporting services pays significantly fewer taxes than a company serving domestic clients.

- 😀 The video emphasizes that many businesses are unaware of these benefits, leading them to overpay taxes unnecessarily.

- 😀 Pedro offers consultations and support to businesses wishing to ensure they are benefiting from these tax reductions or start exporting services.

- 😀 The video encourages business owners to contact Pedro for assistance in navigating international service export taxation.

Q & A

What is the main benefit of exporting services for Brazilian companies?

-The main benefit is that Brazilian companies exporting services are exempt from certain taxes, such as COFINS, PIS, and ISS, which reduces their overall tax burden significantly.

Which taxes are exempt for companies exporting services?

-Companies exporting services are exempt from COFINS, PIS, and ISS, which are normally applicable when providing services within Brazil.

How can a company identify if it's benefiting from exportation tax exemptions?

-A company can verify this by checking the tax payment guides, particularly under the Simples Nacional regime. If the company is not paying COFINS, PIS, or ISS, it is likely benefiting from these exemptions.

Does the exportation of services affect a company’s tax regime?

-No, the tax regime (e.g., Simples Nacional, Lucro Presumido, or Lucro Real) does not change the fact that a company can benefit from tax exemptions when exporting services. However, the exemptions do reduce the total amount of taxes paid.

Can you provide an example of the tax savings for a company exporting services?

-For instance, if a company pays R$ 3,143.42 in taxes for domestic services, after applying the exportation exemptions, it would only pay R$ 1,600 in taxes, representing almost a 50% reduction in taxes.

Why does the government provide these tax exemptions for exportation of services?

-The government provides these exemptions to encourage and support companies in expanding internationally, thus promoting the exportation of services and contributing to the country’s economic growth.

How can a business owner get assistance if they want to start exporting services?

-Business owners can contact specialized accountants or firms, such as the one in the video, who can guide them on how to structure their company for exporting services and ensure they comply with the tax regulations.

What types of services are typically eligible for these exportation tax exemptions?

-Services that are often eligible include digital marketing, software development, graphic design, affiliate marketing, and other services offered to clients outside Brazil.

How does the Simples Nacional tax guide differ for companies exporting services compared to those providing domestic services?

-For companies exporting services, the Simples Nacional tax guide will only show the IRPJ, CSLL, and INSS taxes, while for companies offering domestic services, it will also include COFINS, PIS, and ISS.

Is there a risk of paying unnecessary taxes even if a company exports services?

-Yes, many companies fail to apply for the tax exemptions and end up paying unnecessary taxes. It’s important for companies to check their tax guides and ensure they are properly benefiting from these exemptions.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Texas Land Property Tax Exemption - Ag and Wildlife Exemptions

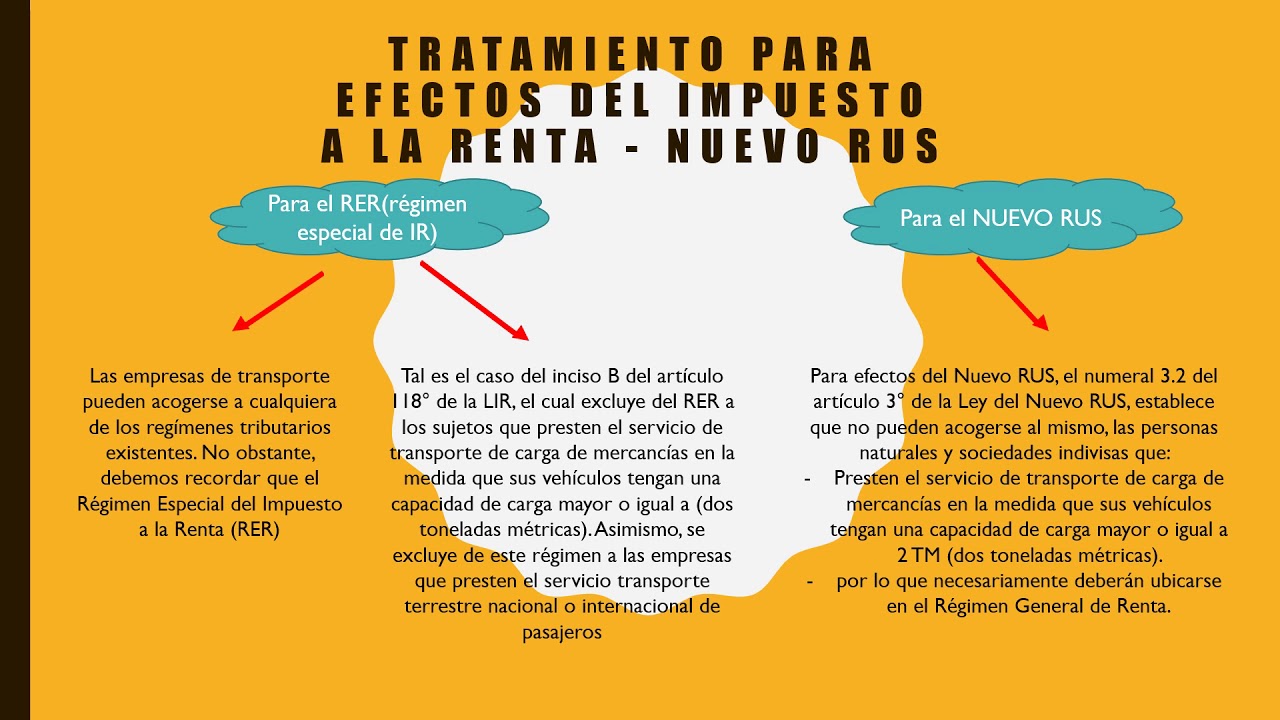

Aspecto tributario de las empresas de transporte

CORPORATION - International Carriers

Tax & regulations of GIFT IFSC - An Overview | DAIS 2024 | #taxation #taxbenefits #ifsc #giftcity

PPh Orang Pribadi (Update 2023) - 6. PPh Pasal 24 (Kredit Pajak Luar Negeri)

1 1 6 Different Direct Tax Laws 3

5.0 / 5 (0 votes)