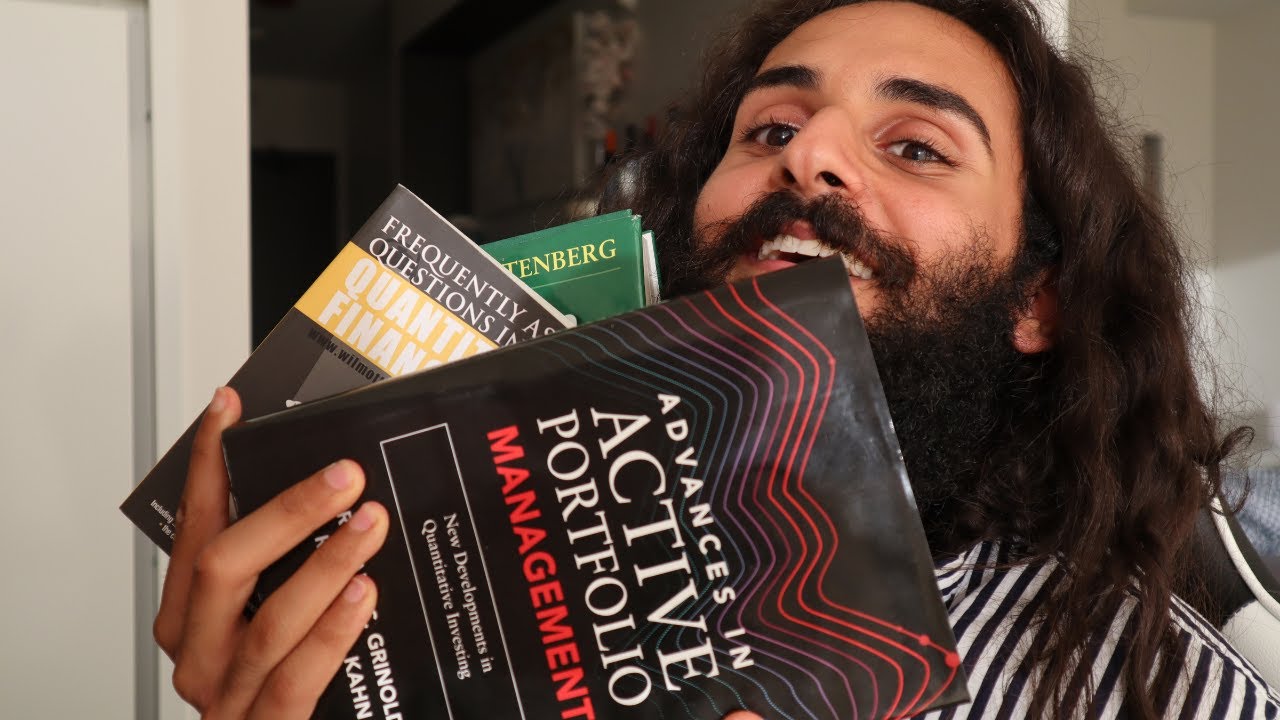

Everything you need to know to become a quant trader (in 2024) + sample interview problem

Summary

TLDRIn this video, Coding Jesus, a senior software engineer in quantitative trading, shares his updated guide to breaking into the field of Quantitative Trading. He recommends key resources including books on options trading, market making, and coding with Python for data analysis. He emphasizes the importance of foundational knowledge in probability, statistics, and relevant math, alongside practical insights into coding and risk management. Highlighting books like 'Option Volatility and Pricing,' 'Inside the Black Box,' and 'Python for Data Analysis,' he provides a roadmap for aspiring quantitative traders to succeed in this competitive field.

Takeaways

- 😀 *Option Volatility and Pricing* is a foundational book for anyone looking to enter the world of quantitative trading, providing essential knowledge on option theory, hedging, volatility, and pricing models.

- 😀 While coding is not always a formal requirement for quantitative trading roles, having coding skills—particularly in Python—can significantly enhance your prospects and performance.

- 😀 *Option Market Making: Trading and Risk for Financial and Commodity Options Markets* is another crucial resource for understanding market-making strategies, which are fundamental to many proprietary trading firms.

- 😀 *Python for Data Analysis* teaches key libraries like pandas, numpy, and scipy, which are essential for manipulating data in quantitative trading, especially when dealing with time series data.

- 😀 A solid understanding of statistics and probability is vital for passing technical screenings and succeeding in quantitative trading roles, even if you don't use advanced math every day.

- 😀 *Statistics the Fun Way* is a great book for reinforcing fundamental concepts in probability and statistics in an easy-to-understand manner, making it accessible even for those without a math background.

- 😀 The speaker emphasizes that while formal math knowledge is essential, it's also crucial to be able to apply these concepts practically, especially when solving problems encountered during technical screenings.

- 😀 *Inside the Black Box* is a recommended read for understanding the history, operations, and key considerations of quantitative trading, offering insights into risk management, transaction costs, and execution models.

- 😀 In quantitative trading, it’s not just about the models but also understanding their real-world implications—this includes things like risk analysis, portfolio construction, and alpha generation.

- 😀 Coding skills in Python are a 'nice to have' for quantitative traders, as they enable you to clean and manipulate data, which is crucial for analyzing market trends and making informed trading decisions.

Q & A

What is the focus of the speaker's video?

-The video is focused on providing updated resources and insights for those interested in becoming quantitative traders. It includes book recommendations and practical advice to help individuals break into the field of quantitative trading.

What makes 'Option Volatility and Pricing' an essential read for aspiring quantitative traders?

-'Option Volatility and Pricing' is considered a critical resource because it provides comprehensive coverage of option theory, risk management, pricing models, and volatility strategies. It's highly recommended for those looking to understand the foundations of quantitative trading and options trading in particular.

What does 'Option Market Making: Trading and Risk Management for Financial and Commodity Options Markets' cover?

-This book delves into the practical aspects of market making, a core activity for proprietary trading firms. It covers topics such as fair value models, volatility contracts, risk management strategies, and more advanced concepts like delta-neutral strategies and arbitrage.

Do you need to know how to code to become a quantitative trader?

-While many job descriptions may state that coding is not a strict requirement, it is a valuable skill to have. Being able to manipulate and analyze data is crucial in quantitative trading, and learning how to code, particularly in Python, will significantly enhance your ability to perform key tasks in the field.

Why is Python for Data Analysis important for aspiring quantitative traders?

-Python for Data Analysis is essential because it teaches how to manipulate time-series and non-time-series data, which is crucial in quantitative trading. The book covers libraries such as pandas, numpy, and scipy, which are foundational tools for data analysis and drawing insights from large datasets.

How can 'Statistics the Fun Way' help someone preparing for a quantitative trading role?

-'Statistics the Fun Way' provides an approachable way to learn the fundamentals of probability and statistics, which are key to passing technical interviews and performing well in quantitative trading roles. It covers topics such as hypothesis testing, Bayes' theorem, and measuring uncertainty, making complex concepts more digestible.

What is the main focus of 'Inside the Black Box'?

-'Inside the Black Box' provides an in-depth exploration of the world of quantitative trading, covering both the history of the field and practical day-to-day considerations for traders. It discusses models used in trading, portfolio construction, risk management, and order execution strategies.

What is the benefit of learning about market-making in quantitative trading?

-Learning about market-making is essential because it is a core function in most proprietary trading firms. It helps traders understand how prices are quoted, the role of liquidity in the market, and how to manage risk in real-time trading environments. It’s particularly useful for those interested in the more practical aspects of quantitative trading.

How do the books recommended in the video help with technical interviews for quantitative trading roles?

-The books recommended in the video, particularly those covering topics like statistics, probability, and data analysis, help prepare candidates for the technical aspects of quantitative trading interviews. These books equip candidates with the necessary knowledge in math and coding to pass the technical screening processes that are common in the industry.

Why is it important to understand the history of quantitative trading?

-Understanding the history of quantitative trading is important because it gives context to the current practices and advancements in the industry. It helps aspiring traders understand how the field has evolved, the key milestones in the development of trading strategies, and the controversies that have shaped the industry, such as high-frequency trading.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Everything you need to know to become a quant trader (top 5 books)

3 SOFT SKILLS you need to master to break into quant trading

What is a quant? (explained by a quant developer)

read these 5 books to break into quant trading as a software engineer

3 things day traders refuse to understand about quant trading

Apa Itu Momentum Investing? Strategi Investasi Saham Ala Agasmhndr | Cerita Stockbitor

5.0 / 5 (0 votes)