Czym są ORDER BLOCKI (Jak je wykorzystać?) (SMC Trading PL)

Summary

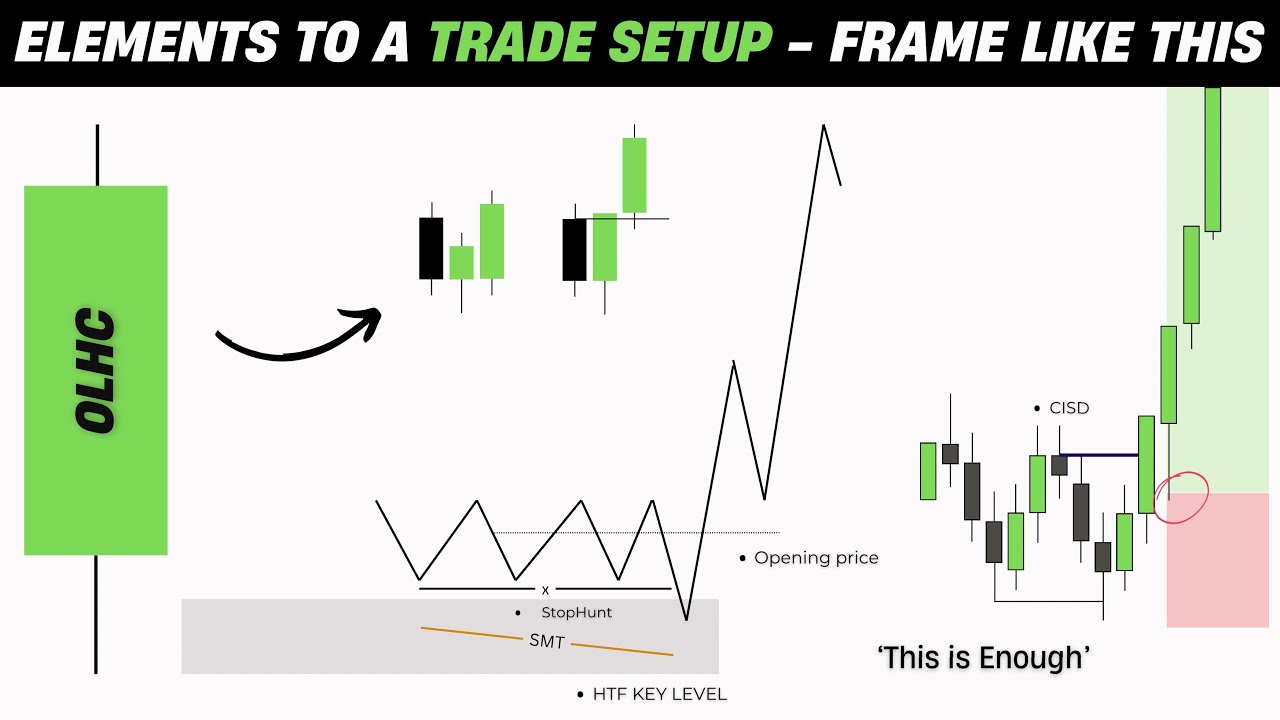

TLDRIn this video, the speaker introduces the concept of order blocks, a crucial tool in ICT (Inner Circle Trader) methodology for predicting market price movements. Order blocks represent areas where large orders create price shifts, and understanding them can help traders anticipate reversals or continuations. The speaker explains how to identify these blocks on various timeframes, using real chart examples. Emphasis is placed on precision, understanding market structure, and employing proper risk management techniques, like stop loss placement and profit targeting. The video encourages backtesting and developing a personalized trading strategy based on these insights.

Takeaways

- 😀 Order blocks are an essential concept in trading, especially for those following ICT (Inner Circle Trader) methodologies, which aim to anticipate price movements.

- 😀 An order block refers to a price range containing significant orders that can lead to a major price movement when touched by the market.

- 😀 Understanding order blocks allows traders to anticipate price actions and movements in specific directions based on market structure and orders.

- 😀 Price movements are influenced by underlying orders in the market, which can be identified by looking at specific price ranges or 'order blocks'.

- 😀 Order blocks can be identified by looking for the largest candle that closes before a price expansion, which is in the opposite direction of the initial price move.

- 😀 Order blocks can be detected on various timeframes (e.g., 4-hour, daily, 5-minute) and can help with predicting price direction across all chart intervals.

- 😀 The concept of order blocks allows traders to make more precise predictions about price behavior, enhancing their ability to speculate effectively.

- 😀 It's important to note that the analysis of order blocks should not rely solely on support lines or trend lines but focus on price action and structure.

- 😀 A key technique in understanding order blocks involves observing the last major candle's body, which can be used to anticipate price retracements or reversals.

- 😀 Traders can place trades based on the likelihood of price returning to the order block and move in the opposite direction, often using stop losses and profit targets for risk management.

Q & A

What are order blocks in trading?

-Order blocks are price ranges on a chart that contain significant buy or sell orders. They are used by traders to predict price movements, as prices tend to react when they reach these areas, either continuing in the same direction or reversing.

How do order blocks relate to ICT (Inner Circle Trader) methodology?

-Order blocks are a key concept in the ICT methodology. This trading approach uses order blocks to help traders identify high-probability entry points, where price action is likely to reverse or continue based on previous institutional order flows.

Why is it important to anticipate price movements with order blocks?

-Anticipating price movements with order blocks is crucial for making informed trading decisions. By identifying these areas, traders can better predict potential market reversals or continuations, improving their chances of success in trades.

What is the basic principle behind order blocks?

-The basic principle is that an order block represents an area where significant orders (buy or sell) have been placed, often leading to price action moving in the opposite direction of the order block. This results in a price reversal or continuation when the order block is revisited.

What is the difference between a 'trend' and an 'order block'?

-A 'trend' refers to the general direction of the market (up or down), while an 'order block' is a specific price range that marks where significant buying or selling orders have been executed. Order blocks help pinpoint precise entry and exit points within a trend.

Why is backtesting important when using order blocks?

-Backtesting is important because it allows traders to verify the effectiveness of using order blocks in predicting price movements. By analyzing past data, traders can refine their strategies and develop a better understanding of how order blocks perform in different market conditions.

What is the significance of the 'range' in identifying order blocks?

-The 'range' in identifying order blocks refers to the price movement before a significant reversal. By marking the range where price action shifts, traders can identify the potential start of an order block, which is essential for making accurate predictions about future price movements.

How does the size of a candle relate to identifying an order block?

-The size of the candle is key to identifying an order block. A large candle in the opposite direction of the trend typically indicates strong institutional activity and can be used to define the boundaries of an order block. This large candle represents the start of a potential price reversal or continuation.

What does 'fractal nature' mean in the context of order blocks?

-The 'fractal nature' means that order blocks can be identified on various timeframes, whether it’s a daily chart, a four-hour chart, or a smaller timeframe like a 5-minute or 1-minute chart. This allows traders to use the concept of order blocks across different scales of price action.

How do wicks (knots) of candles play a role in marking order blocks?

-While some traders focus only on the body of the candle (the open and close prices), others include the wicks (or knots) when marking order blocks. The wicks can often provide additional context, as price action frequently reacts to them, making them valuable in identifying order block levels.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)