ĆWICZENIE KTÓRE ZMIENIŁO MÓJ TRADING

Summary

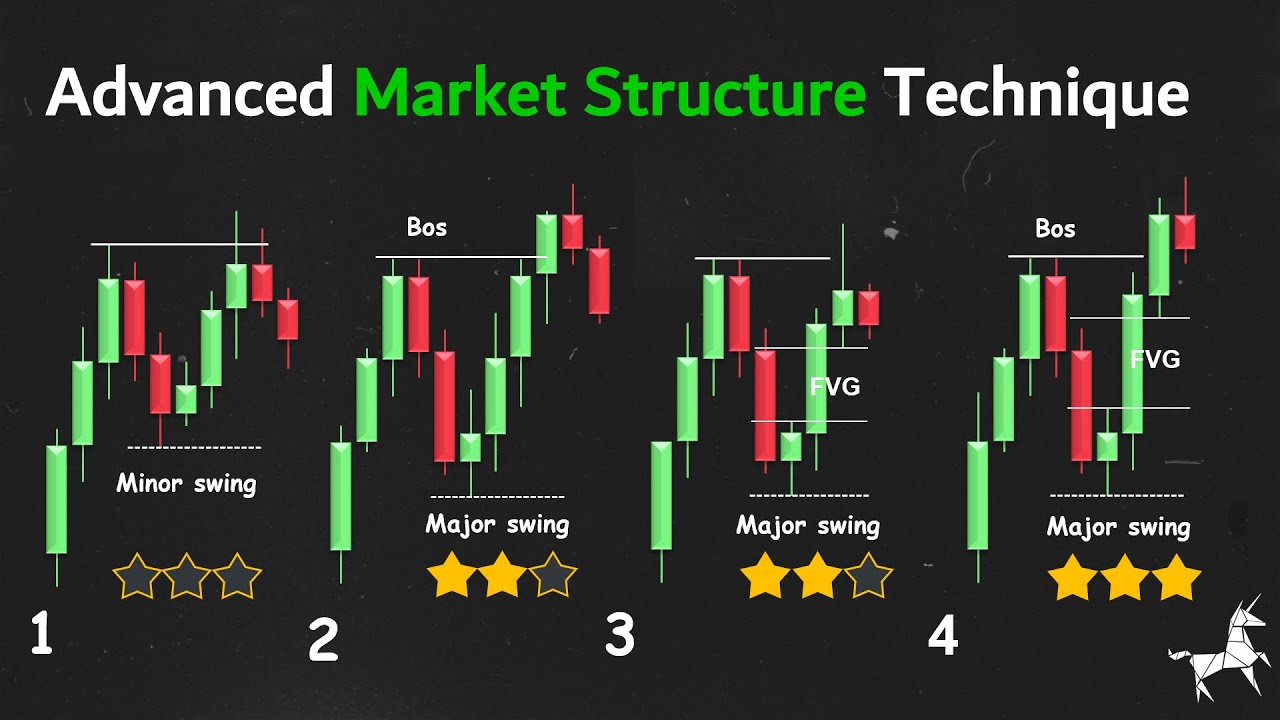

TLDRIn this video, the speaker emphasizes the importance of understanding market context and structure when analyzing price movements. Using a 15-minute chart, they explain how traders should focus on significant trends and price patterns, particularly upward movements, while considering previous corrections and key levels. The speaker highlights the need for a consistent approach to trading that incorporates both technical and fundamental analysis. They also stress the importance of adapting quickly to market changes, while maintaining a clear understanding of broader market trends and structures.

Takeaways

- 😀 The latest significant price movement is crucial for understanding market trends, with a focus on upward movements in this context.

- 😀 It’s important to examine the structure of price movements, such as highs and lows from previous days, to form a better understanding of market behavior.

- 😀 Context is key when analyzing the market, and the current trend should always be considered in relation to the previous significant move.

- 😀 The speaker stresses the need to stay focused on the broader context of price movements rather than getting caught up in short-term fluctuations.

- 😀 Tools like Fibonacci retracements and other price structure indicators can be helpful when analyzing potential future price movements.

- 😀 Price action analysis should always consider whether key levels (like highs or lows) have been broken or respected by the market.

- 😀 Market analysis is not about focusing on a single event or price level; it’s about understanding the larger narrative of price movements.

- 😀 Regardless of the time or day, once you understand the current market structure, you can interpret price action and make informed decisions.

- 😀 The speaker highlights the importance of understanding both the technical and fundamental context of the market for better decision-making.

- 😀 By focusing on the context and structure of the market, traders can gain a more accurate and informed perspective on where the market may be headed next.

Q & A

What is the main focus of the speaker in the script?

-The speaker primarily focuses on understanding and interpreting significant price movements in the context of market analysis, particularly through technical analysis methods such as identifying key trends, price levels, and market structure.

Why does the speaker consider the last upward movement significant?

-The speaker considers the last upward movement significant because it is the most recent, ongoing trend in the market, which provides the context for the current price action and influences how future movements are analyzed.

How does the speaker suggest we approach analyzing market trends?

-The speaker suggests that analysts should always work within the context of significant trends (like the current upward movement) and understand the broader market structure. It is also important to focus on price levels, such as highs and lows, and understand the context behind those movements.

What does the speaker mean by 'working within the context of a trend'?

-'Working within the context of a trend' means interpreting market movements by recognizing the prevailing trend and ensuring that all analysis is done relative to that trend, rather than ignoring it or misinterpreting price action that is part of the broader movement.

What role do price levels such as peaks and corrections play in the analysis?

-Price levels like peaks and corrections are crucial as they help define the structure of the market. These levels can signal when a market has transitioned to a new phase, such as breaking a previous high or moving beyond a correction, which can suggest potential future price movements.

How does the speaker view the importance of identifying specific price points like Fibonacci retracements?

-While the speaker acknowledges the importance of tools like Fibonacci retracements, they emphasize that the broader market context should always take precedence. The key is understanding how these price points fit into the current trend, rather than relying on them in isolation.

Why does the speaker mention that the same patterns can appear regardless of the time frame?

-The speaker points out that market patterns, such as trends and price movements, remain consistent regardless of the specific time frame or day of the week. This means traders can analyze the same structure on different time scales and still interpret the market behavior similarly.

What does the speaker mean when they say 'the market hasn't moved beyond a certain structure'?

-When the speaker says 'the market hasn't moved beyond a certain structure,' they are referring to a situation where the price hasn't broken through key levels or structures, such as previous highs or lows. This indicates that the market is still within a particular range and has not transitioned to a new phase.

How does the speaker suggest incorporating fundamental analysis into technical analysis?

-The speaker suggests that incorporating fundamental analysis involves understanding the broader economic or market factors, such as previous highs and lows, which can provide additional context for interpreting price movements and structure. This helps traders align their technical insights with the overall market environment.

What is the key takeaway about market analysis from the speaker's explanation?

-The key takeaway is that market analysis should always focus on understanding the broader context of price movements, trends, and market structure. By doing so, traders can interpret current market conditions more effectively and make informed decisions based on both technical and fundamental factors.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

"PENGKOLAN" Cara kalian melihat Market Structure langsung berubah!

ICT Mentorship Core Content - Month 03 - Institutional Market Structure

Episode 9: Identifying Institutional Order Flow - ICT Concepts

99% of Traders Will NEVER Know This Secret

I Discovered Best Market Structure Analysis (Premium Video)

Next Day Model - Fractal Way To Get Bias For Trading

5.0 / 5 (0 votes)