Investment Banking Interview Questions and Answers for software testing/Investment banking project/

Summary

TLDRThis video covers key concepts in investment banking, focusing on portfolio management, derivatives, stock markets, and financial instruments like options and futures. It explains how investment banks help companies raise capital, manage IPOs, and facilitate mergers and acquisitions. The video also introduces common investment tools such as shares, bonds, mutual funds, and commodities, along with market order types and basic stock trading strategies. It's a valuable resource for those interested in finance, investment banking, and related fields.

Takeaways

- 😀 Portfolio refers to a collection of financial investments like stocks, bonds, and cash, along with their positions and holdings.

- 😀 Positions in a portfolio show the current profit and loss, while holdings display the profit and loss from previous days.

- 😀 Derivatives are financial contracts whose value is based on an underlying asset, such as forward contracts, swaps, futures, and options.

- 😀 An option is a type of derivative that gives the buyer the right (but not the obligation) to buy or sell an asset at a set price in the future.

- 😀 A **call option** is when the buyer expects the asset price to rise, whereas a **put option** is when the buyer expects the price to fall.

- 😀 The **premium value** of an option refers to the minimum value, also known as the current market price of the underlying asset.

- 😀 A **future** is a contract that requires the parties to transact an asset at a specific price on a predetermined future date.

- 😀 In a future contract, a **long position** is when the buyer expects the asset's price to increase, and a **short position** is when the buyer expects the price to decrease.

- 😀 The **trade date** is when the buyer's order is executed in the market, while the **settlement date** is when the transfer of shares occurs between the buyer and the seller.

- 😀 These financial concepts, such as portfolios, derivatives, options, and futures, are often discussed in investment banking-related interviews, especially for software and manual testing roles.

Q & A

What is a portfolio in financial terms?

-A portfolio is a collection of financial investments, such as stocks, bonds, commodities, and cash. It includes positions (profit and loss details of the current date) and holdings (profit and loss details from the previous day).

What does 'position' mean in the context of a portfolio?

-A position refers to the profit and loss details of the current date within a portfolio, showing how an asset or investment is performing on that specific day.

What does 'holdings' mean in the context of a portfolio?

-Holdings refer to the profit and loss details of the previous day in a portfolio, showing how the asset or investment performed in the past.

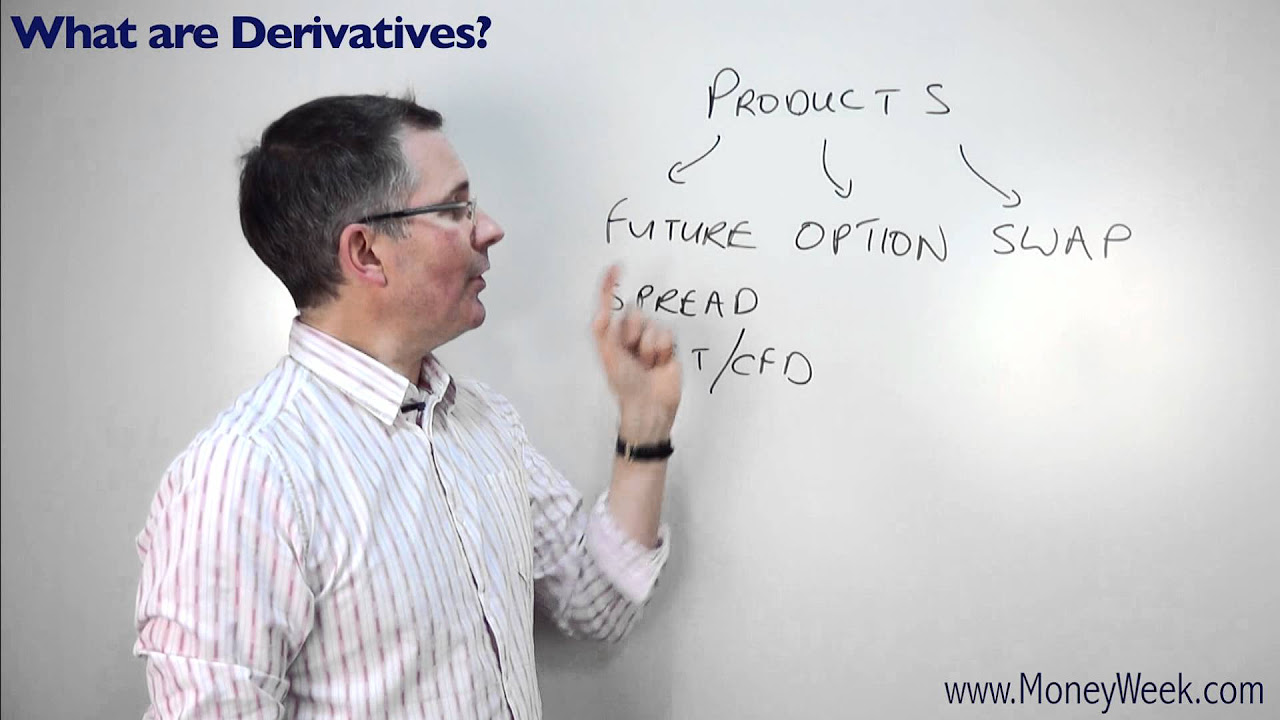

What is a derivative in financial markets?

-A derivative is a financial contract whose price is determined by the value of an underlying asset. It involves a contract between two or more parties to exchange assets or cash flows.

What are the types of derivatives mentioned in the script?

-The types of derivatives mentioned are forward contracts, swap contracts, futures contracts, and option contracts.

What is an option contract and what are its types?

-An option contract is a financial derivative that gives the buyer the right, but not the obligation, to buy or sell an asset. The two main types of options are 'call options' (betting on price increase) and 'put options' (betting on price decrease).

What is a call option and when is it used?

-A call option is used when the buyer predicts that the price of the underlying asset will increase in the future. The buyer has the right to purchase the asset at a predetermined price.

What is a put option and when is it used?

-A put option is used when the buyer predicts that the price of the underlying asset will decrease. The buyer has the right to sell the asset at a predetermined price.

What is meant by the 'premium value' in options trading?

-The premium value is the current market price of an asset in the context of an option contract. It is the minimum value required to execute an option trade.

What is a futures contract and how does it differ from an options contract?

-A futures contract is an agreement to buy or sell an asset at a predetermined future date and price. Unlike options, which give the right but not the obligation, futures contracts obligate both parties to fulfill the agreement.

What is the difference between long and short positions in futures contracts?

-In a long position, the buyer expects the asset's price to rise in the future, while in a short position, the buyer expects the asset's price to fall. Both positions predict future price movements but in opposite directions.

What is the trade date and settlement date in financial transactions?

-The trade date is when the buyer's order is executed in the market, and the settlement date is when the transfer of the asset or share takes place between the buyer and the seller.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Apa itu Instrumen Keuangan? - Dr. Erwinna Chendra

History of Derivatives Trading

Futures and Options Halal or Haram? Derivatives Halal or Haram?

Basics of Futures and Options (F&O) | Futures and Options explained | Futures Trading for beginners

DERIVATIVES in Stock Market - Explained | Mission Options E01

What are derivatives? - MoneyWeek Investment Tutorials

5.0 / 5 (0 votes)