What's Next for Chainlink? Detailed LINK Elliott Wave Price Analysis and Price Prediction

Summary

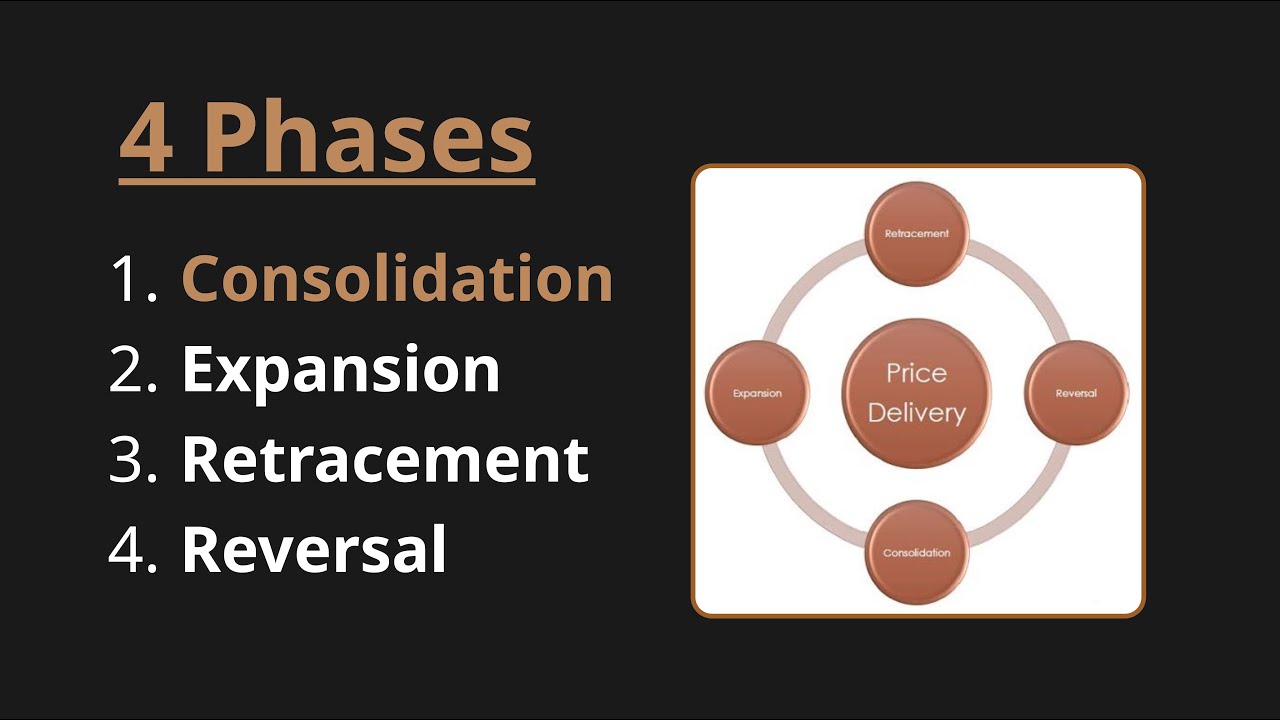

TLDRIn this update, the speaker discusses the recent reversal and consolidation of the LINK cryptocurrency within a significant support region. They highlight the ongoing uptrend, supported by a five-wave structure, and mention targets like $17.30 for the third wave. The speaker emphasizes the importance of holding above key support levels, specifically the 50% retracement, and notes the potential for further upside movements. They caution that the market may not always follow a predictable pattern and stress the need for flexibility in trading decisions. The video encourages viewers to engage with the content, join channel memberships, and follow on social media for more updates.

Takeaways

- 😀 LINK has recently reversed from a significant support zone after months of consolidation.

- 😀 The market seems to be following a bullish roadmap, with the trend expected to continue as long as it holds above the November low.

- 😀 A five-wave move in Elliott Wave Theory is anticipated, with the first ideal target for the third wave at $17.30.

- 😀 It is possible for LINK to continue moving higher after this breakout, potentially reaching around $70 (6922).

- 😀 Wave patterns do not always behave as expected, and the third wave can sometimes extend beyond typical limits.

- 😀 Pullbacks in the market provide entry opportunities, but they don't always occur or follow predictable patterns.

- 😀 The current upward movement from the November low appears to be an impulsive wave, signaling continued bullish momentum.

- 😀 Micro support areas will be adjusted as the price action unfolds, with the 50% retracement level at $12.24 acting as a critical support zone.

- 😀 The 50% retracement level will serve as a dynamic stop-loss, adjusting as the price progresses.

- 😀 Once the price reaches the third wave target of $17.30, a potential pullback for a fourth wave can be expected, but it could extend higher depending on market conditions.

Q & A

What is the overall trend direction for Link (Chainlink) according to the video?

-The overall trend for Link is bullish, with the price currently following an uptrend after consolidating in a long-term support region. As long as the price holds above the November low, the expectation is for the price to continue rising.

What is the significance of the five-wave pattern mentioned in the video?

-The five-wave pattern is important for confirming the trend's progression. The video suggests that the current trend should ideally unfold as five waves, with the target being $17.30 for the third wave. This pattern helps identify the structural movement in the market and provides a framework for potential price targets.

What is the target price for the third wave, and why is it important?

-The target price for the third wave is $17.30. It is considered the first ideal target for the bullish movement and is a key milestone in the larger wave count. Achieving this target would confirm the continuation of the uptrend, and traders are advised to monitor it closely.

What role does the 50% retracement level play in the analysis?

-The 50% retracement level, currently at $12.24, is a crucial support level in the analysis. As long as the price remains above this level, the expectation is that the uptrend will continue towards the next target. The 50% retracement serves as a dynamic stop point, helping to track potential trend reversals.

What does the speaker mean by 'micro support area'?

-The 'micro support area' refers to smaller, more precise support levels within the larger trend. These are adjusted as the price moves, providing real-time guidance on potential entry points or price reversals. These levels are flexible and evolve with the market.

Why does the speaker mention that the five-wave pattern doesn’t always form perfectly?

-The speaker acknowledges that while the five-wave pattern is an ideal structure, the market does not always follow a perfect pattern. Sometimes, the third wave can extend unexpectedly, and the overall market behavior can become more erratic, which requires traders to remain flexible in their analysis.

What is the significance of the November low in the analysis?

-The November low is an important reference point for the analysis. As long as the price stays above this low, the assumption is that the uptrend will continue. If the price breaks below this level, it could signal a potential reversal or trend change.

What is meant by the phrase 'aggressive upside movements'?

-Aggressive upside movements refer to rapid or sharp price increases, often driven by significant market events or shifts. The speaker mentions that Link might experience such movements, similar to ADI (another asset), but cautions that these movements are not always predictable.

What are the potential risks or challenges highlighted in the video?

-One of the challenges mentioned is the unpredictability of market movements, particularly when the expected five-wave pattern doesn't form perfectly. Additionally, pullbacks and price corrections can sometimes be difficult to predict, and the speaker warns that traders should be prepared for these fluctuations.

How can traders use the information in this video for their own trading strategies?

-Traders can use the information by focusing on the larger trend and key support levels, such as the 50% retracement at $12.24 and the target of $17.30. They should also monitor the development of the five-wave pattern and adjust their strategies accordingly, being ready for potential pullbacks or price corrections when the market reaches certain milestones.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

TESLA Stock - Bulls vs Bears Battle, Who's Winning?

Bitcoin Price Elliott Wave Price Update: Understanding the Bullish and Bearish BTC Scenarios

NVDA Stock - Did Bulls Crush The Bears Again?

TESLA Stock - Bullish Re-Test?

Anticipating Expansions From Consolidations - Episode 1

TESLA Stock - Huge Bullish Recovery On TSLA

5.0 / 5 (0 votes)