勝率の高いトレード手法教えます【再現性高】

Summary

TLDRThe video script discusses a reliable trading method that focuses on trend following and Elliott wave theory, particularly the third wave, to achieve high win rates in trades. The speaker emphasizes the importance of identifying the high and low points of the previous candlestick, confirming support and resistance levels, and ensuring the clarity of recent highs for better reproducibility of the trading method. The video outlines three key points to increase the success rate: confirming support and resistance, examining the manner of high updates and subsequent pullbacks, and considering the trend direction of higher timeframes. Two cautionary notes are also highlighted—being mindful of the time frame for trading and setting appropriate stop-losses. The speaker suggests using tools like Fibonacci retracements and indicators that measure limit amplitudes to refine entry and exit points. The summary underscores the significance of combining trading techniques with environmental awareness, scenario analysis, and mental control for sustainable profitability in trading.

Takeaways

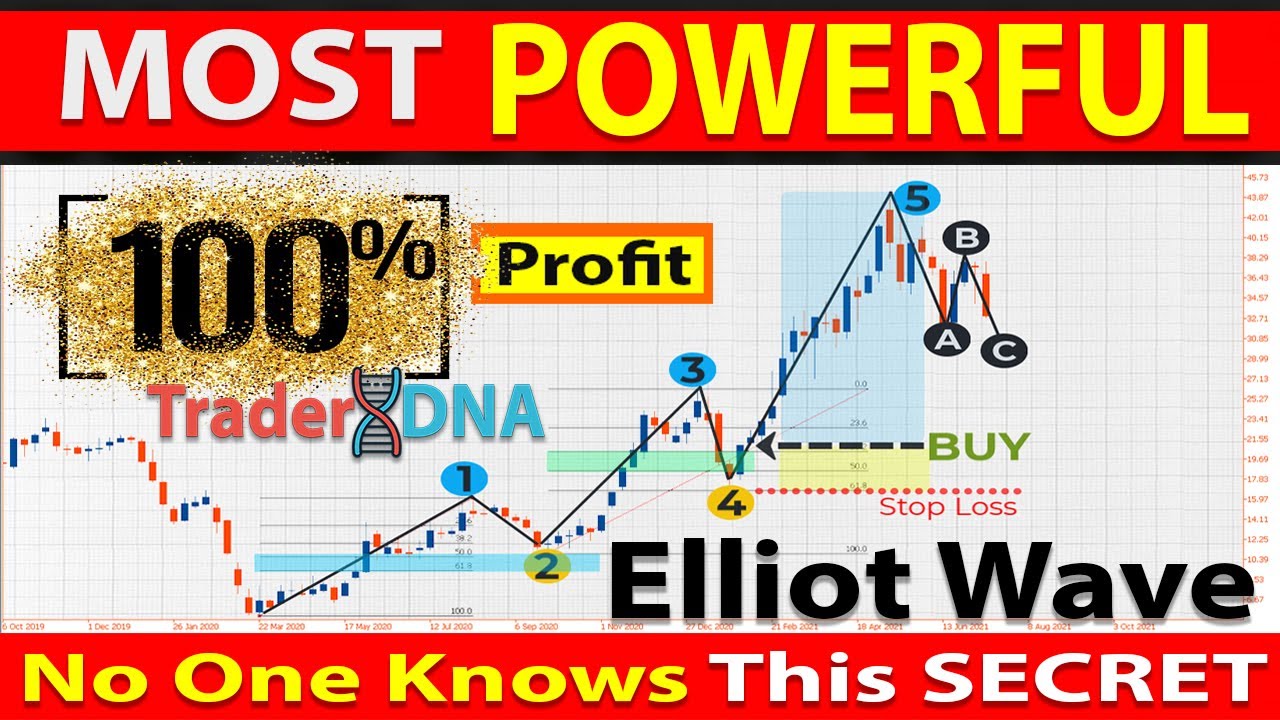

- 📈 Focus on trend following and Elliott Wave Theory, specifically targeting the third wave for higher win rates in trades.

- 🔍 Identify key support and resistance levels by confirming the latest high and low of the previous candlestick, ensuring a clear reference point for trade entries.

- 🚫 Avoid entering trades immediately upon reaching new highs as it may lead to a lack of support and potential losses.

- 📊 Emphasize the importance of past chart analysis to understand the success rate of the trading method and to identify optimal entry points.

- 🟢 Look for chart patterns such as Head and Shoulders or Double Bottom before entering a long position, as these can signal a potential reversal.

- 🔺 Pay attention to price action and trend transitions, such as moving averages turning upwards, to increase the likelihood of a successful trade.

- ⏰ Consider the time frame of trades, as certain market sessions may offer better opportunities for the trading method to be effective.

- 🔼 Monitor the direction of the higher time frame trend to align with the trading method for increased chances of success.

- 📌 Use indicators like Fibonacci retracements or limit order volume to determine potential entry and exit points in a trade.

- ✂️ Implement strict risk management by setting stop-loss orders at appropriate support levels to mitigate potential losses.

- 💡 Recognize that a combination of trade technique, environmental awareness, scenario understanding, and mental control is essential for consistent profitability in trading.

Q & A

What is the main trading method introduced in the video?

-The main trading method introduced is a trend following strategy that focuses on Elliott Wave Theory, specifically capturing the third wave for a high win rate trade. It involves confirming the previous high, checking for a new high, and then looking for a pullback to the previous high before considering a trade.

What are the three key points to consider when using this trading method?

-The three key points are: 1) Confirming the previous high and the pullback to it, 2) Ensuring there is support or resistance at play, and 3) Observing the trend direction on higher time frames.

Why is it important to identify the previous high accurately?

-Identifying the previous high accurately is crucial for the reproducibility of the trading method. If the high is not clearly defined, the method's effectiveness and reliability decrease.

What is the significance of observing the pullback after a new high is reached?

-Observing the pullback is important because it helps to confirm if the market has found support or resistance at the previous high level, which is a key factor in determining the potential for a successful trade.

How does the speaker suggest improving the success rate of the trading method?

-The speaker suggests improving the success rate by thoroughly confirming support and resistance levels, looking at how the new high was reached and the nature of the pullback, and considering the trend direction on higher time frames.

What is the role of past chart analysis in this trading method?

-Past chart analysis is used to validate the trading method by observing historical price action and identifying patterns that led to successful trades. It helps to understand under what conditions the method is more likely to be successful.

Why is it advised not to enter a trade immediately after the price returns to the previous high?

-Entering a trade immediately after the price returns to the previous high can be risky because it may not have found sufficient support or resistance. It's better to wait for confirmation of support or resistance before entering a trade.

What are the two additional points of caution mentioned in the video?

-The two additional points of caution are related to the time of trading and the management of trades. It's important to consider the market's time zone and typical patterns during different times of the day, and to manage trades with clear exit strategies, such as using stop-loss orders.

How does the speaker suggest managing the risk in trades?

-The speaker suggests using stop-loss orders to manage risk, placing them below the previous low in a bullish scenario or above the previous high in a bearish scenario. Additionally, the use of indicators like Fibonacci retracements and limit order volumes can help in managing exits.

What is the significance of the 'limit order volume' indicator mentioned by the speaker?

-The 'limit order volume' indicator helps to predict the day's potential high and low prices by showing the volume of limit orders at different price levels. This can assist traders in making more informed decisions about entry and exit points.

Why does the speaker emphasize the importance of not relying solely on trading methods for consistent profitability?

-The speaker emphasizes that while trading methods are important, they should be combined with other skills such as environmental awareness, scenario analysis, and mental control for consistent profitability. No single method can guarantee success in trading.

What additional resources does the speaker offer to help traders improve their skills?

-The speaker offers a community (fx コミュニティ) and an indicator (簿ライン) that automatically displays the limit order volume, which can help traders identify potential support and resistance levels and manage their trades more effectively.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

🔴 Most Effective "ELLIOT WAVE and FIBONACCI" Price Action Trading Strategy (Wave Trading Explained)

My Incredibly EASY Trading Strategy Made Me $31k This Month

آموزش امواج الیوت مقدماتی

SUI Coin Price News Today - Technical Analysis and Elliott Wave Analysis and Price Prediction!

What's Behind the USD INR Market Shift? | Rohit Srivastava Insights

Cardano ADA Price News Today - Elliott Wave Technical Analysis and Price Now! Price Prediction!

5.0 / 5 (0 votes)