آموزش امواج الیوت مقدماتی

Summary

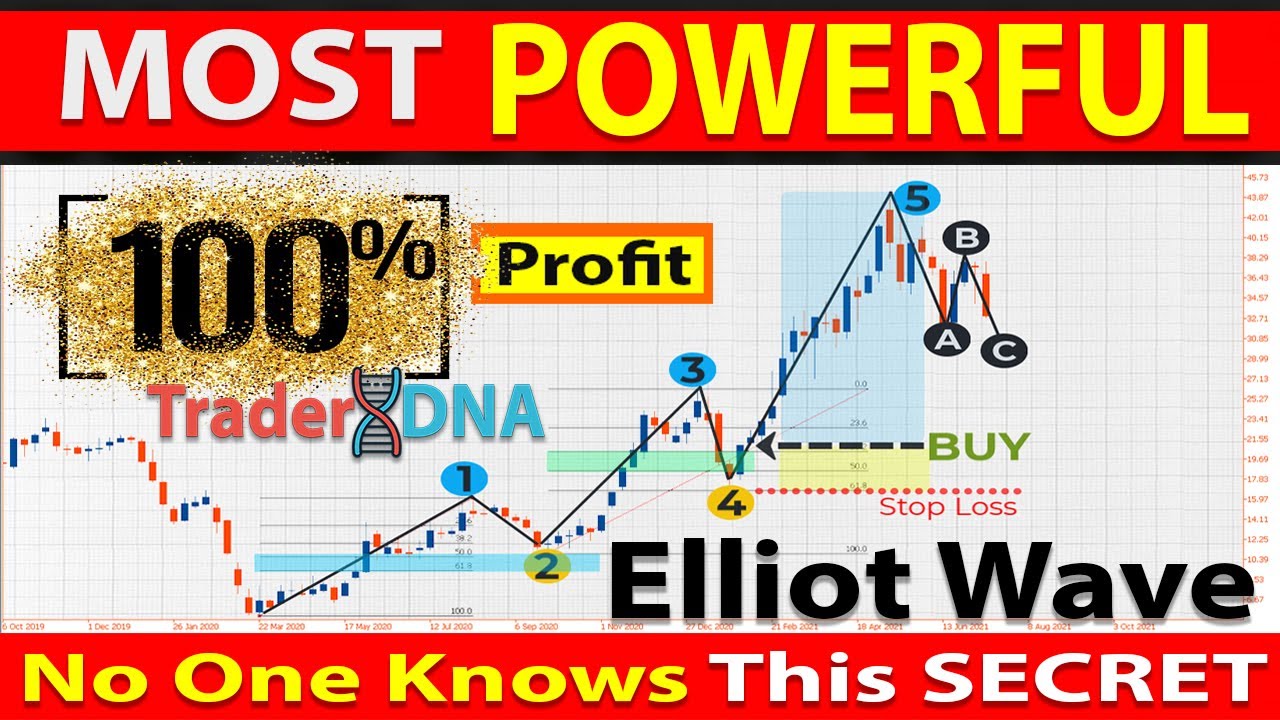

TLDRIn this detailed video, Mohammad introduces Elliott Waves, explaining their five-wave structure and the correction phases that follow. He highlights key concepts like the three golden rules, fractality, and the application of these waves in market analysis. Through live chart demonstrations, he showcases how to identify trends, corrections, and entry points. Emphasis is placed on accurate wave counting, understanding the behavior of price corrections, and making informed trading decisions. Mohammad also touches on advanced concepts like wave structures, offering expert tips and inviting viewers to further explore his live trading videos for precise insights into Elliott Wave strategies.

Takeaways

- 😀 Elliott Waves consist of five main waves: waves 1, 2, 3, 4, and 5, followed by a three-wave correction (ABC).

- 😀 Elliott Waves are fractal, meaning they are repetitive and can be broken down into smaller sub-waves, each following the same pattern.

- 😀 Each wave has its own set of rules. The most important rules include wave 3 being the longest, wave 4 not crossing the top of wave 1, and wave 2 not crossing the bottom of wave 1.

- 😀 Wave 2 typically shows a price correction in a zigzag pattern, whereas wave 4 shows a time correction, often appearing as flat or triangular patterns.

- 😀 Wave ABC is a corrective wave pattern. Wave A is usually five waves, wave B three waves, and wave C another five waves.

- 😀 A key concept is that waves 2 and 4 correct the market in different ways: wave 2 quickly corrects price, while wave 4 corrects time.

- 😀 Elliott Waves operate within various timeframes, and understanding the patterns in larger timeframes is crucial before focusing on smaller timeframes.

- 😀 The three golden rules of Elliott Waves must be adhered to: wave 3 must not be the shortest, wave D cannot exceed wave 1's bottom, and wave 4 cannot cross wave 1’s top.

- 😀 When counting waves, always go back to larger timeframes to correct mistakes in wave counts before continuing with smaller timeframes.

- 😀 Elliott Waves can provide entry signals and trade opportunities by accurately identifying key wave structures, including using the ABC pattern for corrective movements.

Q & A

What are the basic components of Elliott waves?

-Elliott waves consist of five main waves: wave 1, wave 2 (correction), wave 3 (trend continuation), wave 4 (correction), and wave 5 (final move in the trend). These waves form the foundation of Elliott wave analysis.

What is the importance of the ABC correction in Elliott waves?

-The ABC correction follows the five-wave pattern and represents a counter-move or retracement of the preceding trend. It is typically composed of a five-wave structure for wave A, a three-wave structure for wave B, and a five-wave structure for wave C.

What are the three golden rules of Elliott waves?

-The three golden rules are: 1) Wave 2 should not surpass the starting point of wave 1. 2) Wave 3 cannot be the shortest wave between waves 1, 3, and 5. 3) Wave 4 should not overlap the top of wave 1.

How do wave 2 and wave 4 differ in terms of price and time correction?

-Wave 2 typically corrects price quickly in a zigzag pattern, while wave 4 generally corrects time, creating flat or triangular patterns and taking longer to develop.

What is the fractal nature of Elliott waves?

-Elliott waves are fractal, meaning they repeat at different time scales. Each larger wave can be broken down into smaller waves, and these smaller waves can follow the same rules and patterns as the larger waves.

What does it mean that Elliott waves are 'self-contained'?

-This means that each wave is composed of smaller waves within it. For example, wave 1 consists of five smaller waves, wave 2 corrects this with three waves, and so on.

How can we use Elliott waves to define entry and exit points in trading?

-Elliott waves help identify key levels in the market. By analyzing wave formations, traders can define entry points at the end of wave 5 or wave C, and set stop-loss orders according to the rules, such as placing the stop behind the low of wave 1.

What is the significance of the range or base created by corrective waves?

-The corrective waves, often forming as ABC patterns, create a range or base where price consolidation occurs. This base can help traders identify when the trend is likely to continue or reverse.

How can lower timeframes be useful when analyzing Elliott waves?

-Lower timeframes allow for a more detailed analysis of smaller waves within a larger trend. By zooming in on lower timeframes, traders can more accurately count waves and find precise entry signals.

What is the difference between an ABC correction and a five-wave trend?

-An ABC correction is a three-wave move (A, B, C) that retraces part of the previous trend, while a five-wave trend is a complete trend in the direction of the market, typically followed by an ABC correction.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

🔴 Most Effective "ELLIOT WAVE and FIBONACCI" Price Action Trading Strategy (Wave Trading Explained)

Ethereum Support and Resistance Levels: Latest Elliott Wave Forecast for ETH and Microstructure

Cronos (CRO): Elliott Wellen Lernen - Einen Chart Labeln

XRP DAILY ANALYSIS - RIPPLE XRP PRICE PREDICTION - RIPPLE XRP 2024 - RIPPLE ANALYSIS

Gelombang Mekanik Fisika Kelas 11- Part 1 : Konsep Gelombang Mekanik

The ONLY Elliott Wave Theory Trading Guide You’ll Ever Need

5.0 / 5 (0 votes)