Week 9 Masterclass Sriram Chidambaram Financial Planning for Startups

Summary

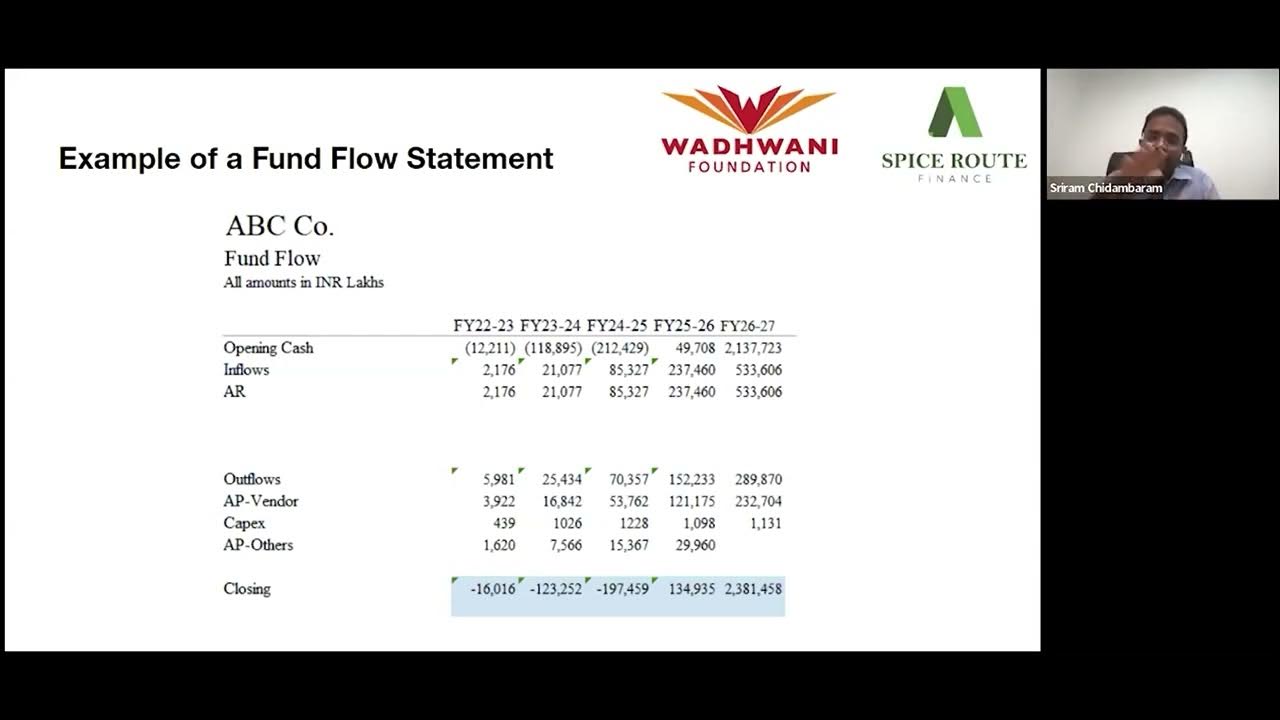

TLDRThis transcript focuses on the critical elements of financial modeling for entrepreneurs, particularly in scaling businesses. It covers product pricing strategies, revenue breakdown, and cost structures, including operational costs, overheads, and finance expenses. The script explains unit economics and how to determine break-even points. It also emphasizes the importance of manpower planning, aligning staff needs with business growth. Through practical examples and benchmarking, it provides a framework for understanding and managing financial growth and organizational scaling, ensuring businesses can grow efficiently while maintaining a healthy cost structure.

Takeaways

- 😀 A 5-year high-level business plan involves forecasting product pricing, volume growth, and market competition. As the market matures, prices generally decrease while volume increases.

- 😀 Understanding cost structures is essential for effective financial planning, with three primary categories: operational costs, SG&A (Selling, General, and Administrative), and finance costs.

- 😀 Unit economics is key to understanding profitability. Gross margin is calculated as Revenue minus operational costs, and contribution margin helps determine when a business becomes profitable.

- 😀 Even if a business initially operates at a negative contribution margin, scaling up can lead to positive margins. Focus on breakeven points and scaling effectively.

- 😀 Direct costs (e.g., delivery expenses) increase with volume, while indirect costs (e.g., office overheads) grow more slowly as the business expands.

- 😀 Benchmarking competitors can provide insights into your own cost structure, especially when you are in the early stages of growth.

- 😀 Manpower planning is crucial as revenue grows. Link your manpower needs to revenue projections, focusing on line functions (direct operations) and staff functions (support roles).

- 😀 Industry standards for SG&A costs can vary. For example, sales costs typically range between 8-20% of revenue, and staffing needs often follow specific benchmarks (e.g., 1 HR person per 100 employees).

- 😀 Operational expenses include things like facilities, quality assurance, insurance for employees, and other essential functions directly linked to running the business.

- 😀 Always begin your financial planning at a high level (e.g., five-year overview), then break it down to avoid becoming overwhelmed by details early on.

- 😀 As a business scales, it’s important to continuously reassess and adjust the organizational structure to match growing volumes, ensuring smooth execution without overextending resources.

Q & A

What is the importance of understanding unit economics in business planning?

-Unit economics help businesses understand the relationship between revenue and operational costs at a granular level. By calculating gross margin and contribution margin, businesses can assess profitability per unit, which is crucial for scaling operations and managing costs effectively.

How does pricing typically change over time as the market grows?

-As the market matures and competitors enter, pricing usually decreases. Initially, a business may set high prices to cover early-stage costs, but over time, economies of scale and competitive pressure often drive prices lower.

What are the key cost categories in a business's financial model?

-The key cost categories are operational costs (including direct and indirect costs), selling, general and administrative (SG&A) costs, and financing costs. Operational costs relate to the production or service delivery, SG&A covers support and administrative functions, and financing costs include depreciation, interest, and amortization.

Why is benchmarking important in understanding operational costs?

-Benchmarking allows businesses to compare their operational costs with those of competitors. By studying financials from similar companies, especially in the early stages, businesses can better understand and plan for their own cost structures.

What is the definition of contribution margin, and why is it important?

-Contribution margin is the revenue minus the direct costs associated with producing a product or service. It helps businesses understand how much revenue is available to cover fixed costs after direct costs have been paid, and it’s essential for assessing profitability and scalability.

How do operational expenses differ from SG&A costs?

-Operational expenses are costs directly associated with production or service delivery, such as manufacturing and quality assurance. SG&A costs are indirect costs related to the support functions, such as sales, marketing, and administrative expenses.

What does the term 'learning curve' refer to in business planning?

-The learning curve refers to the concept that as a company scales its operations, it will gain efficiencies and reduce costs over time. The more a company produces, the better it becomes at managing production processes and overcoming challenges.

What role does manpower planning play in scaling a business?

-Manpower planning ensures that a business has the right number of employees in the right roles to meet increasing demand. It is important to link manpower requirements with revenue plans to maintain efficiency as the company grows.

What is the significance of linking organizational structure to revenue growth?

-Linking organizational structure to revenue growth allows businesses to plan their workforce efficiently. As sales volumes increase, businesses can scale their staffing levels appropriately, ensuring that the right number of line and staff functions are in place to support growth.

How can an entrepreneur use financial models to predict company growth?

-Entrepreneurs can use financial models to predict growth by outlining revenue, costs, and headcount projections over time. These models help visualize how changes in volume or market conditions will impact financial performance, helping businesses plan effectively for scaling.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Week 9 Masterclass Sriram Chidambaram Crucial Financial Insights for Startups Success

Four Critical Resources - How to Build a Startup

How To Make 100 Million Doing this? Episode #11

PRZEDSIĘBIORCZOŚĆ - Rodzaje Działalności - Edukacja w Chmurach UŚ

The future is small - How EIF supports SMEs across Europe

Financial Projections for Your STARTUP

5.0 / 5 (0 votes)