Business Cycles and Cyclical Industries

Summary

TLDRThis video explains the differences between cyclical and non-cyclical industries, focusing on their relationship with the business cycle and economic performance. It defines key concepts such as GDP and outlines how cyclical industries, like luxury goods and automobiles, thrive in economic expansions but suffer during recessions, exemplified by Canada Goose's high beta of 2.13. In contrast, non-cyclical industries, such as Walmart, remain stable regardless of economic conditions, with a low beta of 0.28. The video concludes by discussing investment strategies based on economic trends, highlighting the importance of understanding these industries for informed decision-making.

Takeaways

- 😀 A business cycle is measured by real GDP over time, including phases of expansion, peak, recession, and recovery.

- 📈 The average U.S. business cycle lasts about five years, with expansions typically longer than recessions.

- 💰 GDP (Gross Domestic Product) represents the total value of all finished goods and services produced in a country over a specific time period.

- 🚗 Cyclical industries are closely tied to the overall economy, experiencing growth in expansions and declines in recessions.

- 🛍️ Examples of cyclical industries include automobiles, luxury retail, furniture, and hospitality, which suffer during economic downturns.

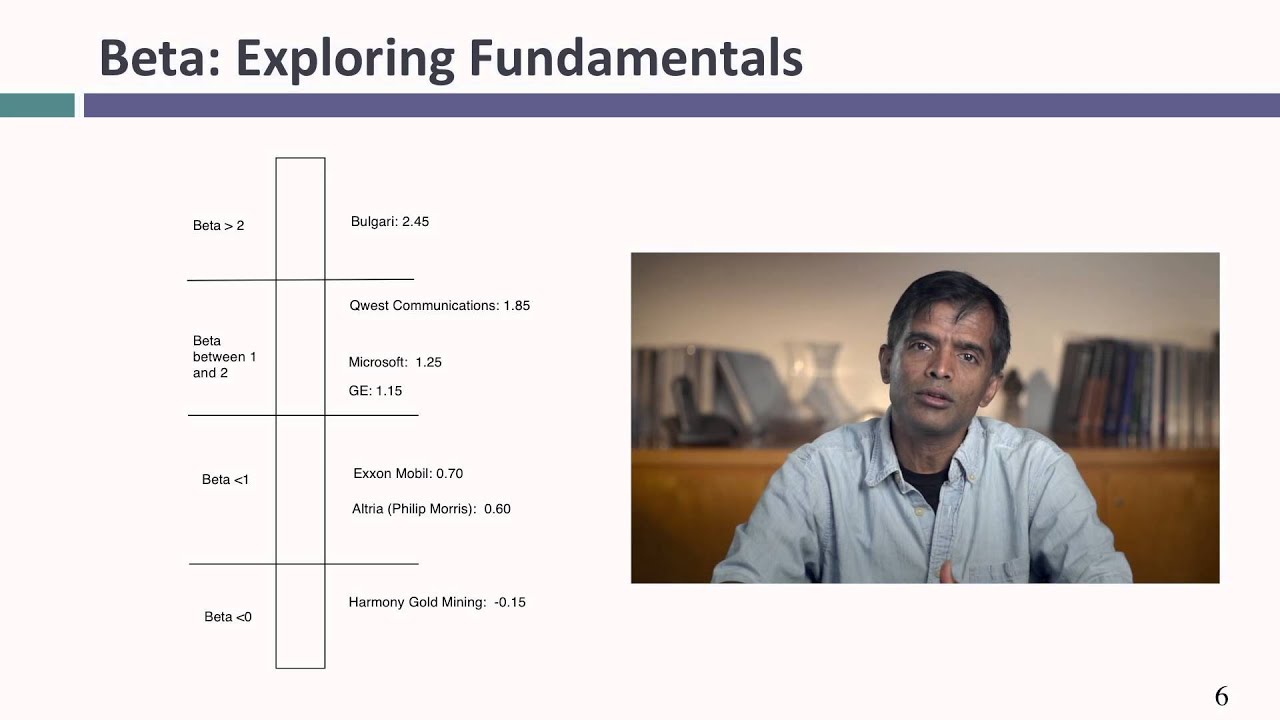

- 📊 Stocks of cyclical companies often have high betas (greater than 1), indicating higher volatility compared to the market.

- ❄️ Non-cyclical industries operate independently of the economic cycle, maintaining stability regardless of economic conditions.

- 🛒 Low-cost providers like Walmart and consumer staples (food, beverages, toiletries) are examples of non-cyclical industries.

- 📉 Non-cyclical companies typically have low betas (less than 1), indicating they are less sensitive to market fluctuations.

- 🔍 Understanding cyclical vs. non-cyclical industries can inform investment strategies, guiding choices based on economic outlook.

Q & A

What is the business cycle?

-The business cycle refers to the fluctuations in economic activity, measured in terms of real GDP, typically consisting of phases such as expansion, peak, recession, trough, and recovery.

How is GDP defined?

-GDP, or Gross Domestic Product, is the total value of all finished goods and services produced in a country over a specific time period, usually measured quarterly or annually.

What are cyclical industries?

-Cyclical industries are sectors whose performance closely follows the overall economy; they tend to do well in periods of economic expansion and suffer during recessions.

Can you give examples of cyclical industries?

-Examples of cyclical industries include automobiles, luxury retail, furniture sales, and hotels, all of which experience decreased demand during economic downturns.

What does a high beta indicate for a stock?

-A high beta indicates that a stock is more volatile than the overall market. For example, a stock with a beta of 2.13, like Canada Goose, is expected to have larger price swings compared to the market.

What are non-cyclical industries?

-Non-cyclical industries consist of sectors whose performance is relatively stable regardless of the state of the economy, as consumers continue to purchase essential goods and services.

What types of companies are typically considered non-cyclical?

-Low-cost providers, such as Walmart, and companies that sell consumer staples like food products, toiletries, and beverages are typically classified as non-cyclical.

How do non-cyclical companies behave during recessions?

-Non-cyclical companies generally experience less impact during recessions, as consumers continue to buy essential products. Their sales might slightly decrease, but the changes are much less significant compared to cyclical companies.

What investment strategy should one consider in a growing economy?

-In a growing economy, it may be beneficial to invest in cyclical stocks, as they have a higher chance of increasing in value along with economic growth.

What sources can be used for further research on cyclical and non-cyclical industries?

-Helpful resources include Wall Street Journal, Yahoo Finance, Market Watch, Financial Times, and Investopedia, which offer more information on economic trends and stock investing.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Cyclical Unemployment

Det økonomiske kredsløb og konjunktursvingninger

NEW- Macro Unit 2 Summary- Economic Indicators

Unemployment- Macro Topic 2.3

Fibroadenoma vs Fibroadenosis | How are these two breast conditions different | Dr. Rohan Khandelwal

Session 9: Estimating Hurdle Rates - Betas and Fundamentals

5.0 / 5 (0 votes)