Business Plan : Plan Financier Prévisionnel sur 3 ans دراسة مالية لمشروع شرح مبسط جداا

Summary

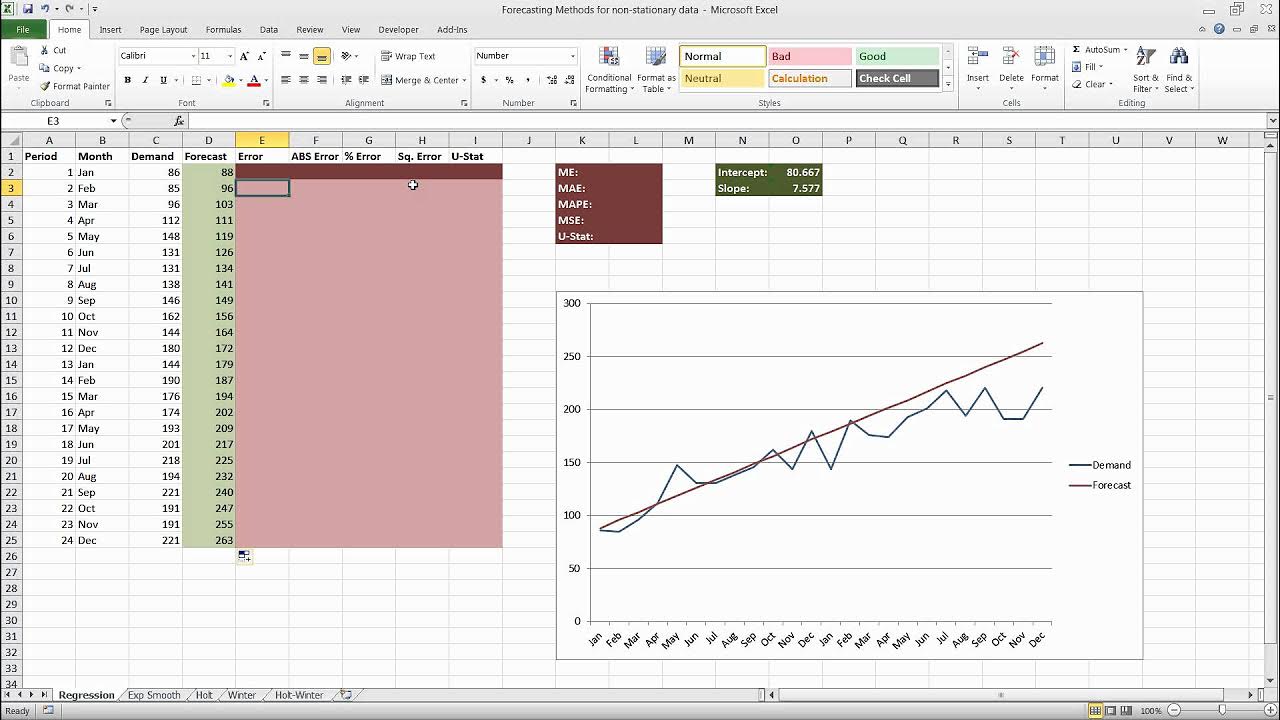

TLDRThis video tutorial guides viewers through creating a financial forecast plan using Excel. It covers essential components such as startup needs, financing requirements, and operational expenses over three years. The presenter discusses variable costs tied to business activity, cash flow management, and the importance of break-even analysis. Key elements include calculating revenue projections from sales and services, estimating fixed and variable expenses, and understanding the working capital requirements. By utilizing various tables, the video aims to empower entrepreneurs with the tools necessary for effective financial planning and decision-making in their businesses.

Takeaways

- 😀 The Renaissance, meaning 'rebirth', started in the 14th century.

- 😀 It was a pivotal period in European history, marking significant changes.

- 😀 Humanism emerged as a key theme, emphasizing human potential and achievements.

- 😀 There was a notable revival of classical art and literature during this time.

- 😀 Prominent figures of the Renaissance included artists like Leonardo da Vinci and Michelangelo.

- 😀 The invention of the printing press transformed the dissemination of knowledge.

- 😀 The Renaissance had a profound impact on politics, science, and religion.

- 😀 This era set the groundwork for modern philosophy and the concept of individualism.

- 😀 The influences of the Renaissance continue to resonate in various fields today.

- 😀 Overall, the Renaissance represented a significant cultural and intellectual awakening in Europe.

Q & A

What is the purpose of the financial plan discussed in the video?

-The financial plan aims to establish a budget forecast using Excel to manage startup needs, financing, expenses, revenue, and cash flow for a new business.

What are the initial needs of the company during the startup phase?

-The company needs to list all investment expenses, including both tangible and intangible assets, as well as any startup jobs.

What is included in the financing section of the financial plan?

-The financing section includes the sources of funds needed to cover startup costs, which can come from personal contributions, loans from financial institutions, or other types of investments.

How are operational expenses categorized in the plan?

-Operational expenses are categorized into fixed charges, which remain constant, and variable charges, which fluctuate based on business activity levels.

What is the significance of cash inflows in the financial planning process?

-Cash inflows, such as revenue from sales of goods and services, are crucial for understanding the company's financial health and ensuring sufficient liquidity to cover expenses.

What factors are considered in calculating the break-even point?

-The break-even point calculation takes into account fixed and variable costs, sales prices, and the volume of sales needed to cover all expenses without making a profit or a loss.

What does the cash flow management section entail?

-The cash flow management section involves monitoring cash availability to ensure the business can meet its financial obligations, particularly in the critical startup phase.

What role do salaries play in the financial plan?

-Salaries for employees and management are included as fixed costs in the financial plan, affecting overall profitability and cash flow.

How are sales forecasts generated according to the transcript?

-Sales forecasts are generated based on expected activity levels, historical data, and projected market conditions, with a specific focus on monthly revenue expectations.

What are the implications of a positive working capital requirement?

-A positive working capital requirement indicates that the company has enough resources to cover short-term liabilities and can manage its operational expenses effectively.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Forecasting in Excel Using Simple Linear Regression

Projected income statement Grade 11 PART 1

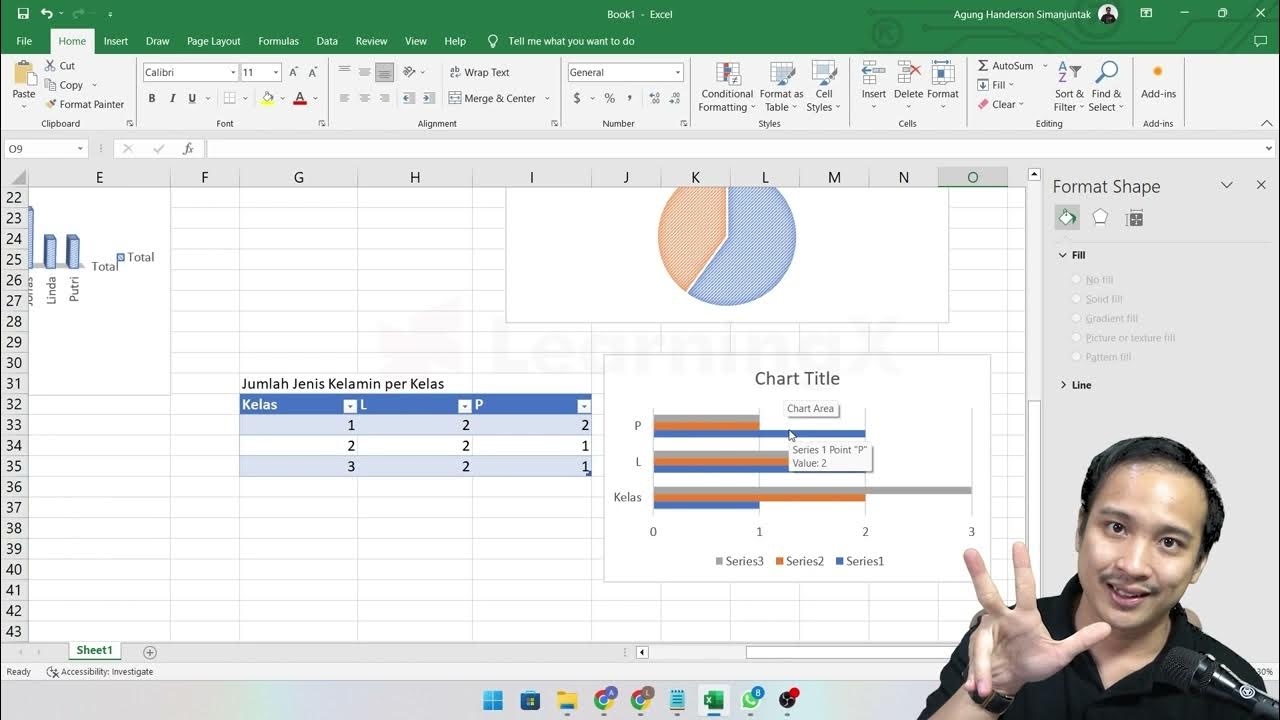

PART 7 PEMBUATAN APLIKASI EXCEL AKUNTANSI 2023 | LABA RUGI

Build a Simple Weather App with HTML CSS and JavaScript | Beginner Tutorial

Microsoft Excel 2019 - Full Tutorial for Beginners in 17 MINUTES!

Chapter 5 - Analisa Data melalui Excel | Informatika Booster

5.0 / 5 (0 votes)