FİNANSAL MUHASEBE - Ünite 1 Konu Anlatımı 1

Summary

TLDRThis video introduces the fundamentals of financial accounting, explaining how businesses transform resources into goods and services. It emphasizes the importance of stakeholders in monitoring financial activities and highlights the role of accounting as an information system that generates insights for decision-making. Key concepts such as financial statements, accounting principles, and the distinction between management and financial accounting are discussed. The program concludes by detailing the balance sheet and income statement, emphasizing their significance in assessing a company's financial health and performance over a specific period.

Takeaways

- 😀 Accounting is a crucial system that tracks financial activities and provides information to stakeholders.

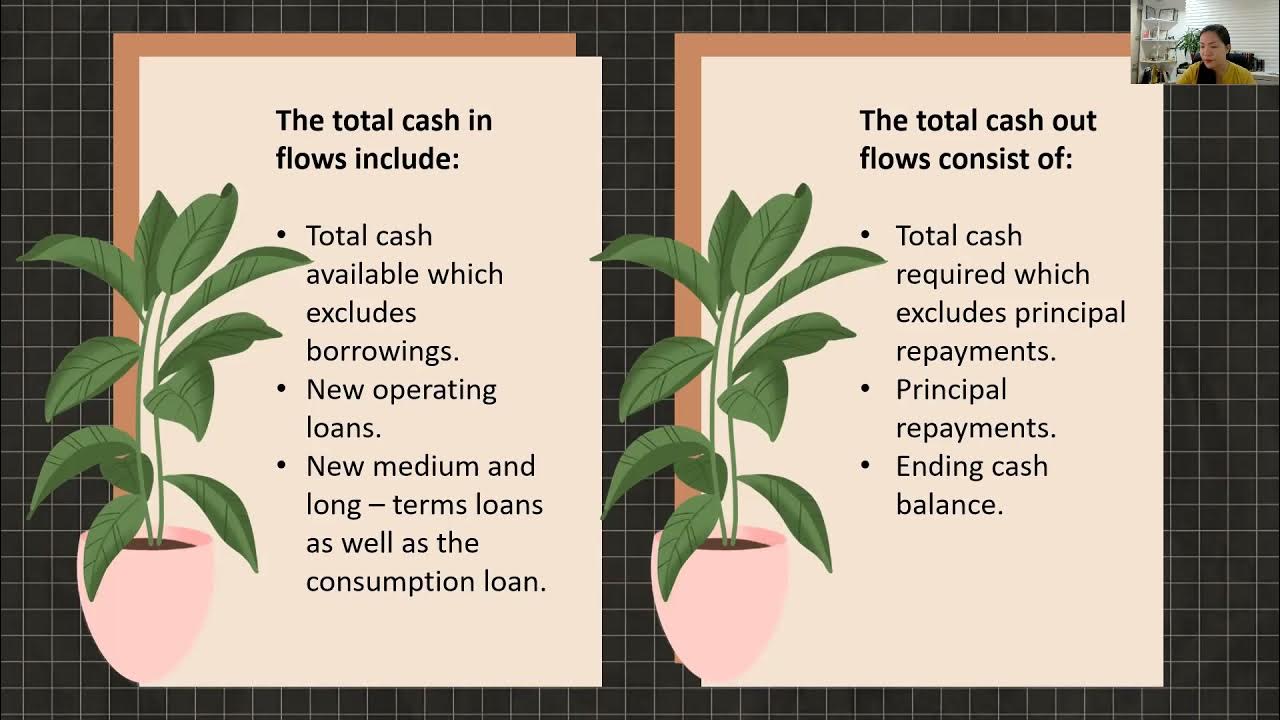

- 📊 Financial accounting involves collecting and processing data related to monetary transactions to inform decision-making.

- 🔍 The main functions of accounting include recording, classifying, summarizing, analyzing, and interpreting financial data.

- 📝 Stakeholders such as management, creditors, customers, and investors rely on accounting information to assess business performance.

- 💼 Accounting is divided into management accounting (focused on internal stakeholders) and financial accounting (focused on external stakeholders).

- 📚 Fundamental accounting principles ensure that financial information is reliable, understandable, and useful for decision-making.

- 📈 The primary financial statements are the balance sheet and income statement, which summarize a company's financial position and performance over time.

- 🏦 The balance sheet displays a company's assets, liabilities, and equity at a specific date, highlighting its financial structure.

- 💵 Assets are classified as current (to be converted to cash within a year) or non-current (held for longer periods), while liabilities are categorized as short-term or long-term.

- 📉 The income statement reflects a company's profitability by comparing income generated against expenses incurred over a specific period.

Q & A

What is the main purpose of accounting in a business?

-The main purpose of accounting is to track financial transactions and events, converting them into useful information for decision-making and monitoring business activities.

Who are the stakeholders that rely on accounting information?

-Stakeholders include internal parties like management and employees, as well as external parties such as investors, creditors, suppliers, and regulatory bodies.

How is accounting defined in the context of a business?

-Accounting is defined as an information system that provides data about financial transactions and their effects on the business, aimed at presenting this information to stakeholders.

What are the four main functions of accounting as outlined in the script?

-The four main functions of accounting are recording, classifying, summarizing, and analyzing financial transactions.

What distinguishes management accounting from financial accounting?

-Management accounting focuses on providing information for internal stakeholders to aid in decision-making, while financial accounting primarily provides information for external stakeholders.

What are the fundamental principles that guide accounting practices?

-Fundamental principles include social responsibility, consistency, relevance, reliability, and completeness, ensuring that accounting information is understandable and useful for decision-making.

What are the primary financial statements discussed in the transcript?

-The primary financial statements are the balance sheet and the income statement (profit and loss statement).

What does a balance sheet represent?

-A balance sheet represents the financial position of a business at a specific date, listing its assets, liabilities, and equity.

How are assets categorized in a balance sheet?

-Assets are categorized into current assets, which are expected to be converted to cash or consumed within one year, and non-current assets, which are long-term resources.

What key information does an income statement provide?

-An income statement provides information about a company's revenues and expenses over a specific period, ultimately reflecting the net profit or loss.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Comptabilité Générale (S1) (séance 1) : Définition et rôle de la comptabilité générale

What is a company: shareholders and stakeholders (Deborah Agostino)

Introduction to Financial Accounting | Animated Accounting

Modul 01 - Laboratorium Pengantar Akuntansi

Akuntansi Sebagai Sistem Informasi | Ekonomi Kelas 12 - EDURAYA MENGAJAR

Financial Statements (September 30, 2021)

5.0 / 5 (0 votes)