ICT Forex - Market Maker Series Vol. 5 of 5

Summary

TLDRThis video is part five in a series by the Inner Circle Trader, focusing on daily bias and market macros. The video provides a detailed analysis of the British Pound vs. US Dollar for the week of July 26, 2021, using five-minute charts to illustrate market behavior. The speaker discusses key trading strategies such as optimal trade entries, market structure breaks, and liquidity pools. Additionally, the importance of managing trades and psychology is emphasized. The speaker encourages viewers to learn from free content, test strategies, and develop confidence in trading, aiming for consistency rather than wealth accumulation.

Takeaways

- 📈 The video focuses on daily bias and generic market macros for trading, particularly for GBP/USD during July 2021.

- 📉 The market analysis includes studying short-term lows and highs, identifying optimal trade entries based on algorithmic behavior and market maker patterns.

- 🕐 Key trading windows include London open, New York open, and kill zones, emphasizing price behavior during these periods.

- 📊 Monday through Wednesday in a bullish week are important for identifying buying opportunities below the opening price, while Thursday and Friday require a different approach.

- 🧠 The concept of the 'Judah swing' catches traders off guard as the market trends downward, presenting buying opportunities during London’s open.

- 🔄 The 'seek and destroy' market profile on FOMC Wednesday is highlighted, showing how the algorithm removes both short-term highs and lows.

- 🚀 The focus shifts towards bullish market expectations and identifying 'buy stop liquidity pools' for potential price targets.

- 🛑 Understanding market structure, bearish order blocks, and how smart money operates is crucial for identifying low-risk trades, especially later in the week.

- 🔍 The series emphasizes using algorithmic price runs and repeating market patterns to predict movements, such as 'smart money reversals' and 'redistribution'.

- 🎯 Traders are encouraged to practice, take notes, and dive deeper into other resources to solidify understanding, with a reminder that success requires persistence and patience.

Q & A

What is the focus of the video series mentioned in the transcript?

-The video series focuses on teaching daily bias, generic market macros, and how to trade in the market maker model, specifically using the British Pound vs. US Dollar as an example.

Why does the speaker emphasize not relying solely on 5-minute charts?

-The speaker emphasizes this because not all platforms allow you to access historical 5-minute charts, so they provide additional context and insights to help fill that gap.

What is the 'Judah swing' mentioned in the video, and how does it affect trading decisions?

-The 'Judah swing' refers to a market move that catches traders off guard, usually presenting an opportunity for a reversal trade. Traders might mistakenly think the market will continue down when it's actually a good time to buy.

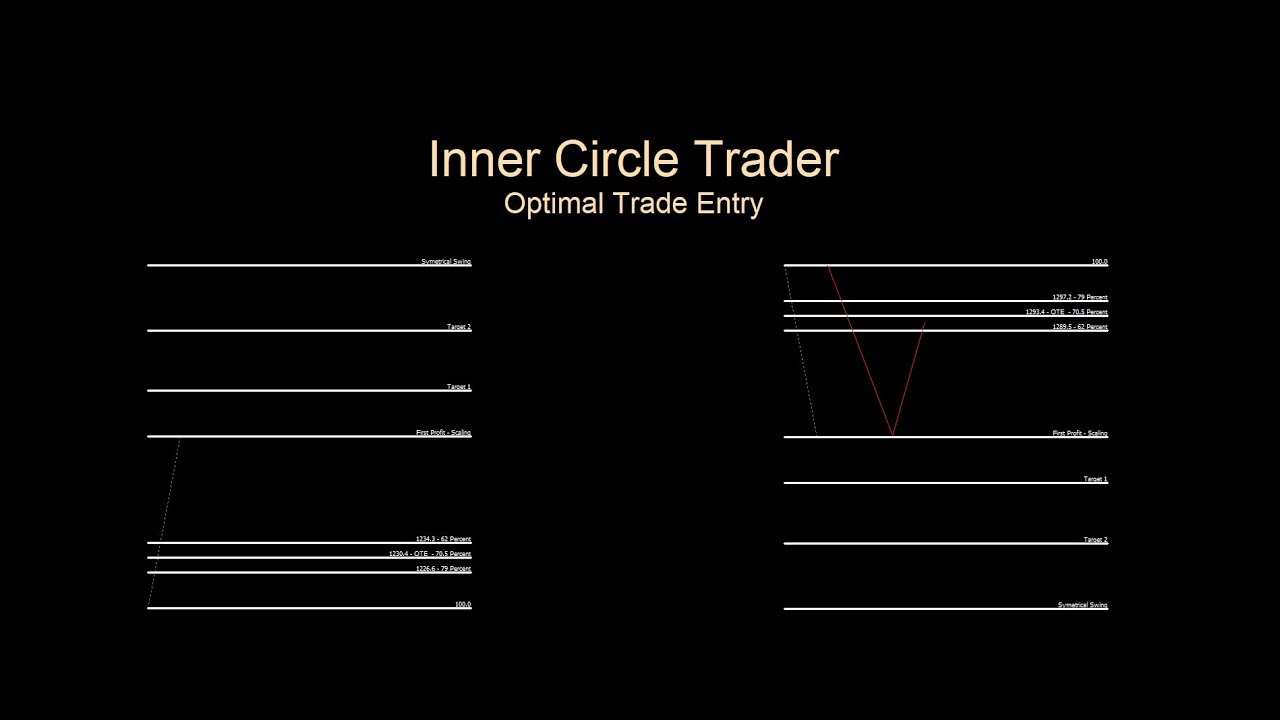

What is 'optimal trade entry' (OTE) in the context of the video?

-Optimal trade entry (OTE) refers to the most favorable price levels to enter a trade, based on retracements and market structure breaks, usually occurring after short-term highs or lows are taken out.

How does the market maker model view price movement during FOMC (Federal Open Market Committee) events?

-During FOMC events, the market typically exhibits back-and-forth price movement, taking out short-term highs and lows, referred to as 'seek and destroy.' At the key time (2 PM), manipulation enters the market, and the algorithm seeks liquidity by taking out lows or highs.

What does the speaker mean by 'seek and destroy' in market behavior?

-'Seek and destroy' is a market behavior where the price constantly targets short-term highs and lows, clearing out liquidity in both directions, before finally making a more significant directional move.

What is the significance of 'buy side liquidity pools' in the speaker's trading strategy?

-Buy side liquidity pools are areas above the current price where buy stops are likely placed. The speaker looks for these areas as targets for price to rally towards, allowing smart money to unload positions.

What is the significance of 'market structure breaks' in the trading strategy discussed?

-Market structure breaks indicate a shift in the market’s direction, either bullish or bearish. These breaks are important signals for entry points, especially when aligned with the overall market bias (bullish or bearish).

Why does the speaker suggest focusing on Monday, Tuesday, and Wednesday for trades?

-The speaker recommends focusing on Monday through Wednesday because these are the days when the highest probability trade setups occur, based on the weekly bias. On Thursdays and Fridays, the market is less predictable.

What advice does the speaker give to those struggling to succeed in trading?

-The speaker advises traders not to give up, even if they struggle initially. Success in trading takes time, practice, and patience. He suggests ignoring outside opinions, continuing to study, and focusing on improving skills through practice and discipline.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

OTE Primer - Intro To ICT Optimal Trade Entry

Learn ICT Concepts in 30 Minutes!

After 10 Years Trading These Are The 6 Major Must Learn Concepts I Wish Someone Taught Me - Lesson 1

Identifying Fake MSS CHOCH and Retracements Updated

Only 3 ICT Confirmations - Market Structure Shift, Displacement & Fair Value Gap

ICT MMXM - My Secret Way to Read Market Maker Moves for Beginners

5.0 / 5 (0 votes)