The BALANCE SHEET for BEGINNERS (Full Example)

Summary

TLDRIn this accounting tutorial, James explains how to create a Balance Sheet, one of the three key financial statements. He outlines the accounting equation: Assets = Liabilities + Equity, and demonstrates how to balance the sheet using Tumble's trial balance. James highlights the importance of including revenue and expenses for a balanced sheet and shows how to differentiate between current and non-current assets and liabilities. The video concludes with a detailed balance sheet example, emphasizing the balance between total assets and total liabilities plus equity.

Takeaways

- 📚 The balance sheet is one of the three main financial statements, alongside the income statement and the cash flow statement.

- 🔍 It provides a snapshot of a business's assets, liabilities, and equity at a specific point in time, reflecting the accounting equation: Assets = Liabilities + Equity.

- 💼 Assets are categorized into current (short-term) and non-current (long-term), including tangible and intangible assets.

- 💵 Liabilities are also divided into current (short-term) and non-current (long-term), such as payables and long-term loans.

- 🏦 Equity consists of capital contributions (like common stock) and retained earnings, which are profits reinvested into the business.

- 📊 To create a balance sheet, a trial balance is needed, showing the closing balances of all general ledger accounts at a point in time.

- 📈 A detailed balance sheet further breaks down assets and liabilities into current and non-current categories for a more comprehensive view.

- 🚫 A common mistake is creating a balance sheet that doesn't balance because it omits revenue and expense accounts, which affect retained earnings.

- 💡 Retained earnings are crucial for the balance sheet's balance as they represent the business's accumulated profits and are part of equity.

- 📝 The process of creating a balance sheet involves organizing accounts into their respective sections and ensuring the total assets equal total liabilities plus equity.

Q & A

What are the three main financial statements?

-The three main financial statements are the balance sheet, the income statement, and the cash flow statement.

What does a balance sheet represent?

-A balance sheet is a financial report that provides a snapshot of a business's assets, liabilities, and equity at a specific point in time.

What is the accounting equation as mentioned in the script?

-The accounting equation is Assets = Liabilities + Equity, which reflects that what a business owns (assets) is equal to what it owes (liabilities) plus what it owes to its owners (equity).

What are the two types of assets mentioned in the script?

-The two types of assets mentioned are current assets, which are short-term assets like receivables and prepaid expenses, and non-current assets, which are long-term assets and can be tangible or intangible.

How are liabilities divided in the balance sheet?

-Liabilities are divided into current liabilities, which are short-term obligations like payables and accrued expenses, and non-current liabilities, which are long-term obligations such as long-term loans.

What are the two components of equity discussed in the video?

-The two components of equity discussed are capital contributions, which is the money invested by the business owners, and retained earnings, which are the accumulated profits held for future use.

What is a trial balance and how is it used in creating a balance sheet?

-A trial balance is an accounting report that shows the closing balances for every general ledger account at a point in time. It is used to ensure that the balance sheet balances, as it includes all accounts and their balances.

Why is it important for a trial balance to be in balance before creating a balance sheet?

-A trial balance being in balance is important because it ensures that the debits and credits are equal, which is a prerequisite for the balance sheet to also balance, with total assets equaling total liabilities and equity.

What mistake is commonly made when creating a balance sheet, as mentioned in the script?

-A common mistake is to forget to include revenue and expenses, which are part of retained earnings and should be included in the equity section of the balance sheet to ensure it balances.

How do you create a detailed balance sheet?

-To create a detailed balance sheet, you divide assets and liabilities into current and non-current, and then list them along with equity components like common stock and retained earnings, ensuring that total assets equal total liabilities plus equity.

What is the significance of the balance sheet balancing?

-The balance sheet balancing is significant as it confirms the financial stability and accuracy of a company's accounting, showing that the value of what the business owns is equal to the value of what it owes to creditors and owners.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Basic Financial Statements

The KEY to Understanding Financial Statements

How The BALANCE SHEET Works (Statement of Financial Position / SOFP)

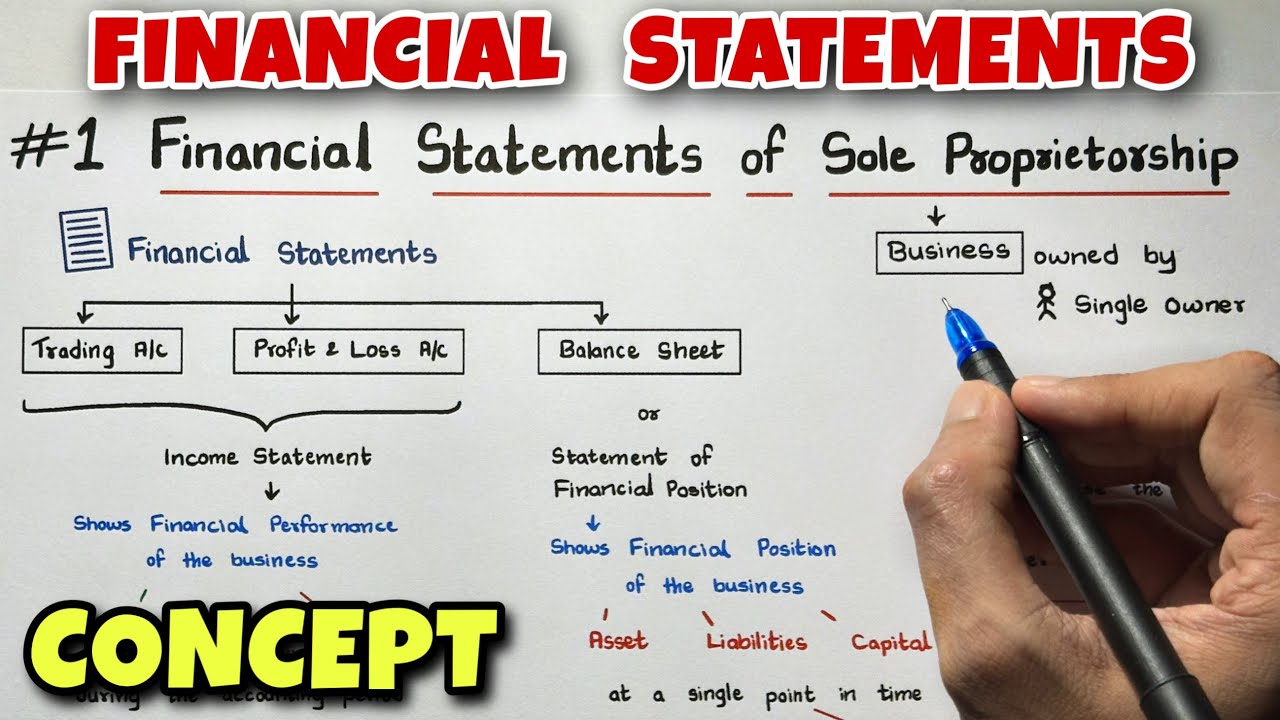

#1 Financial Statements - Concept - Easiest Way - Class 11 - By Saheb Academy

FINANCIAL RATIOS: How to Analyze Financial Statements

How To Read And Understand Financial Statements As A Small Business

5.0 / 5 (0 votes)