Every Options Strategy (and how to manage them) | Iron Condors, Vertical Spreads, Strangles

Summary

TLDRThe script outlines an options trading strategy series, detailing eight common strategies used by traders, including short vertical spreads, long vertical spreads, iron condors, diagonal spreads, short strangles, short puts, short straddles, and ratio spreads. Each strategy is discussed in terms of setup, managing winners, losers, and situations in between. The series emphasizes the importance of adjusting trades based on market conditions and the implied volatility rank (IVR), aiming for risk management and maximizing profits.

Takeaways

- 📈 Understanding and managing options strategies is crucial for successful trading, with eight common strategies being the focus of the series.

- 🔄 Successful traders are prepared to make necessary adjustments to their strategies when market conditions change.

- 🏦 Short vertical spreads are a defined risk trade suitable for beginners, offering peace of mind with a known worst-case scenario.

- 📊 Profit targets for short put and call spreads are typically set at 50% of maximum profit for effective management of winners.

- 🚫 When managing losers in short vertical spreads, rolling the position out to the next monthly cycle can be a viable option if it can be done for a credit.

- 🔄 For long vertical spreads, managing winners is straightforward, but losers require patience and may involve rolling out the position if within 21 days to expiration.

- 🔩 Iron condors are neutral strategies benefiting from minimal stock movement, combining two out-of-the-money short vertical spreads for potential profit.

- 🌉 Diagonal spreads are a hybrid strategy with both directional and time components, offering benefits from stock movement and the passage of time.

- 💸 When setting up a diagonal spread, avoid overpaying and aim to collect a debit that is no more than 75% of the spread's width for optimal risk-return balance.

- 🛑 In undefined risk strategies like short strangles, managing winners involves taking profits at 50% of maximum profit, while losers require careful adjustment protocols.

Q & A

What is the primary focus of the options trading crash course strategy series?

-The primary focus of the options trading crash course strategy series is to educate traders on managing trades using eight common strategies in the options world, emphasizing the importance of making necessary adjustments to those strategies.

Who is the presenter of the options trading crash course strategy series?

-Jim Schultz is the presenter of the options trading crash course strategy series.

What are the three key aspects covered for each strategy in the series?

-For each strategy in the series, the key aspects covered are managing winners, managing losers, and managing the dance floor (situations that are neither clear wins nor losses).

What is a short vertical spread, and why is it recommended for beginner traders?

-A short vertical spread is a defined risk directional trade that involves selling one out-of-the-money option and buying a further out-of-the-money option. It is recommended for beginner traders because it provides a strong sense of security by defining the worst-case scenario on order entry.

How should traders manage their winners and losers in short vertical spread trades?

-Traders should manage winners by setting profit targets at 50% of maximum profit and manage losers by considering a roll out to the next monthly cycle at 21 days to expiration, ensuring to do so for a credit to avoid adding risk to the trade.

What is an iron condor, and how is it set up?

-An iron condor is a neutral strategy benefiting from minimal stock movement, constructed from two out-of-the-money short vertical spreads: a short put spread below and a short call spread above the current stock price. The ideal entry is to collect about one-third the width of the strikes from both spreads.

What are the key considerations for managing an iron condor?

-Key considerations include taking the trade off at 50% of maximum profit for winners, rolling for a credit at 21 days to expiration for losers without changing strikes or adding units, and using the implied volatility rank (IVR) as a guide for mid-situation adjustments.

How does a diagonal spread set up, and why is it preferred in low IV environments?

-A diagonal spread is part vertical spread, part calendar spread, involving buying a back month option a couple of strikes in the money and selling a front month option a couple of strikes out of the money. It's preferred in low IV environments for its flexibility and adaptability.

What is the strategy for managing winners and losers in diagonal spreads?

-For managing winners, set profit targets at 50% of maximum profit. For losers, consider rolling the short option forward to a weekly cycle for a mini diagonal spread, roll forward and adjust the short strike to shrink the spread, or convert into a vertical spread in the back month.

Why is the ratio spread considered the most versatile and flexible strategy?

-The ratio spread is considered the most versatile and flexible due to its structure of one long option paired with two short options, allowing for profit potential in both directions and significant flexibility in adjustments and management of the trade.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

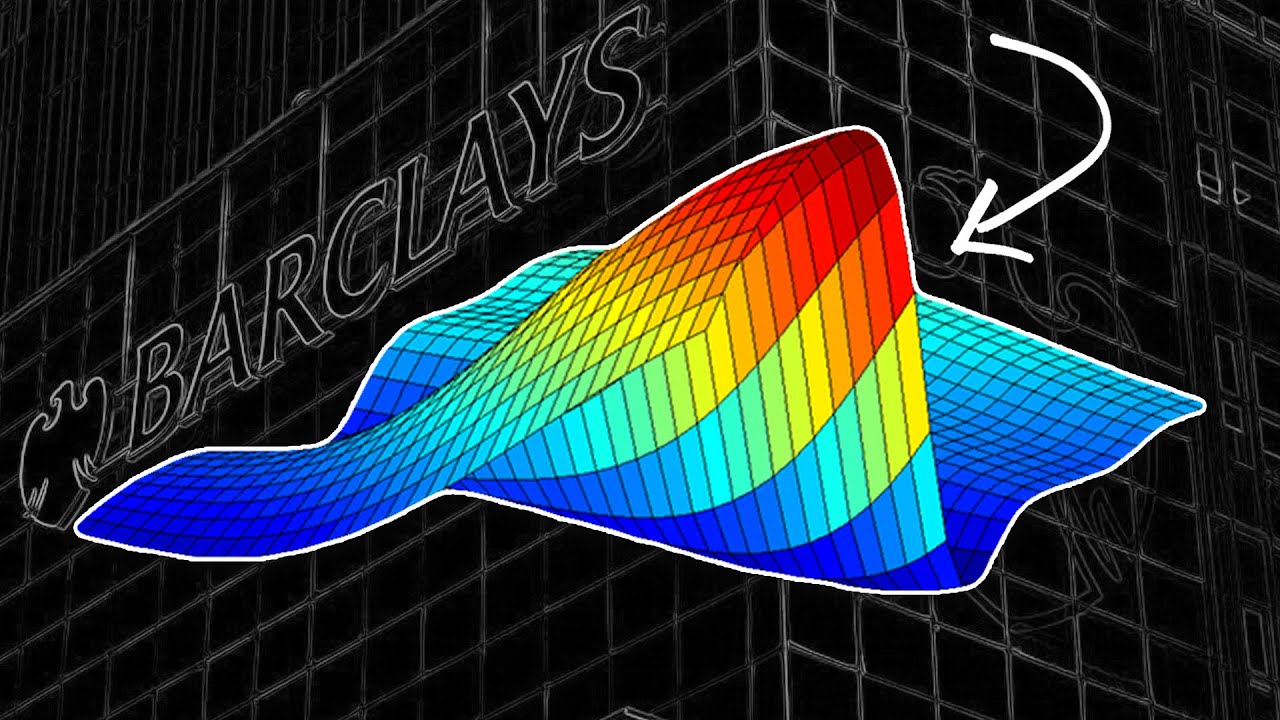

The Barclays Trading Strategy that Outperforms the Market

This Option Strategy Turned $10k Into $1 Million In One Year

Iron Condors vs Strangles: Which Loses Value Faster?

PROFITABLE OPTION SELLING SETUP | MONTHLY + WEEKLY | ULTRA WIDE PROFIT RANGE | 90% PROFITABILITY

You'll Fail With Options Trading Until You Understand This ONE Thing

ESTRATÉGIA SENSATA PARA DOBRAR SEU DINHEIRO EM 1 ANO: ATÉ INICIANTE CONSEGUE

5.0 / 5 (0 votes)