Major takeaways from Tesla's Q3 2018 Earnings Report

Summary

TLDRTesla's Q3 earnings report revealed impressive financials, including a reported net income of $312 million and a significant operating cash flow of $1.4 billion, with only 10% from working capital. The Model 3's gross margin exceeded 20%, and operating leverage led to a substantial decrease in SG&A expenses as a percentage of revenue. Tesla's valuation became more tangible, with metrics like P/E and price-to-free cash flow becoming comparable to tech and automotive sector peers. The company's intention to pay down debt with cash flow rather than raising capital signals a shift towards deleveraging, which could significantly enhance shareholder value.

Takeaways

- 🚀 Tesla reported a Q3 net income of $312 million and a non-GAAP net income of $516 million, significantly exceeding expectations.

- 💰 The company's operating cash flow reached $1.4 billion, with only 10% coming from working capital changes, indicating strong operational performance.

- 📈 Free cash flow was $881 million, and Tesla's cash reserves increased by $731 million to approximately $3 billion.

- 🚗 The Model 3 gross margin was over 20%, reflecting improved efficiency and cost controls in production.

- 🔧 Labor hours per Model 3 decreased by more than 30%, demonstrating significant productivity improvements.

- 🔋 Less than 20% of the original 455,000 Model 3 reservations reported in August 2017 have been canceled, showing strong customer commitment.

- ☀️ Tesla expects to ramp up solar roof production more quickly in the first half of 2019, indicating a focus on the energy division.

- 📊 The company reaffirmed its guidance for positive GAAP net income and free cash flow in Q4, despite plans to pay $230 million of convertible notes in cash.

- 📈 Tesla's valuation metrics, such as P/E, price to cash flow, and price to free cash flow, now compare favorably to other tech and automotive companies, suggesting a more reasonable valuation.

- 💼 Elon Musk indicated that Tesla's intention is to pay off debts rather than refinance them, aiming to reduce the company's overall leverage.

Q & A

What was Tesla's reported GAAP net income in Q3?

-Tesla's reported GAAP net income in Q3 was $312 million.

How much was Tesla's non-GAAP net income in Q3?

-The non-GAAP net income was $516 million.

What was the significance of Tesla's operating cash flow in Q3?

-The operating cash flow was $1.4 billion, with only 10% coming from working capital changes, indicating strong operational performance.

What was the free cash flow reported by Tesla in Q3?

-The free cash flow was $881 million.

How much did Tesla's cash reserves increase in Q3?

-Tesla's cash reserves increased by $731 million to about $3 billion.

What was the gross margin for the Model 3 in Q3?

-The Model 3 gross margin was greater than 20%.

What was the notable decrease in Tesla's SG&A expenses as a percentage of revenues?

-SG&A expenses decreased from 18.7% in Q2 to 10.6% in Q3.

What percentage of Tesla's Model 3 reservations reported in August 2017 have not been cancelled?

-Less than 20% of the reported 455,000 net reservations in August 2017 have been cancelled.

What did Tesla expect in terms of solar roof production in the first half of 2019?

-Tesla expected to ramp up production of the solar roof more quickly during the first half of 2019.

What was Tesla's guidance for Q4 regarding GAAP net income and free cash flow?

-Tesla reaffirmed its prior guidance to achieve positive GAAP net income and free cash flow in Q4.

How did Tesla's valuation metrics change after Q3 earnings, particularly in terms of P/E ratio?

-Tesla's P/E ratio, based on the most recent quarter multiplied by four, was 45.7x, making it more reasonable and comparable to other tech companies.

What was the significance of Tesla's intention to pay off debts rather than refinance them?

-Paying off debts with internally generated cash flow builds book value and is a form of returning capital to shareholders without triggering a tax event.

What was the potential implication of Tesla's Q3 results for future financial performance?

-The Q3 results indicated that Tesla might be at an inflection point where it may never post a GAAP loss again, barring unforeseen economic issues.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Tesla Stock is Crashing - Here's Everything You Need to Know

Palantir Eliminates Doubters on Earnings Blowout (Q2-2024) | PLTR Stock

EBITDA vs Net Income Vs Free Cash Flow (Analyst Explains)

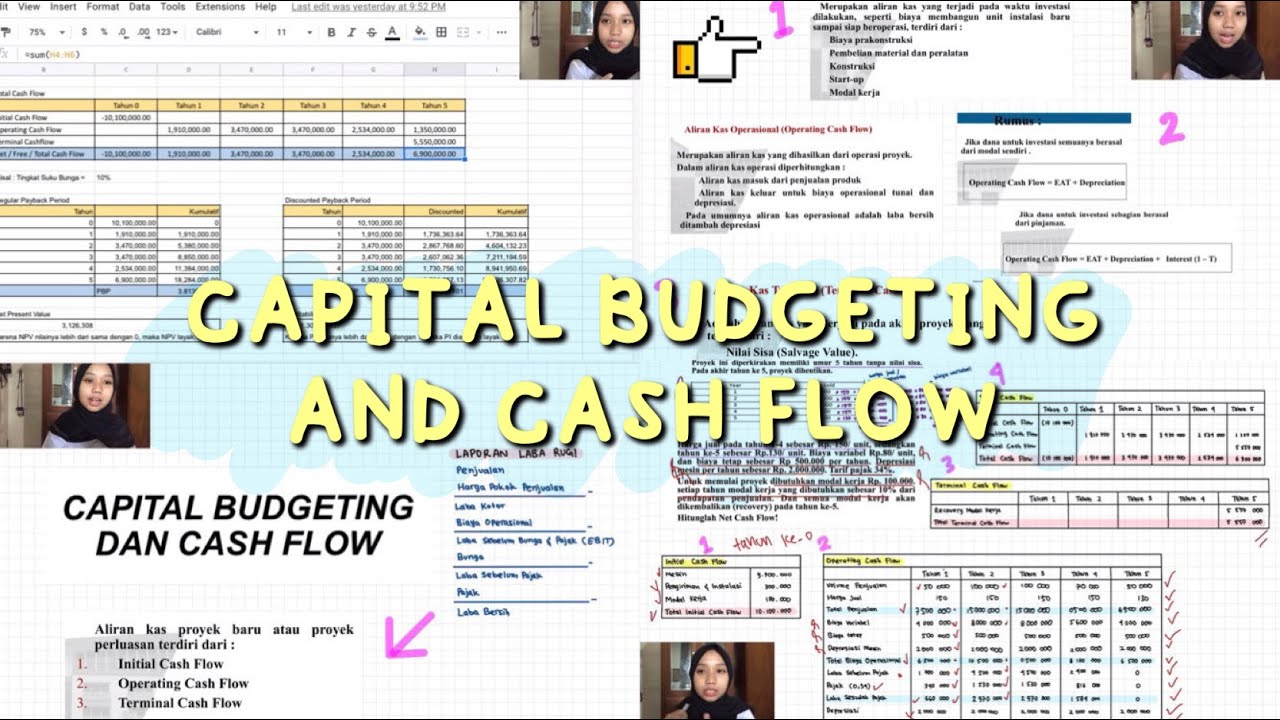

MBTI Manajemen Keuangan - Capital Budgeting : Cash Flow

How To Analyze a Cash Flow Statement

Nike Stock is Crashing - Here's Everything You Need to Know

5.0 / 5 (0 votes)