ICT Mentorship Core Content - Month 02 Growing Small Accounts

Summary

TLDRThis mentorship video emphasizes growing small trading accounts through low-risk strategies. It advises against chasing high returns quickly and highlights the importance of compound interest for steady growth. The speaker shares insights on setting up trades with well-defined risk parameters, aiming for a 3:1 reward-to-risk ratio, and the psychological shift from greed to fear in trading. The video also discusses the significance of time in allowing compound interest to work and provides a detailed example of a trade setup for a 50% monthly return, illustrating how to scale out profits and manage risk effectively.

Takeaways

- 🚫 Avoid the temptation to chase massive gains quickly as a new trader; focus on consistent growth instead.

- 📉 Understand that high risk does not equate to high returns and can often lead to significant losses.

- 💼 Recognize that small, calculated risks can compound over time to grow your account significantly.

- 📈 Learn about the power of compound interest and how it can exponentially increase your account with small, consistent gains.

- 🛠️ Develop a trading plan with well-defined risk parameters to avoid poor planning or lack of strategy.

- 🎯 Aim for a realistic reward-to-risk ratio, ideally seeking three times the reward for every unit of risk taken.

- 🏦 Respect the risk side of trade setups more than the reward; many new traders focus solely on potential profits.

- 📉 Identify trade setups that have the potential for high reward multiples relative to the risk taken.

- 📊 Realize that accuracy in trades is not the only factor for profitability; time and compound interest play crucial roles.

- 🌟 Strive for a high reward-to-risk ratio even if your win rate is low; it's possible to be profitable with a lower accuracy rate.

- 📅 Set achievable goals for monthly growth and focus on consistency rather than sporadic large gains.

Q & A

What is the main focus of the second month of the ICT mentorship program?

-The main focus is on growing small accounts without taking on high risk, emphasizing the importance of consistent wealth building through small, calculated gains rather than chasing massive, quick profits.

Why is it advised not to rush for massive gains as a new trader?

-Rushing for massive gains can lead to poor decision-making and increased risk-taking, which is not sustainable for long-term wealth building. It's important for new traders to suppress the desire for quick riches and focus on consistent, lower-risk strategies.

What is the significance of compound interest in the context of growing a trading account?

-Compound interest is crucial as it allows even small amounts of money to grow exponentially over time. Understanding this concept helps traders to appreciate that they don't need to start with a large capital or take on high risks to see significant growth in their account.

Why is it a misconception that large risk is necessary to build wealth in trading?

-It's a misconception because many new traders believe they need to take on large risks to make money quickly. However, wealth can be built through consistent, small gains and well-defined risk parameters, which are more sustainable and less risky in the long run.

What is the recommended risk percentage for new traders according to the script?

-The script suggests that new traders should aim for well-defined risk parameters, ideally no more than two percent on an average trade, to build wealth without excessive risk.

How does the script suggest traders should approach the reward-to-risk ratio?

-Traders should aim for a favorable reward-to-risk model, ideally looking for trade setups that permit a three-to-one or higher reward multiple to one risk. This approach helps in maintaining a low risk while aiming for higher payouts.

What is the importance of respecting the risk side of trade setups over the reward?

-Respecting the risk side is crucial because it helps in avoiding significant losses that can hurt both psychologically and monetarily. It's better to focus on risk management first, as no one gets broke by taking profits, but they can by taking too much risk.

Why is it beneficial to identify trade setups with a high reward multiple to one risk?

-Identifying such setups allows traders to potentially achieve profitability even with a lower win rate. For example, a trade with a three-to-one reward multiple can be profitable even if the trader is only correct 25% of the time.

What is the significance of time in the context of trading and wealth building?

-Time is a critical factor that allows compound interest to work its magic. It enables traders to grow their accounts steadily over time, even with small, consistent gains, leading to significant wealth accumulation in the long run.

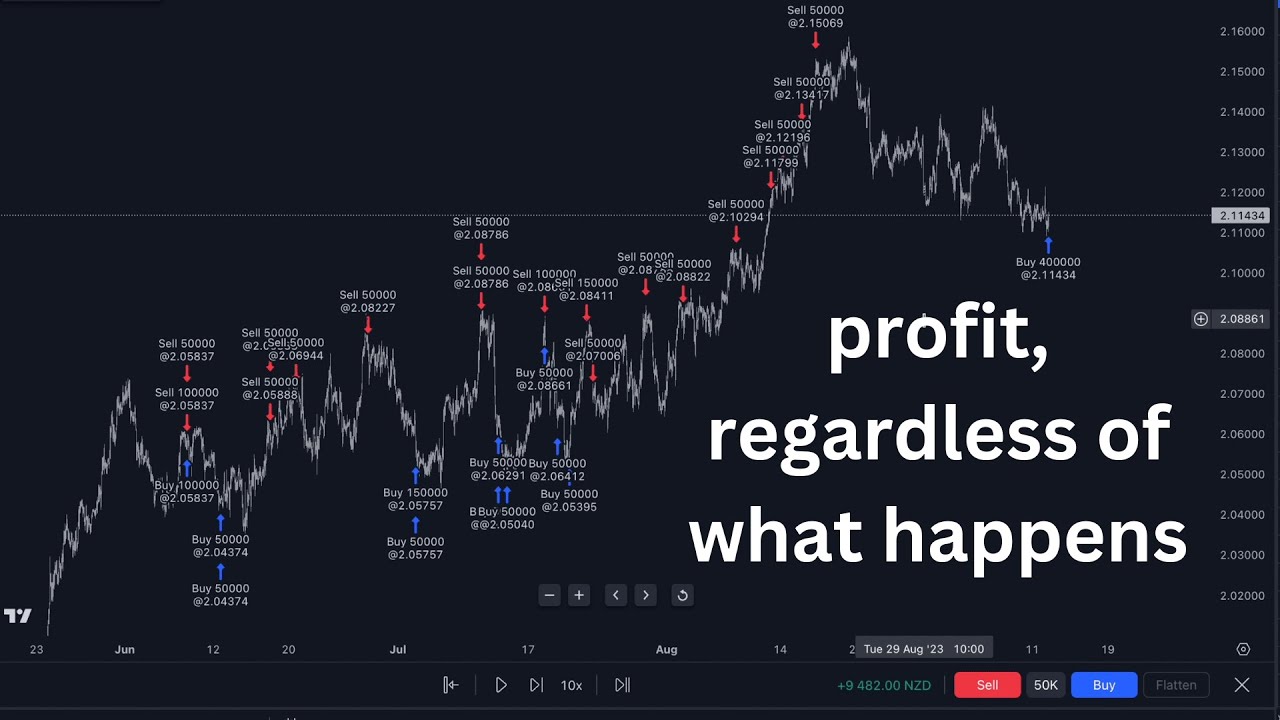

How does the script illustrate the concept of scaling out of trades and its impact on profitability?

-The script uses an example of a trade where the trader scales out of their position at different profit multiples, showing how this strategy can lead to increased profitability. By taking profits at various levels, traders can secure gains while allowing part of their position to run for potentially higher returns.

What is the potential outcome of consistently achieving a 6% monthly return in trading?

-Consistently achieving a 6% monthly return can lead to doubling the account balance every year. Over a longer period, such as 10 years, even a small account can grow into a substantial sum, illustrating the power of compounding with disciplined trading strategies.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Scaling Series: Risk Management

Kenapa Akun Trading Kecil Cepat Habis? Ini 3 Kesalahan Fatalnya

I Found the Formula to Grow a Small Forex Account FAST in 2025

how i make money trading, even when i’m wrong

BACK TO BASICS: My $500 to $50K Trading Roadmap for 2025

Smartest Route To $10,000/Month Trading in 2024 (With ZERO Experience)

5.0 / 5 (0 votes)