How to Find Businesses for Sale Highest Cash Flow

Summary

TLDRIn this video, business broker and commercial lender Leo Landover teaches viewers how to calculate cash flow for a business purchase using his Deal Analyzer workbook. He uses a live business listing as an example, discussing the importance of understanding the type of cash flow (SDE, EBITDA, etc.) and analyzing the deal's financials, including the asking price, revenue, and seller financing options. Leo emphasizes the significance of cash flow post-purchase and how it can replace a day job income, providing a comprehensive guide for potential business buyers.

Takeaways

- 💼 The video is a tutorial on how to calculate cash flow for a business using a deal analyzer workbook.

- 📈 The presenter, Leo Landover, is a business broker and commercial lender who helps buyers purchase profitable businesses.

- 💰 The example given is a boat rental company with an asking price of $820,000 and a cash flow of $320,000.

- 🔍 The video emphasizes the importance of understanding the type of cash flow being presented, such as SDE (Selling Discretionary Earnings), EBITDA, etc.

- 🏢 The business has been operational since 1984, indicating a long-standing and potentially stable business model.

- 💲 The presenter discusses the potential for seller financing and the implications it has on the deal's financing and cash flow.

- 📊 The video includes a detailed analysis using a deal analyzer tool, which compares the seller's asking price with the buyer's potential costs and cash flow.

- 🏦 The presenter explains the concept of Debt Service Coverage Ratio (DSCR) and how it affects the viability of the business purchase.

- 📉 The video also covers the impact of different financing scenarios, such as SBA loans and seller carryback loans, on the buyer's cash flow.

- 📈 The potential for high cash on cash returns and cap rates is highlighted, especially when leveraging financing to minimize upfront investment.

- 🎁 The video concludes with an offer for viewers to obtain the deal analyzer tool used in the tutorial for free.

Q & A

What is the main focus of the video?

-The main focus of the video is to demonstrate how to calculate cash flow for a business using a deal analyzer workbook, with a specific example of a boat rental company.

Who is the host of the video?

-The host of the video is Leo Landover, a business broker and commercial lender.

What is the asking price of the boat rental company mentioned in the video?

-The asking price of the boat rental company is $820,000.

What is the reported cash flow of the business?

-The reported cash flow of the business is $320,000.

What does the acronym 'SDE' stand for in the context of the video?

-In the context of the video, 'SDE' stands for 'Selling Discretionary Earnings', which is an estimate of the cash flow available to a business owner.

What is the significance of the business being in operation since 1984 as mentioned in the video?

-The significance of the business being in operation since 1984 is that it indicates the business has a long history, suggesting stability, established customer loyalty, and goodwill.

What does the video suggest about seller financing?

-The video suggests that seller financing can be a good or bad sign depending on whether the seller can justify their cash flow via tax returns. It advises caution and careful analysis of seller financing deals.

What is the role of the management team in the business as discussed in the video?

-The video highlights that the business has a self-sufficient management team, which implies that the owner is not required to be heavily involved in day-to-day operations, allowing for absentee ownership.

What is the significance of the business being a 'tour and rental' business as per the video?

-The significance is that the business combines both rental services and tour operations, which may affect its valuation and the way potential buyers evaluate the deal.

What is the importance of the 'Deal Analyzer' tool mentioned in the video?

-The 'Deal Analyzer' is an important tool because it allows potential buyers to analyze and compare financials of a business deal side by side, helping them make informed decisions about purchasing a business.

What is the potential monthly cash flow from the business after servicing the debt as discussed in the video?

-The potential monthly cash flow from the business after servicing the debt could be approximately $17,500, based on the calculations presented in the video.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

PENGANGGARAN MODAL

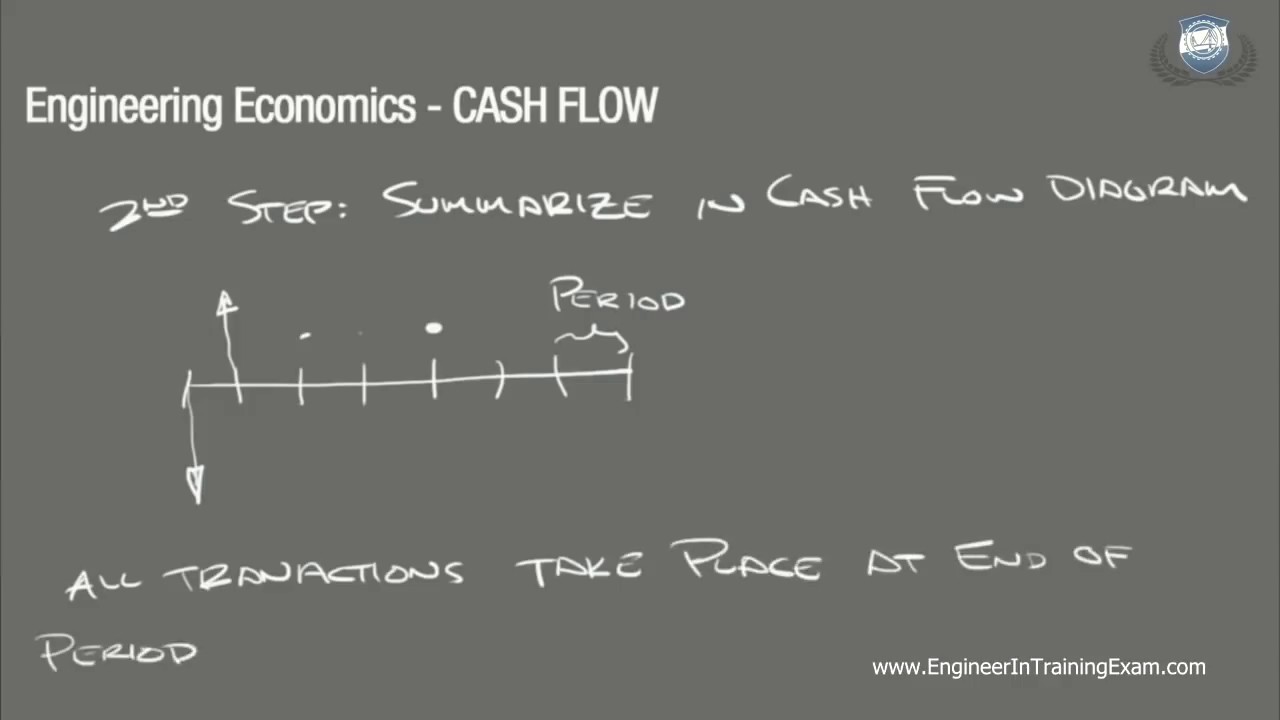

Cash Flow - Fundamentals of Engineering Economics

4 Guaranteed Side Hustles that add $500-$1000 to your pocket!

The Dragons Fight Over Proper.com | Dragons' Den | Shark Tank Global

O Que é Capital de Giro (Como Fazer Sem Segredos)

Shark Tank US | Sharks Advise Hampton Adams Entrepreneur To Sell His Company

5.0 / 5 (0 votes)