Bank Term Funding Program Shut Down, What Happens Next

Summary

TLDRThe Federal Reserve is ceasing new loans from its Bank Term Funding Program (BTFP), which was initiated in response to the 2023 banking crisis. Despite the program's mixed results and initial intent to provide liquidity against high-quality securities, it became a tool for banks to arbitrage the Fed rather than expand in the real economy. With the BTFP's closure, questions arise about banks' reliance on the program for liquidity versus arbitrage and the implications for the banking system's collateral sufficiency and funding availability, especially as the commercial real estate market faces potential losses and liquidity challenges.

Takeaways

- 🛑 The Federal Reserve is ceasing new loans from its Bank Term Funding Program (BTFP), initiated in March 2023 as an emergency measure.

- 💰 Despite the shutdown, there is still $164 billion outstanding from the BTFP, with a surprising increase just last week.

- 🏦 Banks' increased interest in borrowing from the Fed rather than lending to each other or the real economy indicates potential underlying issues.

- 📉 The BTFP was designed to provide liquidity against high-quality securities, preventing banks from having to sell assets in illiquid markets during times of stress.

- 🔄 The program's original purpose was overshadowed by arbitrage opportunities, especially as interest rates changed, leading to questions about its effectiveness.

- 🤔 The shutdown of the BTFP may reveal more about the health of the banking system, particularly in terms of collateral sufficiency and funding sources.

- 🏢 The commercial real estate market's shakeout, delayed due to valuation uncertainties, could expose losses and liquidity issues across the financial system.

- 📉 Banks may now have to rely on other funding sources, such as the discount window, private markets, or repo, to repay their BTFP loans.

- 🔄 The use of certain types of loans as collateral was highlighted as problematic, with some banks struggling to mobilize eligible collateral quickly enough.

- 🌐 The G30 report and BIS findings pointed to a lack of collateral availability as a significant issue during the 2023 bank crisis.

- 💡 The BTFP's shutdown might not lead to an immediate liquidity crisis, but it could provide insights into the banking system's true state and potential risks moving forward.

Q & A

What is the significance of the Federal Reserve stopping new loans from its Bank Term Funding Program (BTFP)?

-The stopping of new loans from the BTFP signifies the end of an emergency measure put in place in response to the financial turmoil in March 2023. It suggests that the Federal Reserve believes the immediate crisis has been addressed, but it also raises questions about the health of the banking system and the use of the program for arbitrage rather than for its intended purpose of providing liquidity to banks in need.

How much money was still being borrowed from the BTFP when it stopped making new loans?

-When the Federal Reserve stopped making new loans from the BTFP, there was still $164 billion being borrowed from the program.

What was the original purpose of the BTFP?

-The BTFP was created as an additional source of liquidity against high-quality securities, aiming to eliminate an institution's need to quickly sell those securities in times of stress and prevent a downward vicious cycle of forced selling and illiquid markets.

What is the role of collateral in the BTFP?

-Collateral plays a crucial role in the BTFP as it allows banks to borrow funds by pledging US Treasuries, agency debt, mortgage-backed securities, and other qualifying assets. The assets are valued at par, which is key to unlocking the funding availability.

Why did some banks show interest in lending to the Fed by borrowing from the BTFP rather than to each other or the real economy?

-Some banks were more interested in arbitraging the Fed by borrowing from the BTFP because they could earn a risk-free spread by borrowing at the BTFP's rate and holding reserves, which was more favorable than finding better paying opportunities in the real economy.

How did the Federal Reserve address the arbitrage opportunity presented by the BTFP?

-The Federal Reserve addressed the arbitrage opportunity by adjusting the rate that banks pay to borrow from the BTFP to align with the actual market rates, eliminating the risk-free profit opportunity.

What does the increase in BTFP borrowing of $548 million last week indicate?

-The increase in BTFP borrowing last week suggests that some banks still needed to tap into the program for liquidity reasons, rather than for arbitrage purposes, as the Fed had shut down the arbitrage opportunity.

How will banks repay the loans borrowed from the BTFP?

-Banks will have to repay the BTFP loans through various means, such as going to the discount window, using their cash reserves, entering the private market for repo transactions, or tapping into other funding sources like broker deposits or advances from the Federal Home Loan Banks (FHLB).

What was the issue with the three banks that failed in March 2023?

-The three banks that failed in March 2023 were unable to access the discount window on time and in sufficient scale largely because they could not mobilize eligible collateral rapidly enough.

What is the concern regarding the US commercial real estate market?

-The concern is that the commercial real estate market is facing a shakeout due to long-delayed adjustments in property valuations. As deals pick up and real estate prices fall, there are widespread concerns about potential losses that could ripple across the financial system and cause liquidity issues, as the loans tied to these properties may not be easily packaged into collateral.

What does the future hold for the banking system as the BTFP is shut down?

-The future for the banking system will depend on how banks manage the repayment of BTFP loans and how the real state of collateral sufficiency and funding is revealed. The shutdown of the BTFP might indicate how close the system is to a liquidity crisis and provide insights into the underlying fundamentals of the banking system.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Bank Term Funding Program Blows Up In Final Minutes...

🚨 Bank Runs Are Back! Fed Reserves Plunge to Critical Levels!

La CRISI IMMOBILIARE COMMERCIALE: $2,2 Trilion di Debiti

Silicon Valley Bank: what really went wrong?

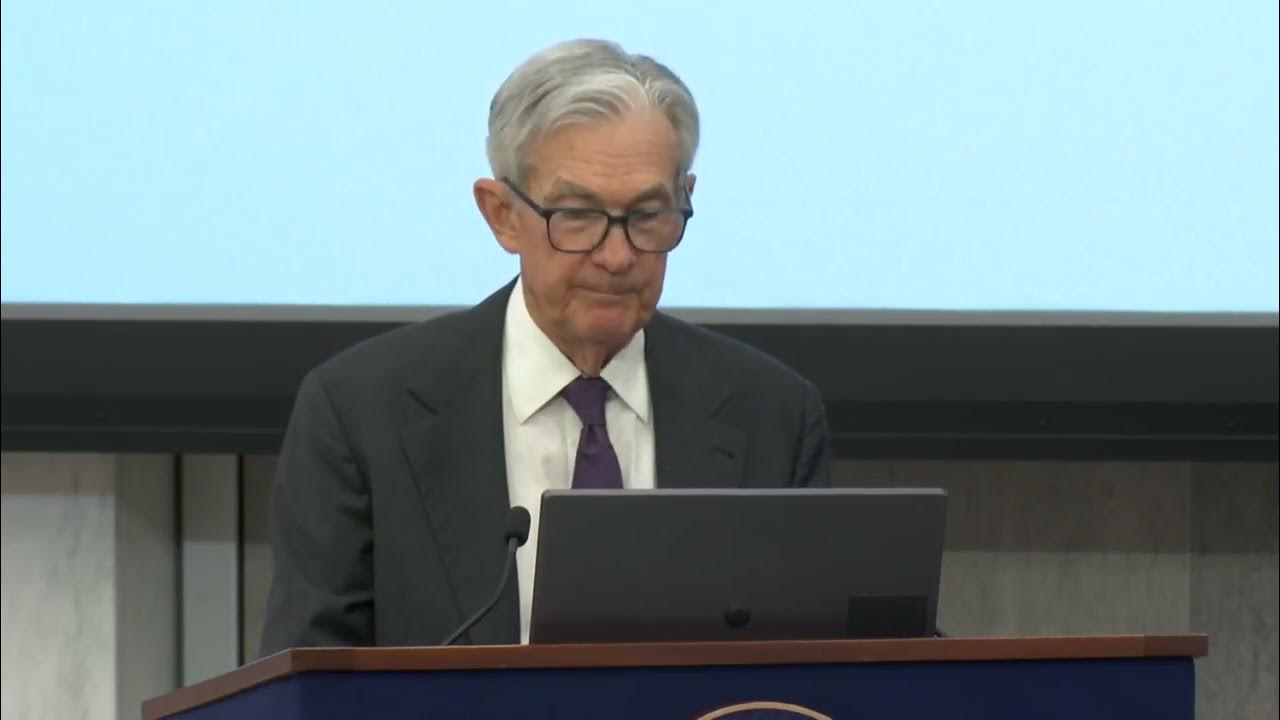

Opening Remarks by Chair Powell, July 22, 2025

How RBI saved India from a Banking Crisis? : Economic Case Study

5.0 / 5 (0 votes)