Perhitungan Titik Impas (Break Even Point) Usaha Kerajinan dari Bahan Limbah Berbentuk Bangun Datar

Summary

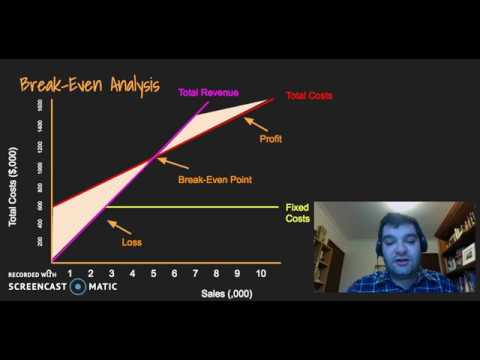

TLDRThis video script discusses the concept of the break-even point in business, where total costs equal total sales, resulting in neither profit nor loss. It explains the importance of fixed and variable costs in calculating the break-even point and how it serves as a planning tool for businesses to estimate profit levels. The script also touches on the evaluation of the break-even point, its role in management decision-making, and the connection between sales planning, cost, and desired profit margins. It encourages viewers to engage with the content by liking, sharing, and subscribing.

Takeaways

- 😀 The concept of break-even point is introduced as a state where a company's total costs equal total sales, resulting in neither profit nor loss.

- 📈 Break-even analysis is used as a planning tool to determine the profit potential and the sales volume needed to achieve it.

- 📊 The script emphasizes the importance of evaluating the break-even point to assess the overall profitability of a company.

- 💼 Fixed costs are identified as constant expenses that a company incurs regardless of production levels, such as labor costs and depreciation.

- 🔄 Variable costs are described as dynamic costs that change with the volume of production, including raw material costs and electricity.

- 💹 The selling price is defined as the per-unit price of goods or services produced, which is crucial in calculating the cost of production.

- 📝 Two methods to calculate the break-even point are presented: one based on sales units and the other on production volume.

- 🔢 The formula for calculating the break-even point in units is given as the fixed costs divided by the selling price minus the variable cost.

- 📊 The script discusses the use of break-even analysis to determine the sales volume at which a company neither makes a profit nor incurs a loss.

- 📈 The script highlights the role of break-even analysis in helping management plan sales and profits by understanding the relationship between costs, volume, and selling price.

- 📊 The importance of sales planning and profit planning is underscored, with the former focusing on forecasting future sales and the latter on achieving the company's profit goals.

Q & A

What is the break-even point in business?

-The break-even point is a state where a company's operations neither yield profit nor incur loss; in other words, the total costs equal total sales.

What is the significance of the break-even point in business planning?

-The break-even point serves as a planning tool to generate profit and provides information about various levels of sales volume and their relationship to the potential for profit.

What are the components required to calculate the break-even point?

-The calculation of the break-even point requires components such as fixed costs, variable costs, and selling price.

What are fixed costs in the context of the break-even analysis?

-Fixed costs are constant expenses that a company incurs regardless of its production level, such as labor costs, machinery depreciation, and others.

Can you explain variable costs in relation to the break-even point?

-Variable costs are dynamic per-unit expenses that depend on the volume of production. If planned production increases, variable costs will also rise, such as raw material costs and electricity.

How is the selling price defined in the break-even analysis?

-The selling price is the per-unit price of goods or services produced, which is used to calculate the cost of goods sold.

What are the two methods to calculate the break-even point in terms of sales volume?

-The two methods are: 1) Break-even point in units, which calculates the minimum production required for a company to avoid losses. 2) Break-even point in sales, which represents the total revenue needed to cover costs at the break-even point.

What is the formula for calculating the break-even point in units?

-The formula for calculating the break-even point in units is: Break-even Point = Fixed Costs / (Selling Price - Variable Cost).

How can the break-even point be used to evaluate a company's overall profit?

-By analyzing the break-even point, management can understand the sales level at which the company neither makes a profit nor incurs a loss, which helps in planning sales and profit.

What is the purpose of sales planning in relation to the break-even point?

-Sales planning aims to forecast the units and monetary value of a company's sales for a future period based on past sales trends, which helps in determining the production volume that can be sold and achieving the desired profit.

How does the break-even point analysis assist in profit planning?

-The break-even point analysis helps in profit planning by understanding the sales volume needed before the company makes a profit or loss, which can be used to set sales targets and desired profit levels.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

BREAK EVEN POINT (BEP)

Titik Impas (Break Even Point) Usaha Makanan Internasional- Prakarya dan Kewirausahaan Kelas 11

Kapan Balikan? Ehh, Kapan Balik Modal? Perhitungan Sederhana BEP - Kuliah Online Matematika Bisnis

Break-even Point | Business Mathematics

Cara Menghitung Break Even Point (BEP) | Analisis dan Contoh Kasus

Preliminary Business Studies Business Planning: Forecasting (Break-Even Analysis)

5.0 / 5 (0 votes)