Banking Explained – Money and Credit

Summary

TLDRThe international banking system, with over 30,000 banks holding vast assets, has evolved from medieval currency exchanges to a complex risk management business. Traditional banks now face competition from alternative financing models like investment banks, credit unions, crowdfunding, and microcredits, each offering unique approaches to serving clients and communities. These new models emphasize shared value, democratic control, and risk diversification, challenging the traditional banking paradigm and reshaping the financial landscape.

Takeaways

- 🏦 The international banking system consists of over 30,000 banks globally, with the top 10 holding around 25 trillion US-Dollars in assets.

- 📈 Banking originated in 11th century Italy to simplify trade by addressing the issue of multiple currencies in circulation.

- 💺 The term 'bank' comes from 'banco', Italian for 'bench', where merchants used to exchange money outdoors.

- 💼 Early banking models included home brokers providing credit and Genoese merchants developing cashless payments.

- 💰 Banks today are primarily in the risk management business, lending money at higher interest rates than they pay to depositors.

- 🏠 Banks play a crucial role in the economy by transforming unused savings into funds for purchasing assets and business expansion.

- 📉 The 2008 financial crisis was a result of banks engaging in high-risk financial constructs and lending practices.

- 🚨 Post-crisis, new regulations and emergency funds were implemented to prevent future banking collapses.

- 🌐 Alternative financing models like investment banks, credit unions, and crowdfunding are gaining popularity.

- 🔄 Credit unions focus on shared value and member benefits, which helped them survive the financial crisis better than traditional banks.

- 💵 Microcredits have become a significant business, providing small loans to help people in developing countries escape poverty.

Q & A

How many different banks are there worldwide?

-There are more than 30,000 different banks worldwide.

What is the combined asset value of the top 10 banks?

-The top 10 banks account for roughly 25 trillion US-Dollars in assets.

What was the original purpose of banks?

-The original purpose of banks was to simplify life, particularly in the context of trade and currency exchange.

Where did the term 'bank' originate from?

-The term 'bank' originates from the Italian word 'banco', which means 'bench', referring to the outdoor benches where money exchange took place.

How did the first banks manage risk in their operations?

-Early banks managed risk by lending money at higher interest rates than they paid to depositors, accepting the calculated risk that some borrowers would default.

What are the main sources of income for banks today?

-Banks' main sources of income include accepting saving deposits, credit card business, buying and selling currencies, custodial services, and cash management services.

What led to the global banking crisis of 2008?

-The global banking crisis of 2008 was triggered by banks lending to borrowers with poor credit, leading to a collapse in the housing market and a subsequent drop in stock prices.

What measures were taken to prevent future banking crises after 2008?

-New regulations were implemented, including mandatory bank emergency funds to absorb shocks and the creation of bailout packages to prevent bank bankruptcies.

How do credit unions differ from traditional banks in their approach to financial services?

-Credit unions focus on shared value rather than profit maximization, aiming to help members create opportunities and invest back into communities, with members democratically electing the board of directors.

What is crowdfunding and how does it impact traditional banking?

-Crowdfunding is a method where individuals or groups obtain funding for a project by collecting small amounts of money from a large number of people, often bypassing traditional banks and spreading risk among many investors.

What is the role of microcredits in developing countries?

-Microcredits are very small loans given mostly in developing countries to help people escape poverty and start businesses, providing access to funds for those previously deemed unworthy by traditional banking standards.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

SECRET METHOD Banks Use To Control The World

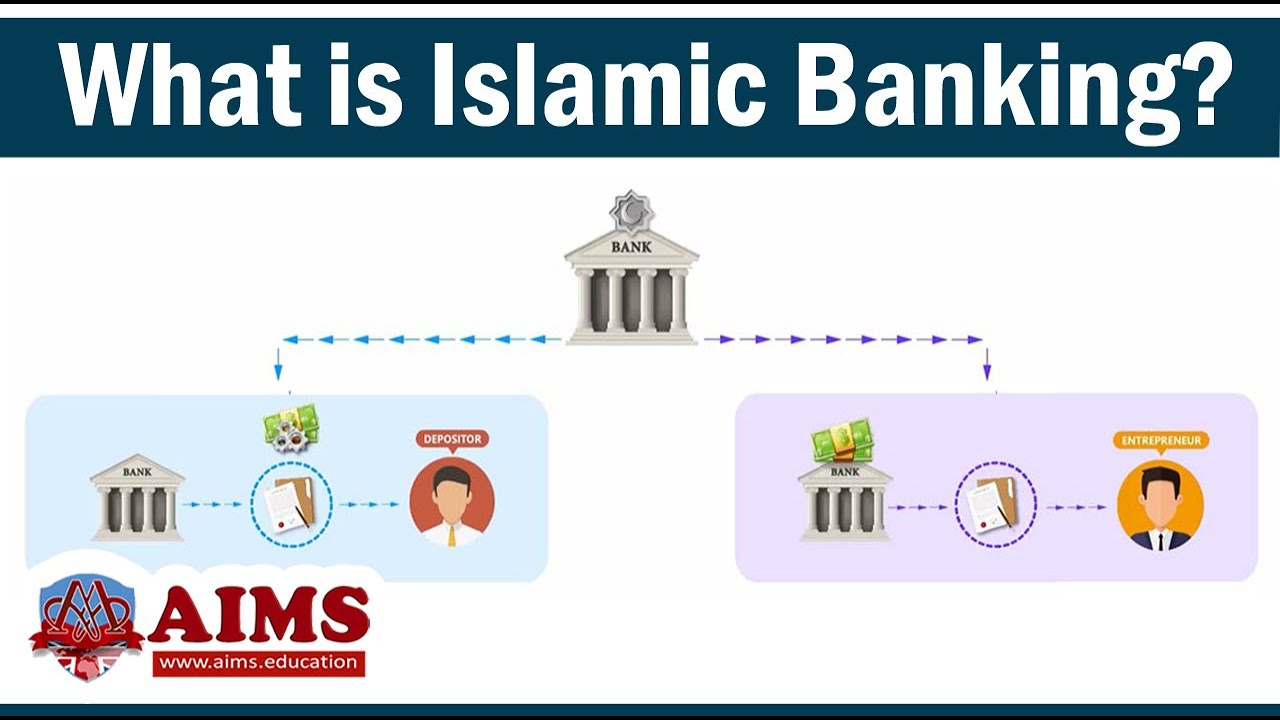

What is Islamic Banking System? & How Islamic Finance Work? AIMS UK

Cedar Vision | Revolutionizing Transaction Banking: Insights from Ramkumar Venkataraman.

Why Warren Buffett Sold Bank Stocks EXCEPT Bank of America? | Berkshire 2023

🚨 FDIC WARNS: Bank CRISIS Accelerates as Losses Hit $364 BILLION

Foreign Exchange Rate Risk

5.0 / 5 (0 votes)