Group CEO Abhishek Kapoor on NDTV Profit

Summary

TLDRIn the Small and Midcap Show, Mahima and Anushi discuss Purvankara's Q1 FY25 performance with Group CEO Abhishek Kapoor. The company reported a 2X revenue jump, delivered over 900 units, and aims to deliver 3,500-4,000 units annually. With a cash balance of over 1,000 crores, Purvankara invested 700 crores in new land acquisitions, adding 4 million square feet for development. Kapoor expresses excitement about future launches and the company's growth strategy, addressing concerns about margin evolution, debt trajectory, and the impact of the budget announcement on the real estate sector.

Takeaways

- 🏢 Abhishek Kapoor, Group CEO of Puravankara, discusses the company's Q1 FY25 performance, highlighting a 2X jump in revenue.

- 📈 The company aims to deliver 3,500 to 4,000 units this year, with over 900 units delivered in the last quarter.

- 💰 Collections have exceeded 900 crores, with a cash balance of over 1,000 crores, and 700 crores deployed in new acquisitions.

- 📊 Puravankara added 4 million square feet of area for development in the last quarter, with 50% of the investment in Mumbai.

- 🔍 Anushi Vakara inquires about the potential for continued 2X growth in revenue and addresses the flat booking value, with expectations for future launches.

- 🏗️ Despite some deferment of launches, the launch plan remains intact, with advanced stages of approvals for upcoming projects.

- 📉 The current margin stands at around 22%, affected by sales, marketing, and expansion overheads that impact the P&L but are not yet revenue-recognizable.

- 📋 Different brands within Puravankara target varying margins: Provident (27-30%), Pankar (30-35%), and Pura (exceeding 35%), with an overall blended margin target of 30%.

- 💼 Net debt has marginally increased due to new acquisitions and commercial portfolio expansion, but the company maintains a strong cash balance for future investments.

- 📉 The real estate sector may benefit from the scrapped indexation benefit, as it could encourage upgrades and new acquisitions among property owners with long-term gains.

- 📈 Puravankara has board and shareholder approval for a QIP (Qualified Institutional Placement) and is open to various capital rise opportunities, including partnerships and public markets.

Q & A

What was the main topic of discussion in the interview with Abhishek Kapoor?

-The main topic of discussion was the financial performance of Purvankara, including its Q1 FY25 numbers, delivery targets, revenue growth, and future plans.

What was the revenue jump reported by Purvankara in Q1 FY25?

-Purvankara reported a 2X jump in revenue in Q1 FY25.

What was the target for unit delivery set by Purvankara for the year?

-Purvankara's target for unit delivery was set between 3,500 to 4,000 units for the year.

How many units did Purvankara deliver in the last quarter as per the interview?

-Purvankara delivered over 900 units in the last quarter.

What was the collections figure mentioned by Abhishek Kapoor for the last quarter?

-The collections figure mentioned was in excess of 900 crores.

What was the cash balance of Purvankara as discussed in the interview?

-The cash balance of Purvankara was over 1,000 crores.

How much did Purvankara deploy in new acquisitions according to the interview?

-Purvankara deployed over 700 crores in new acquisitions.

What was the area of land added for development by Purvankara in the last quarter?

-Purvankara added about 4 million square feet of area for development in the last quarter.

What was Abhishek Kapoor's outlook on the booking value and potential delays?

-Abhishek Kapoor mentioned that the booking value remained flat due to no new launches in the last quarter, but he expects the launches to happen in the coming quarters, which are the peak period for the business.

How did Abhishek Kapoor address the issue of margin evolution for Purvankara?

-He explained that the current margin is around 22% and that it appears lower due to sales, marketing, and expansion overheads hitting the PNL. He also mentioned that margins for different brands within the company vary, with Provident between 27 to 30%, Pankar between 30 to 35%, and Pura Land exceeding 35%.

What was the impact on Purvankara's net debt as discussed by Abhishek Kapoor?

-Abhishek Kapoor clarified that although the net debt has marginally increased, it was due to significant investments in new acquisitions and the building of the commercial portfolio. However, the cash balance remains over 1,000 crores, allowing for more deployment in the coming quarters.

What was Abhishek Kapoor's perspective on the budget announcement regarding the indexation benefit?

-He viewed the scrapping of the indexation benefit as positive for the sector, especially for those with long-term gains on properties bought before 2010, as it could lead to more upgrades and demand for larger units.

Does Purvankara have any equity raise plans as per the interview?

-Purvankara has board and shareholder approval for a QIP (Qualified Institutional Placement), and they will update when they can share more information. They are open to various capital raise options, including partnerships and public market opportunities.

What is Purvankara's strategy for the collection pipeline or collection expectations for FY25?

-The strategy is to monetize the existing land bank and the 14 million square feet launch pipeline, with the aim to unlock the equity invested in their projects and achieve better margins and returns on capital.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Abhishek Kapoor, Group CEO, Puravankara Limited on ET NOW Swadesh

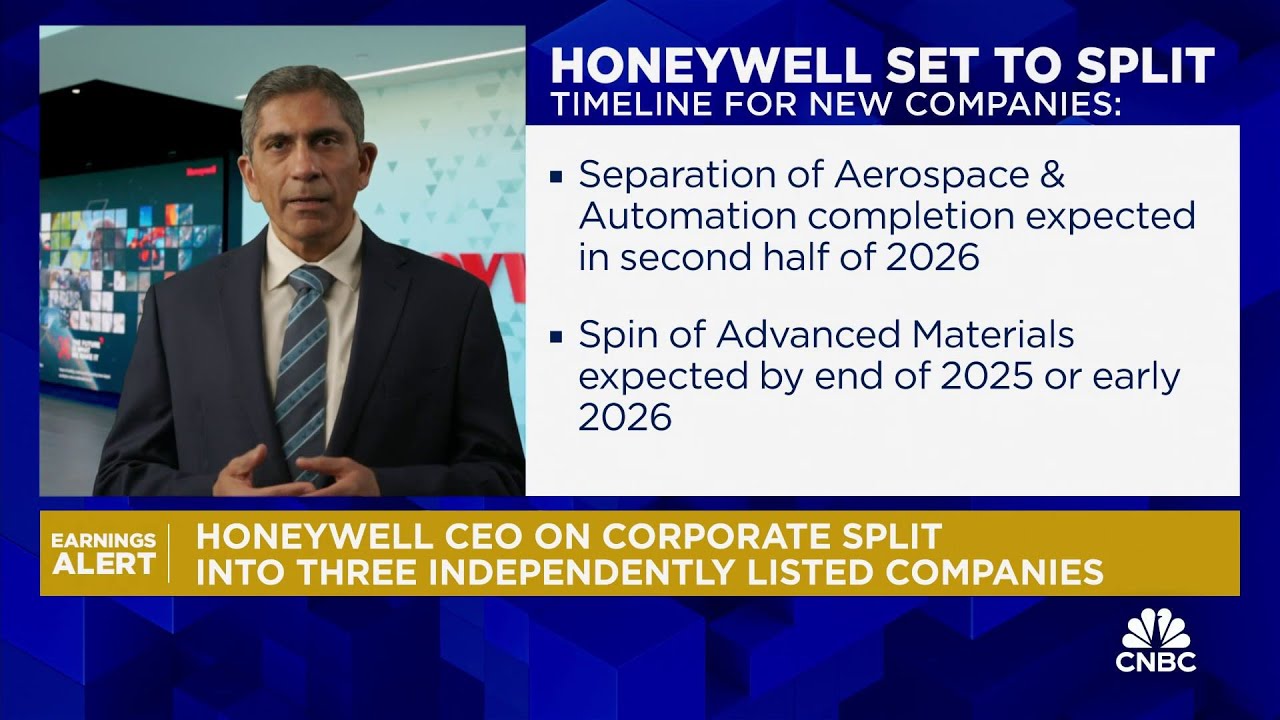

Honeywell CEO: Separation of Aerospace & Automation completion expected in second half of 2026

All Cap vs Small and Mid Cap Fund

Vibhor Steel Tubes Ltd Q1 FY2024-25 Earnings Conference Call

Best Midcap Mutual Fund ?? HDFC Midcap Opportunities Fund vs Kotak vs Motilal Oswal Midcap Fund

The Mutual Fund Debate: Should You Stop SIPs In Small & Mid Cap Funds? | Top Fund Managers Debate

5.0 / 5 (0 votes)