How Americans Are Losers In The US-China Trade War

Summary

TLDRThe script discusses the impact of U.S. tariffs on China, highlighting the complexities of global supply chains. It points out that most iPhone components are from other countries, not China, and that tariffs could hurt American businesses more than Chinese. The potential for job losses and business disruptions in the U.S. due to increased costs is also emphasized.

Takeaways

- 🌏 The U.S. has imposed tariffs on $250 billion worth of Chinese products and threatened more on $267 billion, reflecting a significant trade dispute.

- 📱 President Trump suggested that Apple should manufacture iPhones in America to benefit from potential tax incentives, highlighting a push for domestic production.

- 🤔 Despite Apple's design and marketing efforts, most iPhone components come from various global companies, not China, which only serves as the assembly plant.

- 💼 The actual cost of manufacturing an iPhone in China is minimal, with only $8.46 or 3.6% of the total cost attributed to Chinese parts, suggesting limited impact from tariffs.

- 🚀 Tariffs could potentially benefit competitors like Samsung, as iPhones could become more expensive in the U.S. market, altering competitive dynamics.

- 🏭 U.S. firms are facing disruptions due to increased costs from tariffs on steel and aluminum, impacting major industries like automotive manufacturing.

- 🔩 The auto industry, including companies like Ford and General Motors, has been adversely affected by higher material costs, leading to significant financial losses.

- 💡 Tariffs might lead to job losses in the U.S. steel manufacturing industry, with estimates suggesting a loss of five jobs for every one saved by tariffs.

- 🌐 American companies manage 60% of China's high-valued exports, indicating that tariffs could disproportionately affect U.S. businesses rather than Chinese ones.

- 🛠️ Many manufacturers rely on global supply chains for components, and tariffs can hurt various producers at different stages, including American companies.

Q & A

What is the primary concern expressed in the script about China's economic activities?

-The script expresses concern over China's economic activities, particularly accusing China of 'raping' the U.S. economy through what is described as the greatest theft in history.

What actions has the U.S. taken in response to China's economic activities as mentioned in the script?

-The U.S. has imposed tariffs on 250 billion U.S. dollars worth of Chinese products and has threatened additional tariffs on another 267 billion U.S. dollars worth of products.

What is the role of Apple in this context, as suggested by the script?

-The script suggests that Apple could benefit from manufacturing iPhones in America due to potential tax incentives, which could lead to zero tax, as suggested by President Trump.

What are the main components of an iPhone and where do they come from according to the script?

-The main components of an iPhone, such as the touchscreen display, memory chips, and microprocessors, come from various countries around the world.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

For Oom Piet - Poem Analysis

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Why Omega-3 Supplements cause Heart Problems (unless you pay attention to THIS)

The 7 Sinful Vs 7 Heavenly Roblox YouTubers

ऊं का गलत उच्चारण करते हैं 90 फीसदी लोगहैरानी होगी सही तरीका जान कर

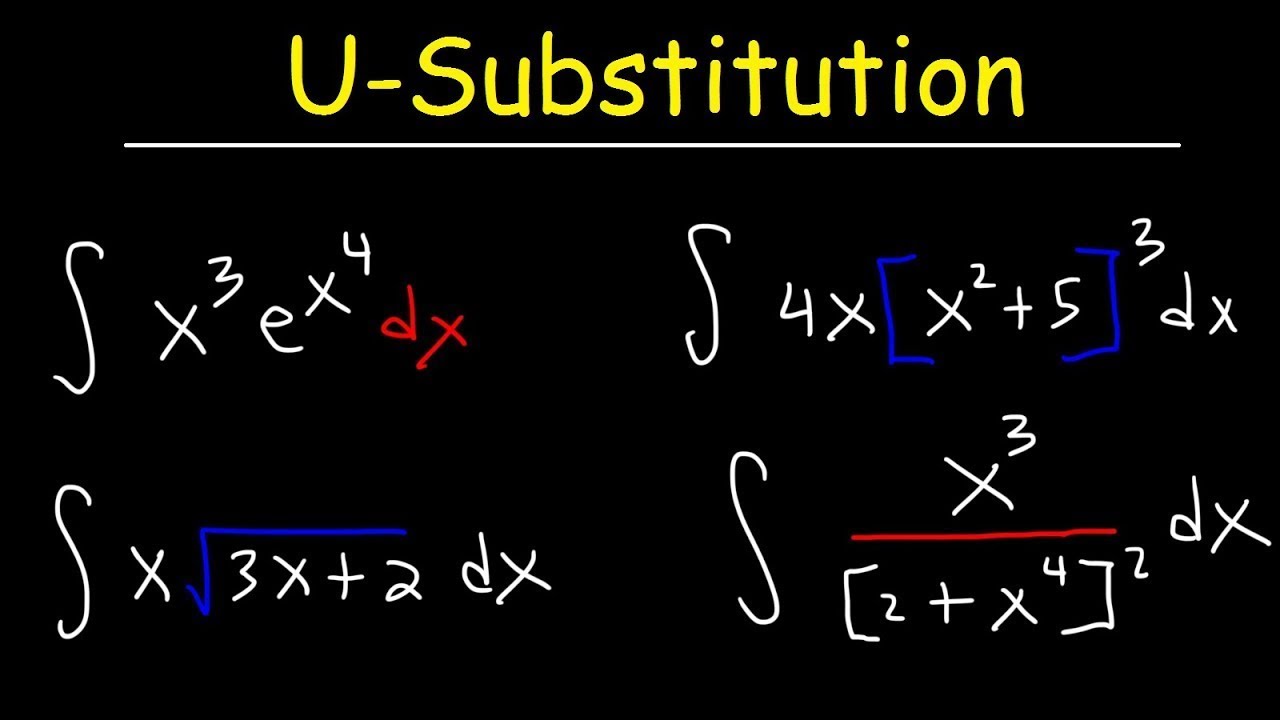

How To Integrate Using U-Substitution

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

5.0 / 5 (0 votes)