Hope/Fear/Greed - Managing Emotions in Trading

Summary

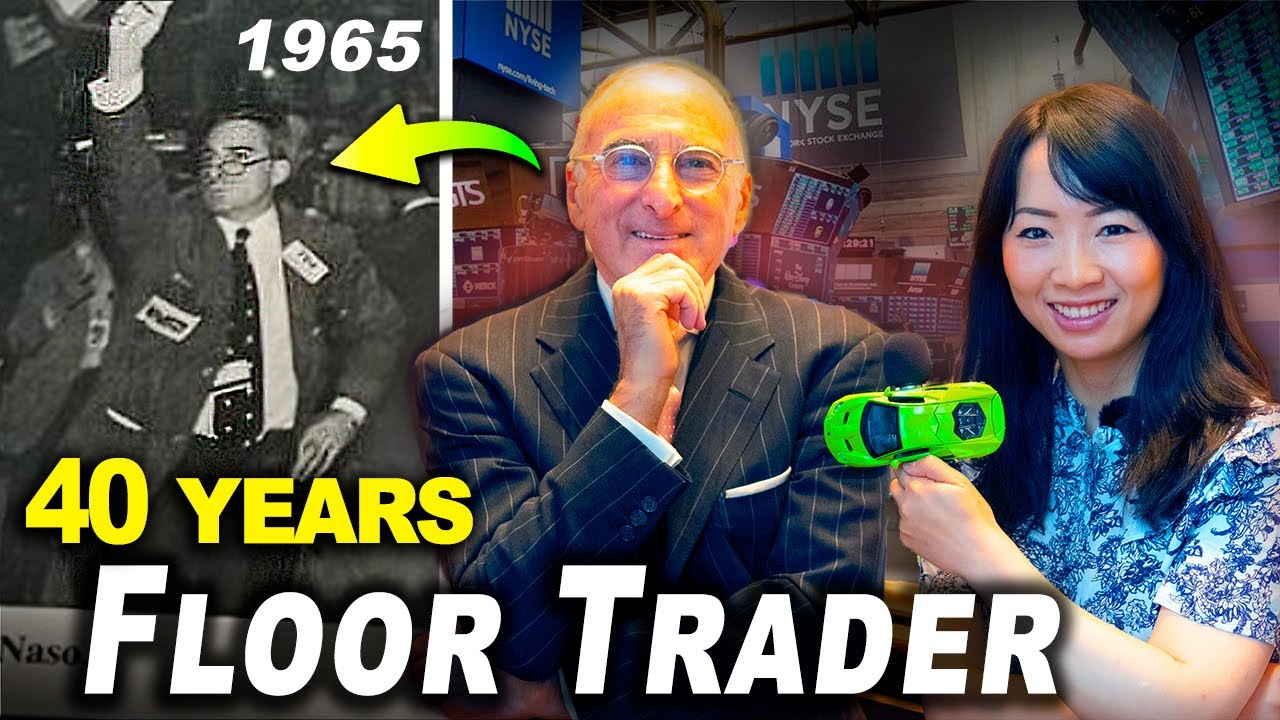

TLDRIn this video, a seasoned trader shares his insights on managing emotions in trading. Drawing on strategies from Zen practices and special forces psychology, he emphasizes the importance of staying calm and focused. He advises traders to start small, gradually building confidence and discipline, and highlights the value of mindfulness and presence. The discussion also touches on the pitfalls of emotional attachment to stocks and the necessity of letting go of losing positions, offering practical tips for developing mental resilience in the face of market volatility.

Takeaways

- 😀 Start with small steps in trading to manage emotions and reduce anxiety. Gradually increase your positions as you gain experience.

- 😀 The Japanese concept of 'Kaizen' (continuous improvement) can help traders make progress in small increments, leading to long-term success.

- 😀 Physical exercise, like spending an hour in the gym daily, is crucial for managing stress and maintaining mental clarity in trading.

- 😀 Meditation, or simply spending quiet time to clear your mind, helps reduce emotional volatility and keeps you focused on trading decisions.

- 😀 Accept that losses are inevitable, but they should always be small relative to your portfolio to protect yourself emotionally and financially.

- 😀 Demo accounts are helpful but have limited utility. Transition to real money trading quickly, even if starting with a micro account, to experience true emotional challenges.

- 😀 Emotional attachment to certain stocks can cloud judgment. It's important to detach from these feelings and make decisions based on logic, not attachment.

- 😀 Presence and mindfulness practices are powerful tools for managing emotions in trading. Stopping emotional thoughts can help improve focus and decision-making.

- 😀 Trading psychology can be reframed through relatable concepts like Special Forces training, which focuses on staying calm and present under pressure.

- 😀 Books by trading psychologists, like Steve Ward's works on trading psychology, offer valuable strategies for managing emotions and staying disciplined in volatile markets.

Q & A

How do you personally manage your emotions when trading?

-I manage my emotions by taking baby steps, trading smaller positions when necessary, and ensuring I have a trading plan. I also spend time in the gym and practice quiet time, which helps me stay focused and grounded.

What advice did William Gan give to someone who couldn't sleep due to their trading position?

-William Gan advised the person to sell shares until they could sleep, emphasizing the importance of taking smaller steps and being mindful of emotional and mental well-being.

What is the 'baby steps' concept, and how does it relate to trading?

-The 'baby steps' concept, often associated with the Japanese method, focuses on making gradual changes rather than taking drastic actions. In trading, it means starting with small positions to build confidence and reduce emotional stress.

What is the significance of the gym in managing your emotions while trading?

-Spending an hour at the gym every day helps release stress and provides a physical outlet for emotions. Physical fitness contributes to mental clarity and focus, which are crucial in making sound trading decisions.

What role does meditation or quiet time play in your emotional management?

-Meditation or quiet time, though not formally called meditation, helps calm the mind and allows for emotional detachment from the stresses of trading. It provides mental clarity and reduces impulsive reactions.

How does risk management relate to emotional control in trading?

-Risk management is crucial for emotional control. By limiting losses to a very small proportion of your portfolio, you can prevent significant emotional stress and avoid irrational decision-making during market fluctuations.

What is the utility of a demo account for beginner traders?

-A demo account is useful for learning basic trading mechanics and familiarizing yourself with the platform. However, it has limited utility when transitioning to real trading, as the emotional aspect of trading with real money is absent.

When should a trader move from a demo account to a real money account?

-Traders should move from a demo account to a real account within a few weeks or months. Even if starting with a small micro account, real money trading offers essential experience in managing emotions and making decisions under real market conditions.

How do personal emotions, like attachment to stocks, affect trading decisions?

-Personal emotions, such as attachment to certain stocks, can cloud judgment and lead to suboptimal decisions. For example, a trader might hold onto a stock because of past success, even when other options may offer better opportunities.

What is the key strategy for preventing emotional attachment to stocks?

-The key strategy is being present and focusing on the current situation rather than past experiences. Emotional attachment can be managed through practices like meditation or reframing situations, as some professional traders do by comparing their mindset to that of Special Forces operatives.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Answering Forex's Most Asked Questions

Trading Psychology | Why Normal Doesn’t Make Money | Part 1

The ONLY Trading Strategy You Need for 2026

+$23,952.98 Momentum Trading Stocks with NO NEWS 😱

I've read 50 trading books – These 2 will make you rich

Veteran Wall Street Trader Reveals Strategies Used At Stock Exchanges

5.0 / 5 (0 votes)