MGT101_Topic002

Summary

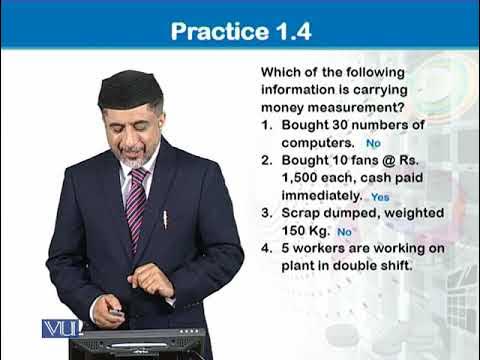

TLDRThis module covers three key sources of financial information: transactions, events, and conditions. Transactions refer to dealings between parties that are measurable in terms of money, such as payments and purchases. Events, like losses by fire or foreign exchange gains, can be non-monetary but are considered in financial accounting when measurable in money. Conditions involve adjustments to previously recorded transactions or events, like depreciation or provisions for doubtful receivables. The module provides examples and exercises to help understand and distinguish between these sources in financial accounting.

Takeaways

- 😀 Transaction, event, and condition are the three main sources of financial information in accounting.

- 😀 A transaction involves an exchange between two parties that is measurable in terms of money.

- 😀 Accounting transactions include deals between the business and its owners or third parties.

- 😀 Examples of accounting transactions include payment of salaries, purchasing a motor vehicle, or receiving cash against a loan.

- 😀 Non-examples of accounting transactions include hiring a production manager or placing an order for machinery, as these do not involve immediate money exchanges.

- 😀 Events in accounting refer to occurrences that have a financial impact, such as a fire loss or foreign exchange gains/losses.

- 😀 Non-monetary events, like winning or losing a game, are not considered in financial accounting.

- 😀 Conditions refer to adjustments made to previously recorded transactions or events, such as depreciation of assets or provisions for doubtful receivables.

- 😀 To classify a financial activity, it must meet specific criteria: measurable in terms of money and a deal between the entity and other parties.

- 😀 Understanding the distinction between transactions, events, and conditions is essential for proper financial reporting and accounting practices.

Q & A

What are the three sources of financial information in accounting?

-The three sources of financial information in accounting are transactions, events, and conditions.

What is the difference between a social transaction and an accounting transaction?

-A social transaction, like receiving a birthday gift, does not involve measurable monetary value, while an accounting transaction involves a business dealing where financial values are measurable in terms of money.

What are the two criteria that make a transaction an accounting transaction?

-An accounting transaction must be measurable in terms of money, and it must involve a dealing between the entity and its owners or other persons.

Is the payment of staff salaries made by check an accounting transaction?

-Yes, the payment of staff salaries made by check is an accounting transaction because it involves a financial exchange (money) between the business and its employees.

Why is 'appointing a production manager on contract' not considered an accounting transaction?

-Appointing a production manager on contract is not considered an accounting transaction because it does not involve a measurable monetary exchange; it's a decision, not a financial transaction.

What qualifies an event as a source of financial information in accounting?

-An event qualifies as a source of financial information in accounting if it is measurable in terms of money, such as a loss by fire or foreign exchange gains or losses.

What are conditions in accounting, and can you give an example?

-Conditions in accounting refer to adjustments made to already recorded transactions or events. An example of a condition is depreciation of assets or provision against receivables when there's doubt about their collection.

Is 'upkeeping expenses of building' an accounting transaction, event, or condition?

-'Upkeeping expenses of building' is an accounting transaction because it involves the spending of money for the maintenance of the property.

What is the key distinction between a transaction and an event in accounting?

-A transaction involves an exchange of value between two parties that is measurable in money, whereas an event is an occurrence that affects financial information but may not always involve an immediate exchange of money.

Can 'winning or losing a game' be considered an event in financial accounting?

-No, winning or losing a game is considered a non-monetary event because it does not have a measurable financial impact and therefore does not contribute to financial accounting.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenant5.0 / 5 (0 votes)