This ICT Scalping Strategy Is Boring, But It Makes Me $29k A Month

Summary

TLDRIn this video, the creator shares how they made $30,000 in 30 days using a simplified, mechanical trading strategy rooted in ICT principles. The strategy focuses on eliminating unnecessary complexity and emotional decision-making. By using two key levels and a set entry time, traders can cut out the fluff, avoid overcomplicating their trades, and focus on consistency. The method emphasizes stress-free trading without the need for multiple timeframes or daily bias. Ultimately, it advocates for a systematic, low-emotion approach to trading that can lead to consistent profitability.

Takeaways

- 😀 The strategy presented is simple, requiring no complex concepts like multiple timeframes, daily bias, or advanced indicators.

- 😀 Focus on two key levels: the high and low of the previous day to identify important levels in the market.

- 😀 The strategy is time-based, with specific entry times every day, removing the need to guess market movements.

- 😀 Trading is a mechanical process: you follow a checklist that ensures consistent trades without overthinking.

- 😀 Emotions like excitement and stress are detrimental to trading; successful traders find consistency in boredom, which leads to profitable results.

- 😀 The strategy avoids trying to catch the top or bottom of trades, focusing instead on stable, mechanical setups.

- 😀 Use the previous day’s high and low, combined with time-based levels, to mark key liquidity zones for potential trades.

- 😀 A failed trade can be quickly cut to minimize loss, with opportunities to enter a new, profitable position after re-evaluating the market.

- 😀 Reversal patterns and fair value gaps are important to recognize; however, an invalidated fair value gap shows when to exit a trade early.

- 😀 Traders should look for quick market movements when multiple key levels are hit at the same time, increasing the likelihood of a reversal.

- 😀 The strategy helps remove stress by focusing on key levels and clear, actionable signals, making trading less overwhelming and more profitable.

Q & A

What is the main focus of the trading strategy shared in the script?

-The main focus of the trading strategy is simplicity and consistency. It aims to cut out unnecessary complexity and focuses on just two key levels from previous trading sessions, using a mechanical checklist to enter trades at specific times.

Why is the strategy described as 'boring'?

-The strategy is considered 'boring' because it avoids the complex analysis, multiple timeframes, and emotional excitement that many traders experience. By simplifying the approach and sticking to basic levels, the strategy is less flashy but more consistent.

How does the trader identify key levels for this strategy?

-The trader identifies key levels by marking the high and low of the previous day on a daily chart. These levels are then used to spot potential entry points during key times, such as the London and Asian sessions.

What role do liquidity and market participants play in this strategy?

-Liquidity is crucial in this strategy because key levels, such as the highs and lows during major market sessions, often coincide with areas where larger market participants (e.g., institutions) will enter the market. These levels provide the most potential for successful trade entries.

What is the significance of the 9:30 AM market open in the strategy?

-The 9:30 AM market open is important because it is the time when the strategy looks for a reaction at the previously marked key levels. At this time, price action will help confirm whether a reversal or continuation is likely, guiding the trader's decision-making.

What happens when a trade based on this strategy gets stopped out?

-When a trade gets stopped out, the strategy encourages not to panic. Instead of giving up on the trade or feeling it was a failure, the trader looks for further opportunities. For example, if a reversal setup fails, it’s seen as an opportunity to enter the market in the opposite direction, potentially recovering losses.

How does the trader handle emotions like excitement and fear during trading?

-The trader emphasizes that emotions like excitement and fear are indicators of gambling, not trading. Successful traders approach the market with patience and discipline, and view trading as a mechanical, emotion-free process.

What is the concept of 'fair value gaps' in the strategy?

-Fair value gaps are price gaps created by expansive candles. Inverted fair value gaps occur when a candle closes through the previous gap, signaling a potential reversal. These gaps are used to assess market direction and confirm entries.

How does this strategy help in avoiding overtrading?

-This strategy helps avoid overtrading by focusing on consistent, mechanical setups rather than chasing every opportunity. By sticking to key levels and waiting for clear entry signals, traders are less likely to overtrade and more likely to make thoughtful, well-timed decisions.

How does the trader suggest managing stop-losses and take-profits?

-Stop-losses are set under key swing highs or lows, while take-profits are targeted at the next key level, such as the previous day's high or low. The trader recommends a clear and disciplined approach to managing risk and rewards, making trades with favorable risk-to-reward ratios.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

NEW Artificial Intelligence BUY/SELL Trading Bot Makes 1170% Profit ( FULL TUTORIAL )

I Make $100k/Month Using One Simple Strategy (Live Trade Results)

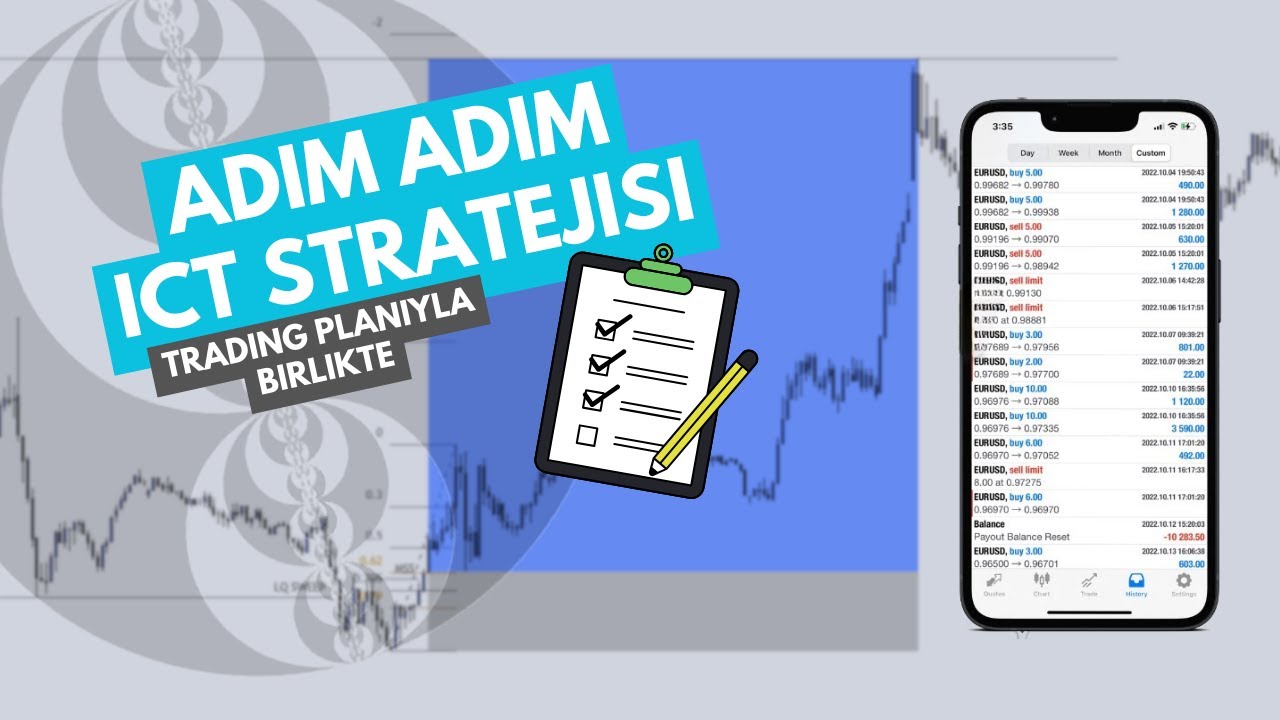

Adım Adım ICT Stratejisi ve Trading Planı

Simple ICT Silver Bullet Strategy | 70% Win Rate

I Have Used Binance Grid Trading Bot for 7 Days (Grid Strategy)

$34 to $32,544 on Pocket Option | The Simple Binary Options Formula That CHANGED Everything for Me!

5.0 / 5 (0 votes)