Diskon Tarif Listrik Sumbang Deflasi Januari 2025?

Summary

TLDRIn January 2025, Indonesia experienced deflation of 0.76% month-on-month and a 0.76% year-on-year decrease in the Consumer Price Index (CPI), lower than December 2024's 1.57%. Key factors contributing to this deflation included reduced electricity tariffs. Core inflation, on the other hand, increased to 2.36% year-on-year, influenced by rising prices of cooking oil, gold jewelry, and rental costs. Food prices surged by 3.07%, driven by higher costs of chili and chicken. Administered prices saw a significant drop of 6.41% due to electricity tariff discounts. Bank Indonesia expects inflation to remain controlled within a target range of 2.5% ± 1% in 2025.

Takeaways

- 😀 Consumer Price Index (CPI) inflation for January 2025 recorded a deflation of 0.76% month-on-month.

- 😀 Year-on-year inflation decreased to 0.76% in January 2025, down from 1.57% in December 2024.

- 😀 The main factor contributing to deflation was a reduction in electricity tariffs under the admin prices group.

- 😀 Core inflation in January 2025 increased to 2.36% year-on-year, up from 2.26% the previous month.

- 😀 Key drivers of core inflation included higher prices for cooking oil, jewelry, and housing rents.

- 😀 Food inflation (volatile food group) rose to 3.07% year-on-year in January 2025, up from just 0.12% in December.

- 😀 The increase in food inflation was largely due to higher prices for chili and broiler chicken.

- 😀 Administered prices experienced a deflation of 6.41% year-on-year, down from an inflation rate of 0.56% in December.

- 😀 The decline in administered prices was primarily due to electricity tariff discounts for households with lower electricity capacity.

- 😀 Bank Indonesia is confident that inflation will remain within the target range of 2.5% ± 1% throughout 2025.

- 😀 Low inflation in Indonesia is attributed to consistent monetary policies and the National Food Inflation Control Movement (GMPIP).

Q & A

What was the overall inflation rate for January 2025 in Indonesia?

-The overall inflation rate in January 2025 showed a deflation of 0.76% month-on-month and a 0.76% decrease year-on-year, which was lower than the 1.57% year-on-year inflation rate in December 2024.

What factors contributed to the deflation in January 2025?

-The deflation was mainly caused by a reduction in administered prices, particularly the decline in electricity tariffs.

What is the core inflation rate for January 2025?

-Core inflation in January 2025 was 2.36% year-on-year, slightly higher than the 2.26% year-on-year core inflation rate in December 2024.

What were the primary factors influencing core inflation?

-The key factors driving core inflation were the prices of commodities such as cooking oil, gold jewelry, and housing rental costs.

How did food prices change in January 2025?

-Food prices, specifically volatile food items, increased by 3.07% year-on-year in January 2025, up from 0.12% in December 2024. This increase was mainly driven by the rising prices of various types of chilies and broiler chicken.

What was the inflation rate for administered prices in January 2025?

-Administered prices showed a deflation of 6.41% year-on-year in January 2025, which was a decrease from the 0.56% year-on-year inflation rate in December 2024.

What measures contributed to the deflation in administered prices?

-The main contributing factors were the implementation of a 50% discount on electricity tariffs for households with up to 2,200 VA of power usage, and the normalization of public transport fares after the holiday season.

What is the inflation target for Indonesia in 2025?

-Bank Indonesia's inflation target for 2025 is within the range of 2.5% ± 1%, with efforts to maintain inflation control through consistent monetary policies.

What is the role of the National Movement for Food Inflation Control (GMPIP)?

-The GMPIP aims to support inflation control, particularly in the food sector, by implementing various initiatives to stabilize food prices and manage inflationary pressures.

What impact does low inflation have on the economy?

-Low inflation can help stabilize the economy by ensuring the purchasing power of consumers remains intact, reducing uncertainty in prices, and promoting a conducive environment for economic growth.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Deflasi 5 Bulan Berturut Turut, Daya Beli Turun? - [Zona Bisnis]

Deflasi 5 Bulan Beruntun, RI Alami Deflasi 0,12% di September 2024

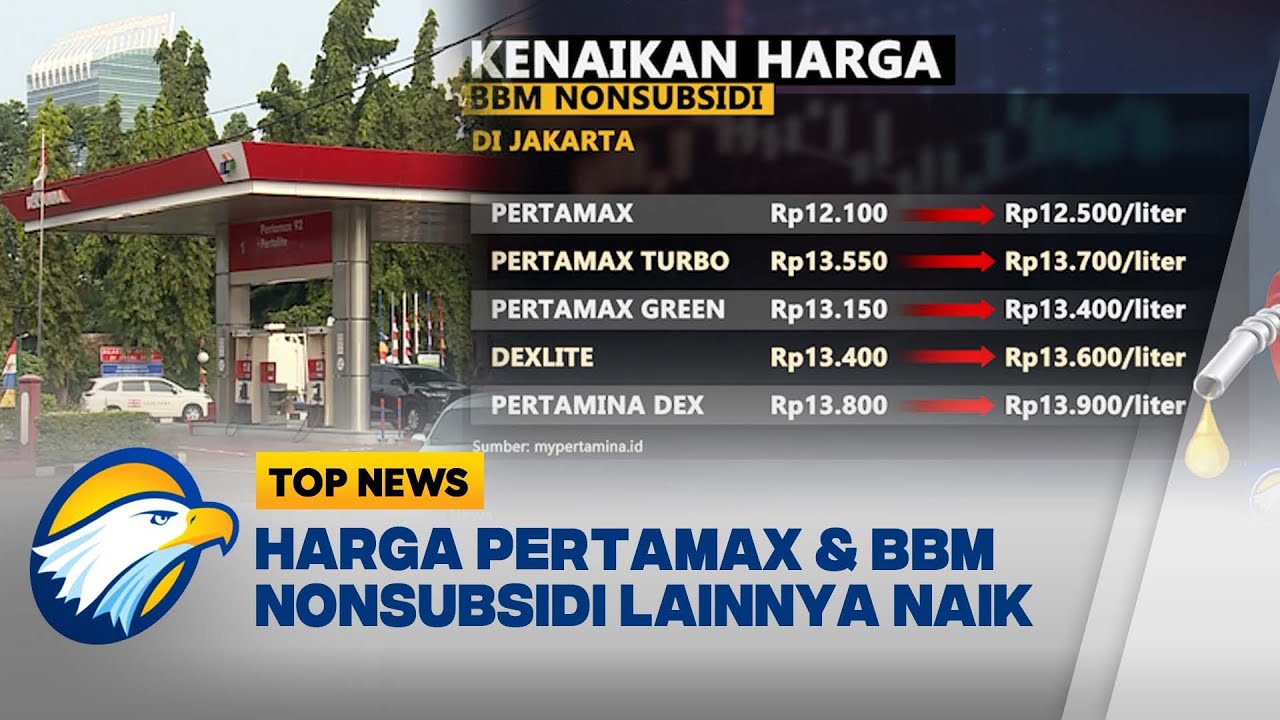

Harga BBM Subsidi Pertamax Naik Mulai 1 Januari 2025, Implementasi Keputusan Menteri ESDM [Top News]

Deflasi Lima Bulan Beruntun, Benarkah Daya Beli Masyarakat Lesu? | Liputan 6

Fenomena Deflasi di Sulawesi Selatan Februari 2025

Tingkat Inflasi Indonesia Juni 2025 Capai 0,19% - [Zonas Bisnis]

5.0 / 5 (0 votes)