E-Way Bill Distance Limit | Is GST E Way Bill Mandatory For Even 1 KM of Distance?

Summary

TLDRIn this video, the speaker explains the key aspects of creating an E-way Bill under GST for transporting goods, focusing on scenarios where it is mandatory, even for short distances like 1 km. The need for an E-way Bill is influenced by factors such as interstate supply, goods value exceeding ₹50,000, and further transportation. The validity of the E-way Bill is calculated based on the travel distance, with 1-day validity granted for every 200 km. Special rules apply to over-dimensional cargo and multimodal shipments. The video provides insights on compliance and clarifies common queries related to E-way Bills.

Takeaways

- 😀 E-Way Bill is mandatory for inter-state supplies when goods value exceeds ₹50,000, regardless of distance.

- 😀 If goods are transported within the same state and their value exceeds ₹50,000, an E-Way Bill is still required.

- 😀 E-Way Bill is necessary if goods are supplied to a consignee and their value exceeds ₹50,000, even for short distances.

- 😀 The distance traveled may influence the E-Way Bill validity, with 200 km granting one day of validity.

- 😀 For distances of up to 150 km, the E-Way Bill validity remains one day.

- 😀 For a 300 km distance, the E-Way Bill validity extends to two days.

- 😀 Over-dimensional cargo and multi-modal shipments, especially involving transportation by ship, have different E-Way Bill validity calculations.

- 😀 For every additional 20 km traveled in the case of over-dimensional cargo or multi-modal shipments, one extra day is added to the E-Way Bill validity.

- 😀 E-Way Bill requirements are influenced by various factors, including inter-state supply, goods value, and whether goods are to be further transported.

- 😀 The revised amendment offers more flexibility, with validity extended to one day for every 200 km of transportation, up from the previous 100 km.

- 😀 Even for distances as short as 1 km, an E-Way Bill is necessary if specific conditions such as high goods value and interstate supply are met.

Q & A

Is an e-way bill required for a distance as short as 1 kilometer?

-Yes, an e-way bill can still be required for a short distance like 1 kilometer if other conditions apply, such as interstate supply or the value of goods exceeding ₹50,000.

What makes an e-way bill mandatory for inter-state supply?

-If goods are transported from one state to another, and their value exceeds ₹50,000, an e-way bill becomes mandatory, regardless of the distance.

Do I need an e-way bill if my goods are only moving within the same state?

-An e-way bill might still be required for goods moving within the same state, particularly if the goods are worth more than ₹50,000 or if further transportation is planned.

What is the validity of an e-way bill for distances up to 200 kilometers?

-For a distance up to 200 kilometers, the validity of the e-way bill is one day.

How is the validity of an e-way bill extended for distances beyond 200 kilometers?

-For every additional 200 kilometers, the validity of the e-way bill is extended by one more day.

What if my goods are transported for over 300 kilometers? How do I calculate the e-way bill's validity?

-For 300 kilometers, the e-way bill will have a validity of 2 days—one day for the first 200 kilometers and one more day for the next 100 kilometers.

Are there any exceptions to the validity rules for e-way bills?

-Yes, over-dimensional cargo and multi-modal shipments have a different validity calculation, where the first 20 kilometers provide a 1-day validity, and additional validity is given for every extra 20 kilometers.

What happens if the distance of transport is less than 200 kilometers for over-dimensional cargo?

-For over-dimensional cargo, the e-way bill is valid for 1 day up to 20 kilometers, and for every additional 20 kilometers, an extra day of validity is added.

When is it not necessary to create an e-way bill, even for interstate transportation?

-If the value of the goods is below ₹50,000, or if the transport does not meet other criteria such as further transportation or inter-state supply, an e-way bill is not necessary.

Why do goods' values affect the e-way bill requirement?

-Goods worth more than ₹50,000 typically require an e-way bill to ensure proper tracking and compliance with GST regulations, even if the distance is short.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

GST Changes from 1st April 2025 | Tax Changes | GST 2025

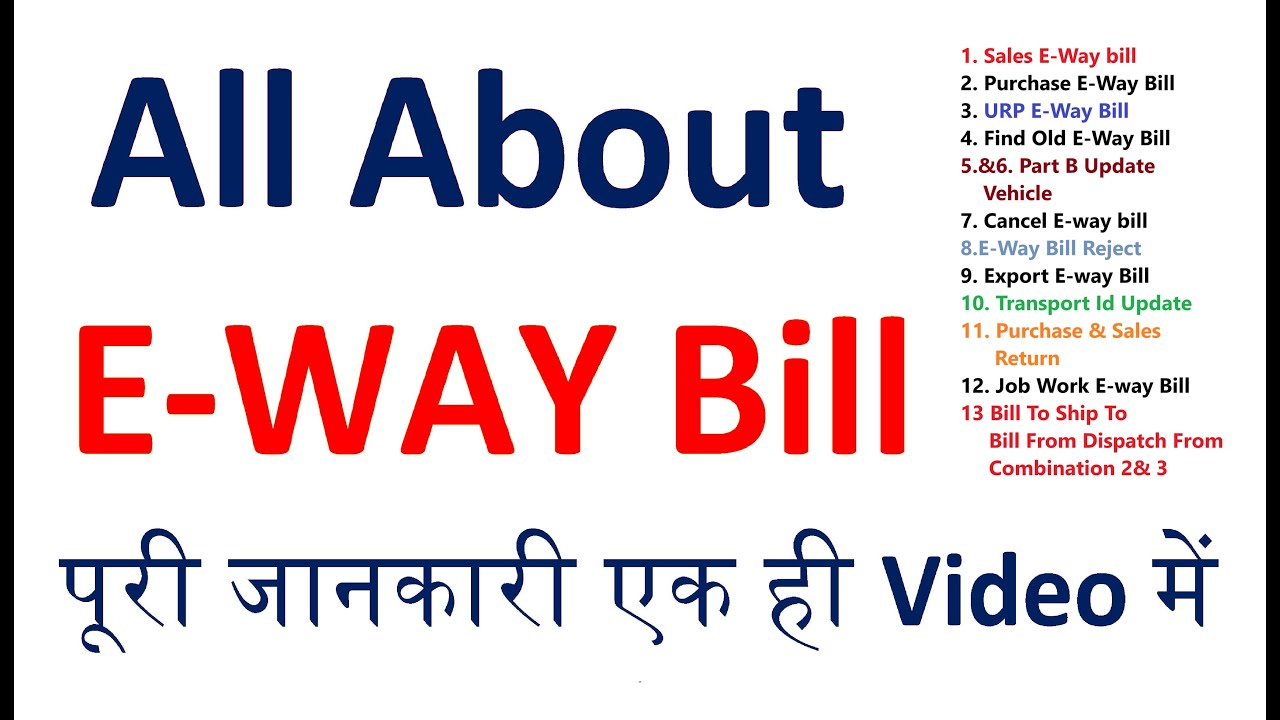

All about e way bill | e-way bill kaise banaye | eway bill cancel kaise kare | eway bill search

June 2025 से GSTR-1 भरना होगा मुश्किल | GSTR-1 filing with HSN code | how to add HSN data in GSTR 1

GST विभाग Small Business को भेज रहा Notice | UPI Payment GST Notice | GST Registration Limit 2025

Important GST Changes - Clause wise analysis of Union Budget 2025-26 || CA (Adv) Bimal Jain

Explanation on how to fill Zomato/ swiggy/ ola/ booking.com/ urbanclap sale in GSTR 1 and GSTR 3B

5.0 / 5 (0 votes)