Valuation based on FCFF & FCFE || Equity || CFA Level-1

Summary

TLDRThis video provides an in-depth explanation of the Free Cash Flow to Equity (FCFE) model used for equity valuation. The speaker contrasts FCFE with the Dividend Discount Model (DDM), emphasizing its broader scope as it considers all available cash for equity shareholders, including net income, non-cash expenses, changes in working capital, and debt servicing. The video explains how to calculate FCFE and discount it using the Weighted Average Cost of Capital (WACC) to determine equity value. This model is especially useful for companies with fluctuating dividends or significant reinvestment, offering a comprehensive approach to valuation.

Takeaways

- 😀 **FCFE (Free Cash Flow to Equity)** represents the cash flow available to equity shareholders after all financial obligations, including debt, are accounted for.

- 😀 **FCFF (Free Cash Flow to Firm)** represents cash flow available to all capital providers, including both debt and equity holders.

- 😀 **Net Income** is the starting point for calculating FCFE. It is adjusted for non-cash expenses (like depreciation) and changes in working capital.

- 😀 **Working Capital Adjustments**: If working capital increases, subtract it from FCFE; if it decreases, add it, as it represents cash freed up or tied down in day-to-day operations.

- 😀 **Capital Expenditures (CapEx)**: Any investments in fixed assets must be deducted from FCFE, as these are cash outflows necessary for future growth.

- 😀 **Debt Adjustments**: If the company repays debt, subtract the repayment from FCFE; if the company borrows money, add the new debt to FCFE.

- 😀 **Discounting FCFE**: The future cash flows are discounted using the **cost of equity** to arrive at the present value of equity.

- 😀 **Preference Shares**: If the company has preference shares, the dividend paid to preference shareholders must be deducted from FCFE to determine the cash flow available to common equity holders.

- 😀 **Growth Rate and Terminal Value**: The FCFE model incorporates a growth rate to estimate future cash flows, and a terminal value is calculated to account for cash flows beyond the forecast period.

- 😀 **Advantages over DDM**: The FCFE model is more suitable for companies with irregular dividends or those investing heavily in growth, as it considers all available cash flow to equity holders, not just dividends.

- 😀 **Cash Flow to Equity vs. Cash Flow to Firm**: The key difference lies in whether the cash flow is available to all capital providers (FCFF) or just to equity holders (FCFE).

Q & A

What is the Free Cash Flow (FCF) model?

-The Free Cash Flow (FCF) model is a method used in company valuation that focuses on the cash available after accounting for operating expenses, taxes, and investments in assets. It represents the cash flow that a company can distribute to its equity holders after all obligations have been met.

How does the Free Cash Flow to Equity (FCFE) model differ from the Dividend Discount Model (DDM)?

-The FCFE model focuses on the cash flow available for distribution to equity shareholders, taking into account all operational costs, taxes, and changes in working capital. In contrast, the DDM looks specifically at dividends paid out to shareholders, ignoring other cash flows or company investments.

What is the importance of understanding Free Cash Flow in company valuation?

-Free Cash Flow is crucial in company valuation because it gives an accurate representation of the cash available for reinvestment, debt repayment, or distribution to equity holders, which is a key indicator of financial health and growth potential.

What factors are considered when calculating Free Cash Flow to Equity (FCFE)?

-The FCFE calculation considers net income, depreciation (a non-cash expense), changes in working capital, and capital expenditures. It also adjusts for any borrowing or debt repayments, providing a clear picture of available cash for equity holders.

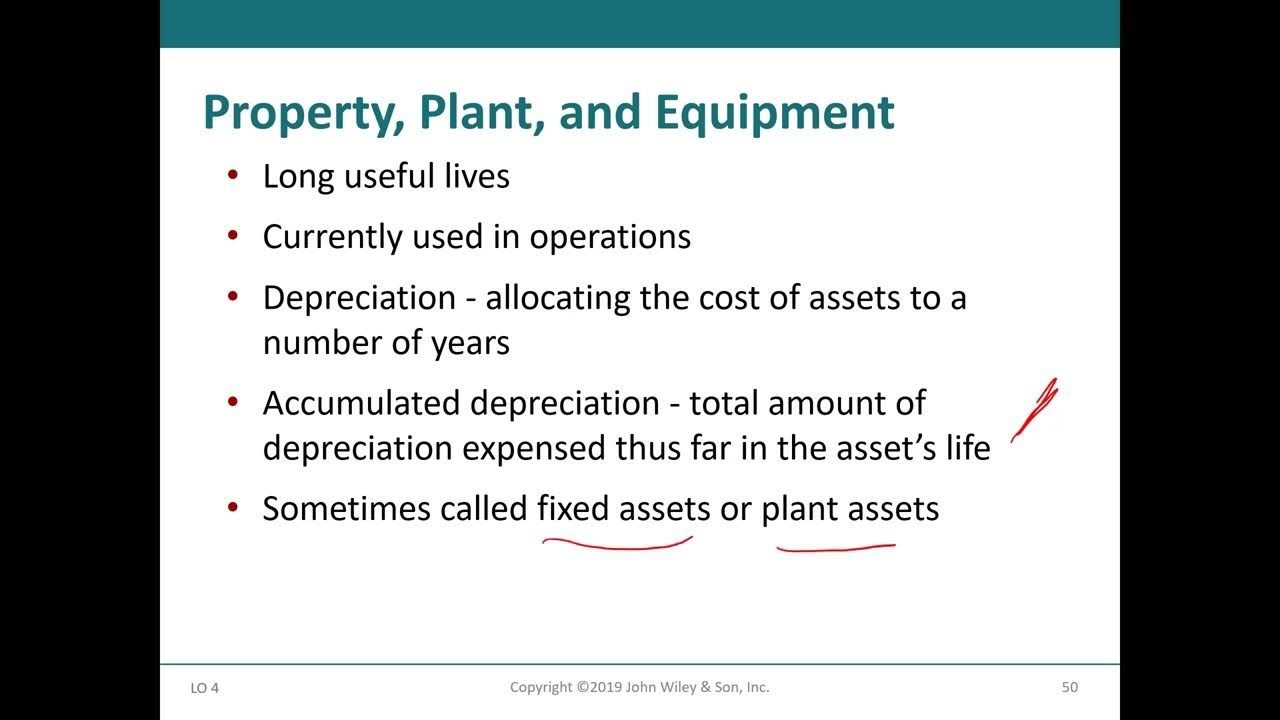

What role does depreciation play in calculating Free Cash Flow to Equity?

-Depreciation is added back to net income in the FCFE calculation because it is a non-cash expense. While depreciation reduces reported income, it doesn't affect the actual cash flow, making it necessary to adjust for it when determining the true cash available to equity holders.

How do changes in working capital affect the Free Cash Flow to Equity?

-Changes in working capital, such as an increase in current assets or a decrease in liabilities, can either absorb or free up cash. If working capital increases (e.g., by purchasing more inventory), it reduces free cash flow, while a decrease (e.g., selling assets) can increase free cash flow.

What is the purpose of discounting Free Cash Flow to Equity in company valuation?

-Discounting Free Cash Flow to Equity helps determine the present value of future cash flows, adjusting for the time value of money. This provides an estimate of the company’s equity value, helping investors assess whether the stock is undervalued or overvalued.

Why is the Free Cash Flow to Debt (FCFD) approach important in the FCFE model?

-The Free Cash Flow to Debt (FCFD) approach is important in the FCFE model because it accounts for the cash available to debt holders after considering interest payments and principal repayments. This helps investors understand the company’s debt capacity and repayment ability, which influences equity valuation.

What is the relationship between net income and Free Cash Flow to Equity?

-Net income serves as the starting point for calculating Free Cash Flow to Equity. However, it is adjusted by adding back non-cash expenses like depreciation and accounting for changes in working capital, capital expenditures, and borrowing to derive the final free cash flow available to equity holders.

How do borrowing repayments affect the Free Cash Flow to Equity?

-Borrowing repayments reduce the Free Cash Flow to Equity because any cash used to repay debt is not available for equity holders. If a company repays debt, it decreases the cash flow to equity holders, while new borrowings can increase it.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Introduction to Equity Valuation || CFA Level-1 || Equity

Top 10 Investment Banking Interview Questions (and Answers)

Financial Accounting 1: 13- Sections Of A Classified Statement Of Financial Position (شرح بالعربي)

8. Financial ratio analysis

Webinar On AI-Enhanced DCF Model - Basics & Industry-Specific Perspectives by Mr. Murali Raman

BAB 4 Aktivitas Berbasis Riset Pencatatan Laporan Keuangan (Penilaian SMK - Akuntansi 11)

5.0 / 5 (0 votes)