Should You Buy Amazon Stock Before October 31? | AMZN Stock Analysis

Summary

TLDRIn this video, the presenter discusses Amazon's upcoming quarterly earnings report scheduled for October 31, 2024, highlighting key financial metrics to watch, including sales growth and operating income. The focus is on Amazon Web Services (AWS), which is critical for investors due to its high-profit margins. While growth is expected to slow compared to previous quarters, the CEO emphasizes progress in AWS and AI investments. The presenter advises caution for investors considering buying before earnings, suggesting a split investment approach to mitigate risks. Overall, the video provides insights into Amazon's financial health and strategic direction.

Takeaways

- 📅 Amazon will report its quarterly financial results on October 31, 2024.

- 📈 Last quarter, Amazon achieved a 10% growth in net sales, totaling $148 billion, compared to $134 billion in the same quarter last year.

- 💰 Operating income significantly increased to $14.7 billion from $7.7 billion year-over-year.

- 🔍 For the upcoming earnings report, net sales are expected to range between $154 billion and $158 billion, reflecting approximately 10% growth.

- 📊 Operating income is forecasted to be between $11.5 billion and $15 billion, suggesting a potential increase from last year's figures.

- ☁️ AWS (Amazon Web Services) is a critical growth segment, with its year-over-year sales growth accelerating from 12% to 19% recently.

- 📉 Investors should be cautious of slower growth rates in overall performance due to high comparisons from previous years.

- 💡 Amazon is increasing capital expenditures, particularly in artificial intelligence and data center infrastructure, which investors should monitor closely.

- 🔄 A balanced investment strategy is recommended, such as investing some funds before earnings and additional amounts afterward to manage risks.

- 💼 With a forward price-to-earnings ratio of 32, Amazon remains a stock of interest for potential investors, but careful consideration is advised around earnings announcements.

Q & A

What is the scheduled date for Amazon's quarterly earnings report?

-Amazon is scheduled to report its quarterly financial results after the market closes on October 31, 2024.

What was Amazon's net sales growth in the last quarter reported?

-In the last quarter, Amazon reported a net sales growth of 10%, reaching $148 billion compared to $134 billion in the same quarter the previous year.

How did Amazon's operating income change in the latest quarter?

-Amazon's operating income jumped to $14.7 billion in the second quarter, up from $7.7 billion in the same quarter of 2023.

What challenges is Amazon facing regarding year-over-year growth rates?

-Amazon is facing a slowdown in year-over-year growth rates as it compares results with quarters that already saw significant increases.

What are the expected net sales for Amazon in the upcoming earnings release?

-For the upcoming earnings release, Amazon expects net sales to be between $154 billion and $158 billion, which reflects roughly 10% growth at the midpoint.

Why is AWS considered the most important segment for Amazon investors?

-AWS, Amazon's web services, is critical because it has a much higher operating profit margin compared to other segments, typically ranging from 24% to 38%.

What is the anticipated operating income range for Amazon in the upcoming quarter?

-The anticipated operating income for the upcoming quarter is expected to be between $11.5 billion and $15 billion.

What significant investment trend is highlighted regarding Amazon's capital expenditures?

-Amazon's capital expenditures for property and equipment increased significantly, jumping from $11.4 billion to $17.6 billion year-over-year, largely due to investments in artificial intelligence capabilities.

What is the suggested investment strategy regarding Amazon stock before the earnings report?

-Investors are advised to consider splitting their investment, buying some stock before the earnings release and the remainder after, to mitigate risks associated with uncertain market reactions.

What has been the trend in AWS's net sales growth recently?

-AWS's net sales growth has been accelerating over the past three quarters, moving from 12% to 19% year-over-year, indicating strong demand for its services.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

The end of Palantir? (Why $PLTR is down and keeps dropping?)

Nike Stock is Crashing - Here's Everything You Need to Know

EBITDA vs Net Income Vs Free Cash Flow (Analyst Explains)

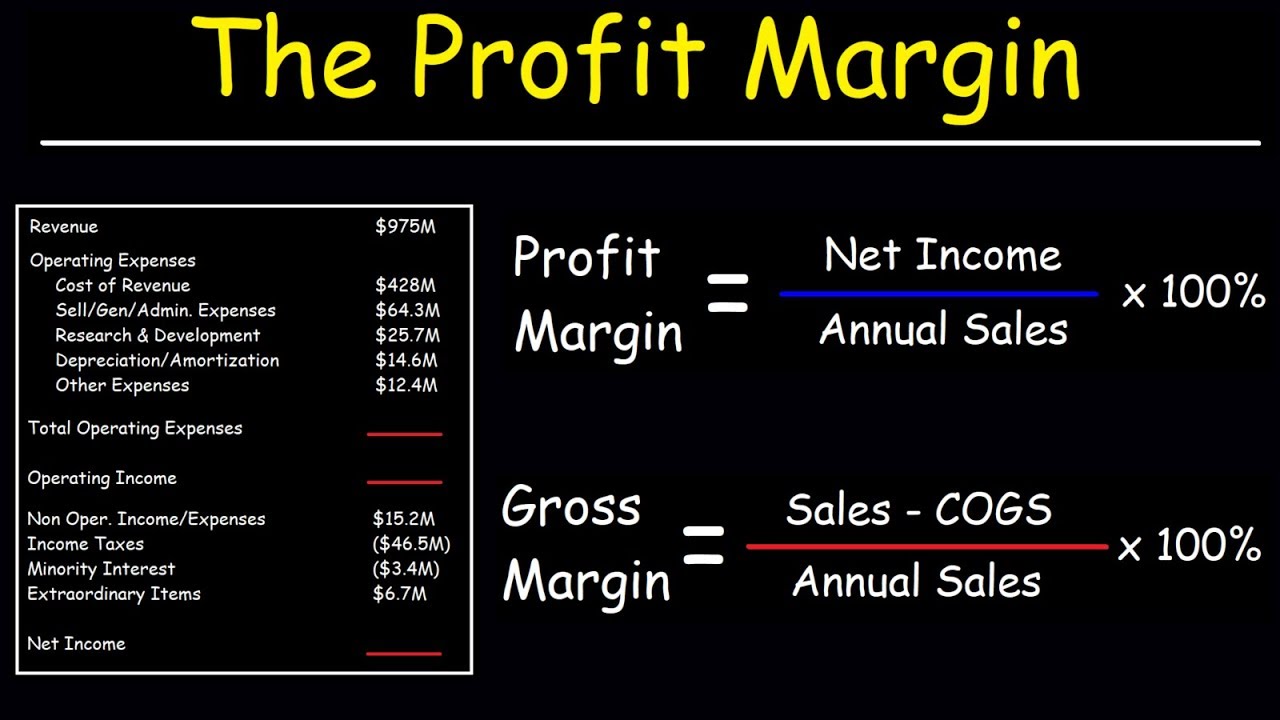

Profit Margin, Gross Margin, and Operating Margin - With Income Statements

THREE Undervalued Dividend Stocks WE'RE BUYING! | Adding Passive Income to Reach Financial Freedom!

No último dia de outubro, balanços frustram antes de PCE; fiscal no radar: Minuto Touro de Ouro

5.0 / 5 (0 votes)