What I Learnt From The ICT's Longest X Space (over 5 hours)

Summary

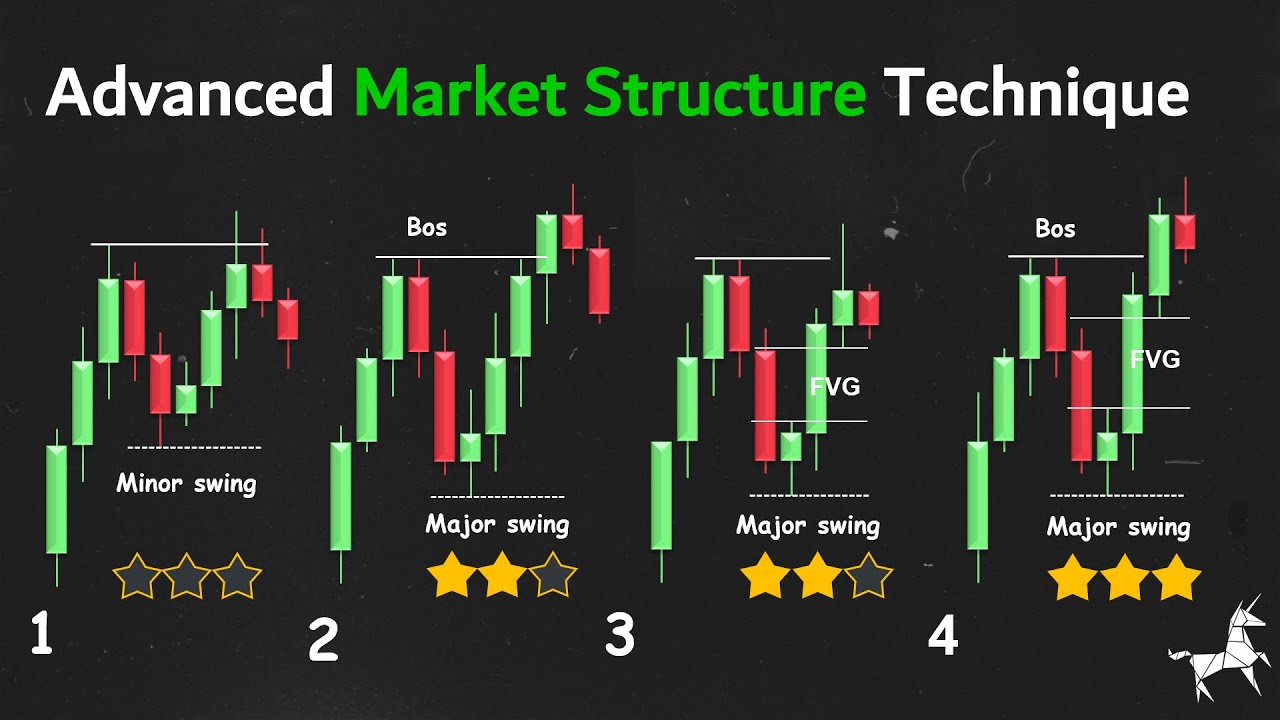

TLDRThis transcript dives into advanced trading strategies, focusing on liquidity manipulation and market dynamics. The speaker explains how algorithms drive price movements, especially through stop hunts and liquidity pools. Key concepts like 'turtle soup' and market inefficiencies are discussed, emphasizing how traders use these to time entries and exits effectively. The speaker also highlights the importance of understanding market liquidity, stop-loss strategies, and the dynamics between short-term and long-term trading perspectives. This detailed insight caters to traders aiming to refine their strategies based on market manipulation and liquidity analysis.

Takeaways

- 😀 The market is driven by algorithms that manipulate price movement by attacking resting orders and enticing buying and selling.

- 😀 Liquidity is strategically placed above certain price levels to control price movement, encouraging short-term market moves without pushing beyond a set limit.

- 😀 The concept of 'turtle soup' is explained as a price pattern formed when liquidity is built above old highs, which can trigger breakouts or reversals.

- 😀 'Turtle soups' work because of the concept of a false breakout and the way market liquidity is manipulated by market makers and large traders.

- 😀 The strategy of stop hunts is critical to understanding price behavior, where liquidity is absorbed to create large market moves in a certain direction.

- 😀 Market analysis should focus on liquidity formed before key market events, like after 7:00 AM Eastern time but before the 9:30 AM market open.

- 😀 Identifying relative equal highs or lows in the market is essential to predicting where price will go next, especially when combined with key timeframes like the opening range.

- 😀 In bearish market conditions, liquidity should be expected above the market's recent highs, as price often rallies to take out this liquidity before falling.

- 😀 A classic bullish trading day often follows a pattern of early sell-offs to capture liquidity, followed by a rally that extends throughout the day with a close near the highs.

- 😀 A high-frequency trading strategy can be implemented by observing small timeframes (like a 15-second chart) for relative equal lows, then using fair value gaps to enter trades.

Q & A

What is the role of algorithms in driving the market?

-Algorithms are responsible for driving the market by creating buying and selling pressures that cause the price to fluctuate. They also target resting orders to manipulate the market and entice further buying and selling activity.

What does the concept of liquidity pools refer to in trading?

-Liquidity pools refer to areas where large amounts of buy or sell orders are gathered, typically above old highs or lows. These pools are strategically placed to create opportunities for traders, often attracting price movement towards them before a reversal or continuation occurs.

Why do markets avoid going above certain levels where liquidity exists?

-Markets avoid going above specific levels with liquidity because once they hit those levels, they attract additional short sellers, which increases net liquidity. The smart money does not want to trigger these pools prematurely; instead, they leave them for later in the day to create favorable market conditions.

What is the purpose of a 'turtle soup' pattern in trading?

-The 'turtle soup' pattern capitalizes on false breakouts where the price briefly moves beyond established highs or lows to trigger stop orders, only to reverse soon after. This pattern works because of how liquidity pools are created around previous highs and lows.

How does the concept of 'stop hunts' factor into trading strategy?

-'Stop hunts' refer to market moves designed to trigger stop-loss orders and take out traders who are positioned incorrectly. Understanding where these stop hunts are likely to occur can help traders anticipate price movements and adjust their strategies accordingly.

How does understanding liquidity affect daily candlestick predictions?

-By understanding where liquidity pools are located, traders can predict the likely direction of a candlestick formation. For example, if a liquidity pool is located above a high, the market may rally to trigger this liquidity before reversing, influencing the expected price movement for the day.

What is the significance of opening range analysis in predicting market moves?

-The opening range, typically the first 30 minutes after the market opens, is crucial for identifying key levels such as relative equal lows or highs. These levels can act as targets for price movement, and analyzing the opening range helps traders anticipate potential moves and adjust their strategy.

Why is the first 90 minutes of market action considered important for trading?

-The first 90 minutes of market action is considered crucial because it often sets the tone for the rest of the day. During this period, liquidity pools are formed and can provide valuable clues for identifying price targets and trade entries for the day.

How does the concept of 'fair value gaps' fit into the trading strategy?

-'Fair value gaps' are areas where price has moved quickly without sufficient trading activity to support the move. These gaps often represent inefficiencies in the market, and they are used by traders as targets for entry after liquidity has been absorbed from those gaps.

What role does volatility play in determining trade targets?

-Volatility significantly influences the potential range of a price movement. Higher volatility increases the likelihood of larger price swings, which can result in greater trading opportunities, such as capturing 50-100 handle moves depending on the market's behavior and the liquidity in play.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Master Liquidity With Time (Objective Trading Approach)

High Probability Targets | Magnetism of Time-Based Liquidity Ep.1 (ICT Concepts)

3 High Probability Scalping Strategies Using Smart Money Concepts

I Discovered Best Market Structure Analysis (Premium Video)

MMXM IPDA cycles + PO3 | Fractal Cheat Code For Price Anticipation

ICT Concepts - Immediate Rebalance (Strongest Signature) 🤫

5.0 / 5 (0 votes)