IPCA +10,8%: NÃO CAIA NESSA ARMADILHA do IPCA+

Summary

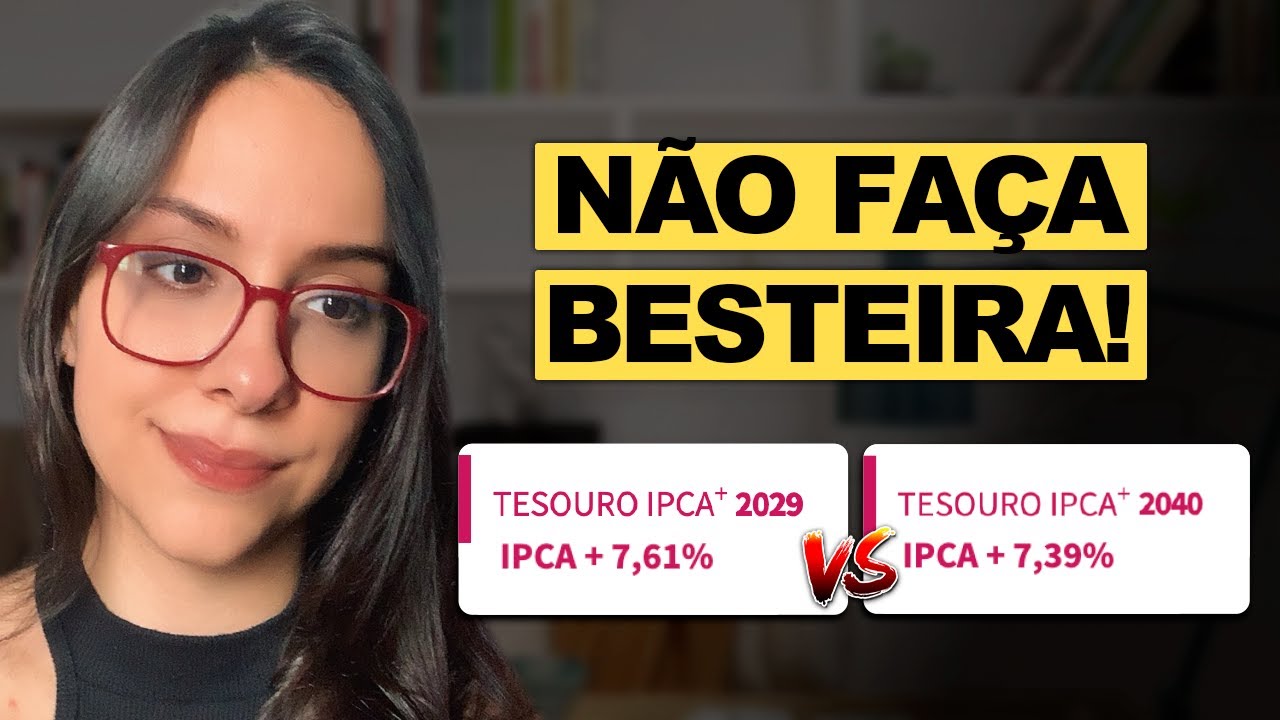

TLDRThis video explores the dynamics of investing in Brazilian fixed-income securities, particularly the Tesouro IPCA+ bonds, in the context of rising interest rates. The host explains the current high yields, why rates are climbing, and the associated risks. Emphasizing the importance of understanding the market and avoiding common traps, the video also highlights the strategic approach of systematic investment and how it has led to impressive returns. With practical tips on when to buy and sell assets, viewers are encouraged to make informed, long-term decisions to avoid the pitfalls of reactive investing.

Takeaways

- 😀 Rigid fixed-income investments, such as Tesouro IPCA+, have become more attractive due to high inflation rates and increased interest rates (14.25% Selic).

- 😀 Recent interest rate hikes are influencing the growing attractiveness of fixed-income products, with higher-than-usual rates like IPCA+7.91% and even IPCA+10.8%.

- 😀 The rise in interest rates is driven by Brazil's fiscal imbalance, which creates higher perceived risk and impacts long-term expectations of economic growth.

- 😀 The curve of future interest rates has shifted to expectations of further increases rather than decreases, leading to higher yields on inflation-linked investments.

- 😀 It’s important to understand the reasons behind the rise in yields on inflation-linked bonds, rather than investing blindly based on higher returns alone.

- 😀 Investing strategies should rely on systematic methods that prioritize fundamentals and help determine when to buy or sell assets, rather than chasing short-term trends.

- 😀 A diversified approach to investing, blending different asset classes such as stocks and fixed income, can enhance returns over time and provide stability in various economic conditions.

- 😀 While inflation-linked bonds can offer substantial returns, it is essential to avoid jumping from one investment to another due to dissatisfaction with recent performance in other asset classes.

- 😀 Investors are often swayed by the popularity of specific asset classes, but real long-term success requires careful portfolio management based on set asset allocations and market movements.

- 😀 Historical patterns show that investors often make the mistake of pulling out of underperforming assets and investing in those performing well, only to lose out on long-term growth opportunities.

- 😀 Following a structured investment strategy and maintaining discipline by focusing on asset allocation can help mitigate risk and maximize long-term returns, regardless of market fluctuations.

Q & A

Why are IPCA+ interest rates continuing to rise in recent years?

-The increase in IPCA+ rates is primarily due to the change in future interest rate expectations. The market now anticipates that the Selic rate, which influences credit costs in Brazil, will remain higher for longer. This adjustment in expectations leads to higher returns on fixed-income securities like IPCA+.

What is the concept of the 'curve of future interest rates' and how does it affect investment decisions?

-The 'curve of future interest rates' represents the market's expectations for the country's interest rates over the coming months and years. It reflects how investors believe the economy will evolve, influencing the yield of fixed-income securities like IPCA+ bonds. A rising curve means higher expected future rates, which leads to higher returns on investments tied to inflation.

What role does Brazil's fiscal situation play in the interest rate hikes?

-Brazil's fiscal challenges, such as its inability to balance public accounts despite record tax revenues, contribute to increased risks in the market. These perceptions of risk lead to higher interest rates as investors demand more return for assuming the risks associated with Brazilian debt.

Is it worth investing in fixed-income securities like Tesouro IPCA+ despite the risk?

-Investing in Tesouro IPCA+ can be a solid choice if you're looking for relatively stable returns above inflation. However, it’s essential to understand the associated risks, such as the country's fiscal instability and inflationary pressure. You should assess your risk tolerance and investment goals before making a decision.

What is the danger of chasing higher returns in the current investment environment?

-The danger lies in the temptation to continuously shift investments in pursuit of the highest possible return. This behavior often leads to buying high and selling low, which can result in lower-than-expected returns. It's essential to have a well-defined investment strategy and avoid jumping from one asset to another based on short-term market movements.

How does the high Selic rate impact fixed-income investments in Brazil?

-The high Selic rate, currently at 14.25%, makes fixed-income investments like Tesouro IPCA+ more attractive due to the higher yields. However, it also makes borrowing more expensive, which can negatively impact economic growth and business profitability. The Selic rate directly affects the return on fixed-income securities.

What was the situation like in 2022 regarding Tesouro IPCA+ rates?

-In 2022, even with a high Selic rate of 13.75%, the Tesouro IPCA+ bonds were yielding much lower rates, such as 5.7% above inflation. This discrepancy highlighted the volatility of the bond market and the unpredictable nature of future interest rate movements.

What is the significance of the current Tesouro IPCA+ rates and how do they compare to historical yields?

-Currently, Tesouro IPCA+ is offering yields around IPCA+ 7-8%, which is significantly higher than the past few years. This presents a strong opportunity for long-term investments, especially when factoring in inflation. It's one of the higher returns seen in recent history, but it still requires careful consideration of associated risks.

How does an investor determine the right time to invest in fixed-income securities like Tesouro IPCA+?

-The right time to invest depends on your individual financial goals, risk tolerance, and the overall market conditions. Investors should focus on long-term strategies and invest when the market conditions align with their goals. For those seeking steady inflation-adjusted returns, the current rates on Tesouro IPCA+ could be a good opportunity.

What is the investment strategy that can help avoid common mistakes in the current market environment?

-The key strategy is to follow a systematic approach to investing, which includes setting clear asset allocation targets, such as a mix of 60% equities and 40% fixed income. This strategy helps investors avoid the temptation to react to short-term market fluctuations and instead focus on long-term goals, buying assets when they are undervalued and selling when they are overvalued.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

TESOURO IPCA+ 2045 ou 2029? | QUAL O MELHOR PARA 2025? IPCA+8%?

Introduction to Investment【Dr. Deric】

GUIA BÁSICO PRA INVESTIR EM RENDA FIXA | TUDO que você PRECISA SABER antes de investir em RENDA FIXA

LFTB11: A MELHOR RENDA FIXA PARA CURTO E MÉDIO PRAZO | CAIO MATHIAS

TESTEI O PORQUINHO DO APLICATIVO DO BANCO INTER EM DÓLAR. O que achei?

O ERRO que MUITOS COMETEM ao INVESTIR no TESOURO IPCA+! TESOURO IPCA+ 2029, 2040 OU 2050?

5.0 / 5 (0 votes)