Ekonomi Moneter Islam - Bagi Hasil dalam Ekonomi Islam

Summary

TLDRThis lecture focuses on the concept of profit-sharing (bagi hasil) in Islamic economics, discussing its relationship with Islamic finance principles. Key points include the distinction between profit-sharing and interest, the factors affecting profit-sharing such as investment ratio and accounting policies, and the application of revenue-sharing models in Indonesia. The lecture also touches on the role of profit-sharing in boosting the real economy, fostering fair wealth distribution, and enhancing productivity. Additionally, it emphasizes how Islamic economics connects money transactions with tangible goods to avoid economic crises, referencing the 2008 financial collapse as a case study.

Takeaways

- 😀 Bagi hasil in Islamic economics is based on sharing both profits and losses, unlike interest, which always results in profit.

- 😀 The concept of Islamic money (or Islamic finance) discusses the time value of money and its application to avoid interest-based transactions.

- 😀 The key difference between profit-sharing and interest is that in profit-sharing, the ratio of profits is tied to actual gains, while interest is fixed and predetermined based on the principal amount.

- 😀 Factors affecting profit-sharing include investment ratios, available funds, and the agreed-upon profit-sharing percentages (nisbah).

- 😀 Expenses and revenues must be defined upfront in a profit-sharing agreement, and only agreed-upon costs should be deducted before sharing profits.

- 😀 Revenue-sharing, as opposed to profit-sharing, is widely adopted in Indonesia because it offers higher returns and attracts more investors to Islamic banks.

- 😀 In profit-sharing agreements, both parties share profits and losses, ensuring equity and fairness, which is a hallmark of Islamic finance.

- 😀 Islamic finance encourages real economic transactions where money must always be linked to tangible assets, avoiding speculative or non-productive investments.

- 😀 The concept of risk-sharing is emphasized in Islamic economics. Both the lender and borrower share risks, and any losses are divided based on the capital invested by each party.

- 😀 In Islamic banking, the relationship between savings and investment is directly affected by expectations of profit-sharing ratios, which in turn influence economic growth and wealth distribution.

Q & A

What is the main focus of the lecture discussed in the transcript?

-The main focus of the lecture is on profit-sharing in Islamic economics, specifically discussing the concept of profit and loss sharing (PLS), its relation to risk and reward, and the ethical implications of financial transactions in Islamic finance.

How does profit-sharing in Islamic finance differ from interest-based systems?

-In Islamic finance, profit-sharing is based on both the potential for profit and the possibility of loss, ensuring that both parties share the risks. In contrast, interest-based systems always guarantee profit for the lender, regardless of the borrower's performance.

What are the key factors that influence profit-sharing in Islamic economics?

-The key factors influencing profit-sharing include the interest rate of investment, the amount of available funds, the agreed-upon profit-sharing ratio (nisbah), and the recognition of income and expenses as specified in the initial agreement.

What is the role of nisbah in determining profit-sharing?

-Nisbah refers to the profit-sharing ratio agreed upon between parties. It determines how the profits are distributed between investors or partners, and it fluctuates based on the actual profits generated. A higher nisbah means a larger share of profit for the investor or partner.

Why is revenue sharing preferred in Indonesia's Islamic banking system?

-Revenue sharing is preferred in Indonesia because it offers higher returns compared to profit-sharing, making it more attractive to investors. Additionally, it incentivizes more people to invest or deposit money in Islamic banks.

What are the potential consequences when a loss occurs in a profit-sharing arrangement?

-When a loss occurs, it is shared based on the proportion of capital each party has invested. If the loss is due to business risk, it is handled by the parties as per their agreement. However, if the loss is due to human error or negligence, the party responsible for the error may bear the loss.

What are the direct and indirect factors affecting profit-sharing?

-Direct factors include the interest rate of investment, the amount of available funds, and the agreed-upon profit-sharing ratio. Indirect factors include the recognition of income and expenses and accounting policies that define what revenue and costs can be included in the profit-sharing arrangement.

How does Islamic finance ensure that economic transactions contribute to the real economy?

-Islamic finance requires that every monetary transaction be backed by real assets or goods, ensuring that the money is used to drive economic activity in the real sector, like investment in goods, services, or production. This helps avoid speculative practices and blindfold economics.

What are the ethical principles behind Islamic profit-sharing arrangements?

-Islamic profit-sharing arrangements emphasize fairness, transparency, and mutual risk-sharing. Both profits and losses are shared based on the contribution of each party, and transactions must be conducted ethically, avoiding exploitative or unjust practices, such as interest-based lending.

How do the concepts of 'profit-sharing' and 'revenue-sharing' differ in Islamic finance?

-In profit-sharing, the profits are distributed after deducting expenses, while in revenue-sharing, the distribution is based on the total revenue without deducting any costs. Revenue-sharing generally results in higher returns for investors, making it a more attractive option for banks and investors in some contexts.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Aplikasi Syari’ah (Ekonomi Islam)

PERBANDINGAN SISTEM EKONOMI ISLAM, KAPITALIS, DAN SOSIALIS

Team 9. Moneter Islam: Kebijakan Syariah, Tanpa Riba dan Pelajaran dari Krisis Venezuela

Definisi,Konsep,Dan Ruang Lingkup EKONOMI ISLAM

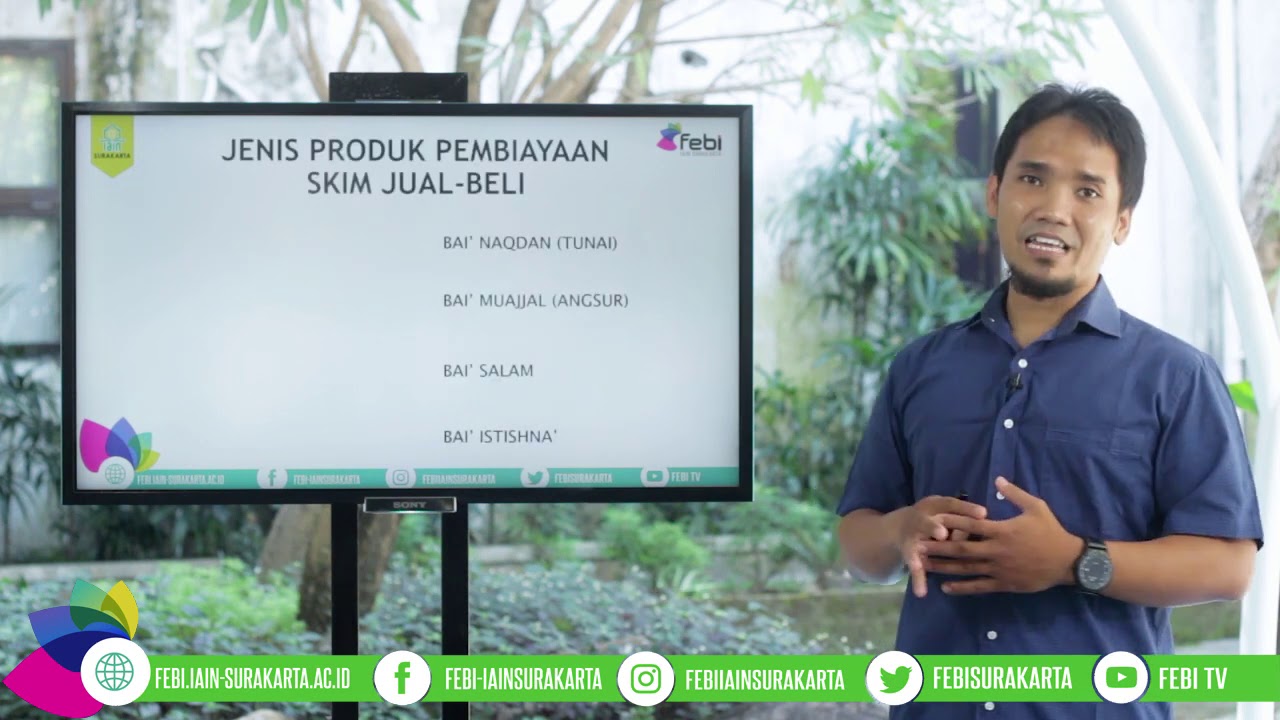

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Pengertian Lembaga Keuangan dalam Islam

5.0 / 5 (0 votes)