🚨 Risque de Faillite de la Réserve Fédérale et la Réserve Stratégique du Bitcoin

Summary

TLDRThis video discusses the controversial proposal by U.S. Senator Cynthia Lummis to establish a strategic reserve of Bitcoin to bolster the U.S. economy amid rising national debt and inflation. While proponents argue that this could enhance the U.S.'s financial leadership and act as a hedge against inflation, critics point out significant risks, including government control over Bitcoin, potential inflationary pressures, and the questionable practicality of the plan. The video ultimately questions the viability of such a reserve and invites viewers to share their opinions on whether this approach is a wise strategy for the future.

Takeaways

- 😀 Bitcoin has garnered increasing interest from both retail and institutional investors, including major financial firms.

- 😀 The approval of Bitcoin ETFs by regulatory bodies signifies a shift in institutional acceptance of cryptocurrencies.

- 😀 The U.S. government holds over 200,000 Bitcoin, positioning it as a significant player in the crypto market.

- 😀 Senator Cynthia Lummis proposed the creation of a strategic Bitcoin reserve to enhance U.S. economic stability.

- 😀 The potential establishment of a Bitcoin reserve raises questions about its viability as a reliable reserve asset comparable to gold.

- 😀 A strategic Bitcoin reserve could solidify the U.S. position as a global financial leader and provide a hedge against national debt.

- 😀 The plan to buy one million Bitcoin would cost approximately $50 billion at current prices, leading to potential price inflation.

- 😀 Concerns exist regarding the control and influence of the U.S. government over Bitcoin, which may contradict its decentralized nature.

- 😀 Economic implications of such a reserve could lead to increased national debt and inflation risks if not managed carefully.

- 😀 Critics argue that while the idea may be appealing, the practical execution poses significant risks for the economy.

Q & A

What has contributed to the growing interest in Bitcoin among various investors?

-The growing interest in Bitcoin has been fueled by both individual and institutional investors, with major financial institutions like Goldman Sachs and BlackRock starting to offer cryptocurrency-related services. Additionally, notable events such as the approval of a Bitcoin ETF by the SEC and El Salvador's adoption of Bitcoin as legal tender have further increased its visibility.

What proposal has Senator Cynthia Lummis made regarding Bitcoin?

-Senator Cynthia Lummis has proposed the creation of a strategic reserve of Bitcoin to enhance the economic position of the United States globally, emphasizing the need for bold actions to secure a better future amid rising inflation and national debt.

How does Lummis envision the implementation of a Bitcoin reserve?

-Lummis's proposal involves establishing a decentralized network of secure Bitcoin vaults managed by the U.S. Treasury, implementing a program to purchase 2 million units of Bitcoin, diversifying funds within the Federal Reserve, and affirming the rights of private Bitcoin holders.

What are the potential benefits of establishing a strategic Bitcoin reserve?

-The potential benefits include solidifying the U.S. position as a global financial leader and allowing the government to leverage Bitcoin's rising value to address national debt.

What challenges could arise from the U.S. government holding Bitcoin as a strategic reserve?

-Challenges include the risk of government control undermining Bitcoin's decentralized nature, potential inflationary pressures from increased money supply, and the possibility of government manipulation of Bitcoin prices.

Why is the current U.S. debt situation significant in the context of the Bitcoin reserve proposal?

-The U.S. national debt, exceeding $35 trillion, necessitates innovative solutions to manage economic burdens, making the concept of a Bitcoin reserve appealing as a potential tool for economic stabilization.

What are the proposed methods for funding the Bitcoin purchases?

-The proposal suggests using the Federal Reserve's profits or leveraging the value of gold reserves held at Fort Knox, although both methods face significant practical challenges.

What historical example is referenced in relation to strategic reserves?

-The text references the U.S. Strategic Petroleum Reserve, established in response to the oil crises of the 1970s, as an example of how governments maintain reserves for national security and economic stability.

How might establishing a Bitcoin reserve impact the Federal Reserve's financial health?

-If the Federal Reserve cannot generate sufficient revenue to cover the costs of increased reserves, it could lead to financial losses, potentially necessitating further government intervention or exacerbating public debt.

What philosophical stance does economist Thomas Sowell take regarding policies?

-Thomas Sowell suggests that policies should be judged based on their outcomes rather than intentions, implying that well-meaning policies can have adverse effects.

What is the overall conclusion regarding the proposal to establish a Bitcoin strategic reserve?

-The proposal to establish a strategic reserve of Bitcoin appears to carry significant risks for national economic stability, with concerns over government control and inflation, leading to skepticism about its feasibility and effectiveness.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Trump says US will sell $5M ‘gold cards’ to foreigners: ‘Green card privileges-plus’

Your Prophet Muhammad ﷺ Married A 9 Year Old? | Youssef Soussi

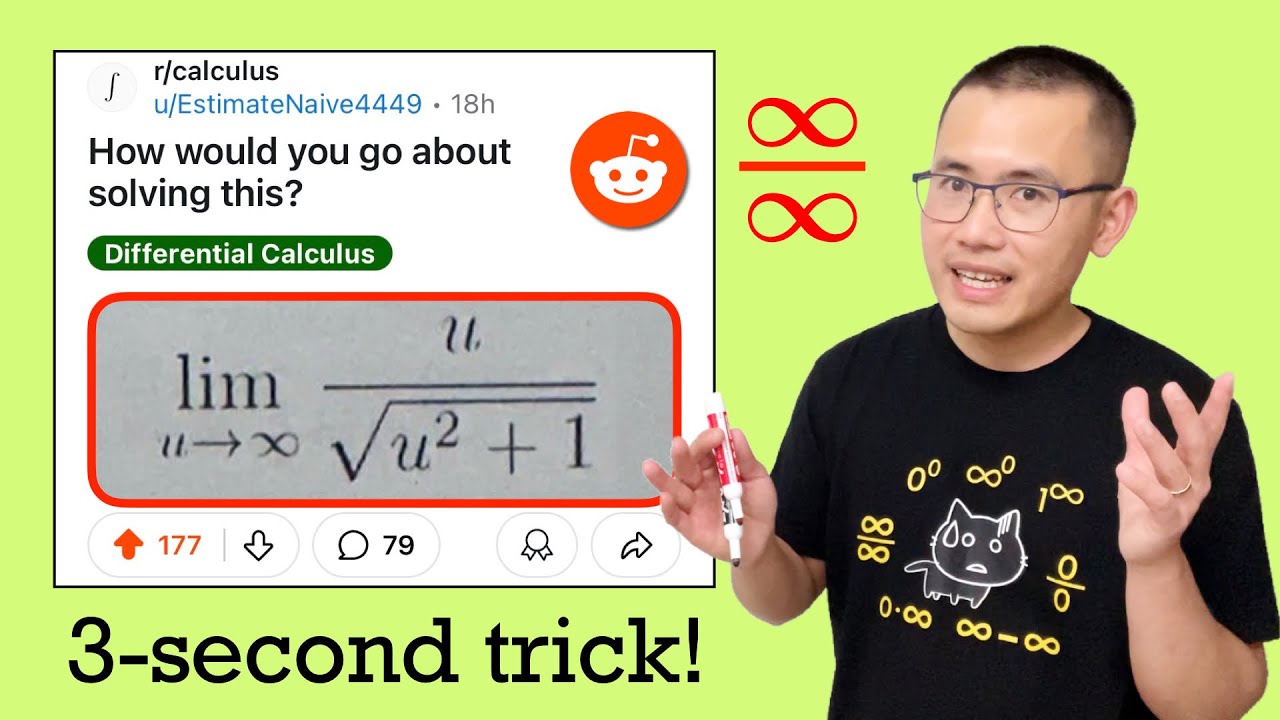

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Trump et Gaza : le droit et l'histoire | Le Dessous des Cartes | ARTE

The DNC Is Already a Complete DISASTER

No Tax on Social Security Income? The Truth About Trump's Plan and What It Means for You

5.0 / 5 (0 votes)