ANALISI DEI MERCATI: CINA RIMBALZO FINITO? USA IL DEBITO CRESCE E L'INFLAZIONE RISCHIA DI RIPARTIRE

Summary

TLDRIn this engaging discussion, the speaker highlights the current economic landscape, focusing on key markets like China, Japan, Europe, and the U.S. China faces challenges with a real estate bubble and recent market volatility, while Japan is expected to gradually raise interest rates. The European Central Bank's delay in stimulating growth raises concerns, especially as Germany struggles. With U.S. elections approaching, potential increases in national debt and inflation loom large. Overall, the analysis encourages proactive investment strategies and invites individuals with liquid assets to explore opportunities for financial growth.

Takeaways

- 😀 A free checkup is available to help you understand how to make your money grow faster, especially for funds that are stagnant in banks.

- 📈 China has experienced a significant 42% rise in its stock index but is facing challenges due to real estate bubbles and infrastructure issues.

- ⚠️ Despite recent gains, investors should be cautious about increasing their investments in China without solid economic fundamentals.

- 🇯🇵 Japan's central bank is expected to gradually increase interest rates, which may strengthen the Yen.

- 🇪🇺 The European Central Bank has cut rates again, but it is seen as lagging in stimulating economic recovery, particularly in Germany's struggling automotive sector.

- 💰 The U.S. is approaching elections, with both candidates planning to increase spending, potentially leading to inflation and tension between the government and the Fed.

- 📊 The Eurostoxx index remains strong, close to historical highs, but requires a daily close above 4990-5000 to maintain momentum.

- 📉 The German DAX index continues to reach new highs despite economic slowdowns, raising concerns about the sustainability of this trend.

- 📉 The Euro is weakening after the ECB's rate cut, with potential targets for decline set around 0.950 and lower.

- 💵 The S&P 500 is near historical highs and is expected to reach 6000 points, particularly after the U.S. elections.

- 🌍 Global gold prices are rising amid ongoing geopolitical tensions, as investors seek safety in gold during crises.

Q & A

What was the primary focus of the discussion in the video?

-The discussion primarily focused on the current state of financial markets, including economic conditions in China, Japan, Europe, and the United States, as well as investment strategies and market trends.

What recent movement occurred in the Chinese stock market?

-The Chinese stock market experienced a 42% rise over two weeks, followed by a significant correction after speculation about government support was refuted.

What are the concerns regarding China's economic situation?

-Concerns include a real estate bubble due to overinvestment in infrastructure that lacks demand, leading to a challenging economic environment.

What expectations are there for Japan's monetary policy?

-There are expectations for gradual interest rate increases from the Bank of Japan, aiming to stimulate the economy, in contrast to China's current economic strategy.

How has the European Central Bank responded to economic challenges?

-The European Central Bank has cut interest rates, but the speaker believes this response is reactive and that the bank is behind in stimulating the economy.

What issues are currently affecting Germany's economy?

-Germany is facing significant challenges in the automotive sector, which could lead to broader economic repercussions across Europe.

What potential risks does the speaker identify concerning the upcoming U.S. elections?

-The speaker identifies risks related to increased government spending and potential inflation as candidates propose aggressive fiscal policies.

What market trends are highlighted regarding the Eurostocks and DAX indices?

-Eurostocks are near historical highs with some volatility concerns, while the DAX continues to set new highs despite economic uncertainty in Germany.

What is the outlook for gold prices according to the video?

-Gold prices are expected to remain strong and bullish, driven by geopolitical tensions and market uncertainty.

What recommendations does the speaker offer to viewers regarding their investments?

-The speaker encourages viewers to participate in a free financial check-up to assess their investment strategies, especially for those with at least 5,000 euros to invest.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

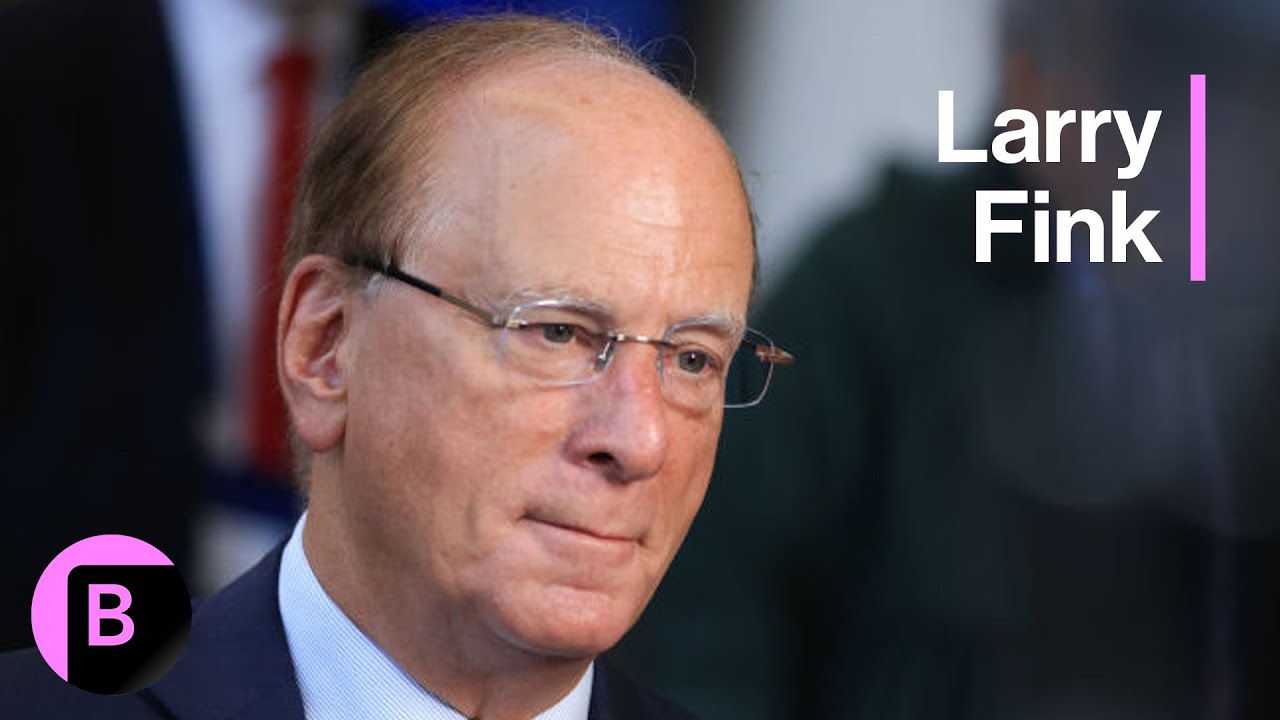

BlackRock CEO Larry Fink on US Economy, Trump Vs. Harris, Geopolitical Risks (Full Interview)

¿Qué riesgos económicos estamos viendo? 📉🫠📉

"Society Is One Big Ponzi Scheme" - Warning On Elites, Debt & Reverse Market Crash | Raoul Pal

"MOST Don't Know It YET..." - Richard Wolff

Bitcoin, 11 Altcoin, ABD ve Çin Piyasası Son Durum

The coming population crisis

5.0 / 5 (0 votes)