Oracle ERP and EPM Cloud: A Day in the Life of Tomorrow's CFO

Summary

TLDRIn this fast-paced corporate setting, the CFO Meredith navigates a critical acquisition, utilizing Oracle's financial tools to run projections and adjust bid ranges by 20%. Amidst competitive bids and supply chain challenges, she leverages the company's intelligent performance management system to forecast sales and strategically assess the impact of increased costs. With a keen eye on security and compliance, Meredith models various scenarios, confidently deciding to raise the bid by 20%, ensuring the company remains in a strong position to secure the deal and drive future growth.

Takeaways

- 💼 Being a CFO in today's business environment requires staying ahead and making strategic decisions quickly.

- 📈 Oracle's financial projections are crucial for running acquisition bids, with the bid range increased by 20%.

- 🗂️ The CFO has to balance personal and professional life, as shown by the character considering a weekend trip while handling an acquisition.

- 📊 Oracle's revenue by product feature is used to analyze financial data, which is vital for decision-making.

- 🔄 The CFO must be prepared for unexpected challenges, such as a competing bid, and have the agility to adjust financial models accordingly.

- 💹 The financial impact of a merger is analyzed over an eight-quarter period, with a focus on debt to equity ratios.

- 📈 The company's performance management system suggests that increasing the sales force could lead to significant revenue growth.

- 💸 The CFO considers the financial implications of the acquisition, including the impact of additional supply chain costs.

- 🔒 Security and compliance are integral parts of the integration process, with the company's cloud platform ensuring smooth operations and up-to-date global compliance.

- 📈 The company is confident in its financial modeling, even in the face of competing bids, and is ready to increase its bid by 20% to secure the deal.

- ✅ The final decision to proceed with the acquisition is made through a vote, demonstrating the collaborative nature of high-stakes financial decisions.

Q & A

What does the CFO need to be prepared for in today's business environment?

-The CFO needs to always be a step ahead, running projections and being ready to adapt to changes such as increased acquisition bid ranges.

What is the context of the CFO's weekend plans mentioned in the script?

-The CFO is considering a weekend trip to the mountains with Maddie and Tara, but an acquisition might complicate the plans.

What does the script imply about the CFO's use of Oracle's capabilities?

-The CFO uses Oracle to show revenue by product and to run financials with updated data, indicating reliance on technology for decision-making.

How does the script suggest the CFO handles a competing bid?

-The CFO is proactive, having already run financials with updated revenue data and higher bid numbers to address the competing bid.

What is the implication of the new merger on the company's debt to equity ratio?

-The debt to equity ratio will be higher for the first two quarters after the merger but will stabilize by the third quarter.

How does the script describe the impact of the acquisition on sales?

-The acquisition is expected to increase sales, with the company's intelligence performance management system suggesting a $300 million increase in sales with 100 reps.

What is the script's stance on the additional supply chain costs due to the acquisition?

-The script suggests that the increased production capacity from the acquisition will offset the 70% increase in supply chain costs by reaching customers more quickly.

How does the script address the issue of security and compliance standards post-acquisition?

-The script indicates that the company's integrated cloud platform ensures streamlined integrations and that global compliance standards are always up to date.

What strategy does the CFO consider in response to a competing bid?

-The CFO considers increasing the bid by 20%, having modeled several competing scenarios and being in a position of strength to justify the price.

What is the final decision made by the team regarding the acquisition?

-The team votes in favor of a competitive bid, indicating a decision to increase the acquisition bid.

How does the script portray the CFO's role and capabilities?

-The script portrays the CFO as a superwoman, capable of handling complex financial scenarios and making strategic decisions that impact the company's future.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Biggest Fraud in History - The Enron Scandal Explained

Tutorial Proteus 8 Professional para principiantes

Will Qwel NERF Bassie?

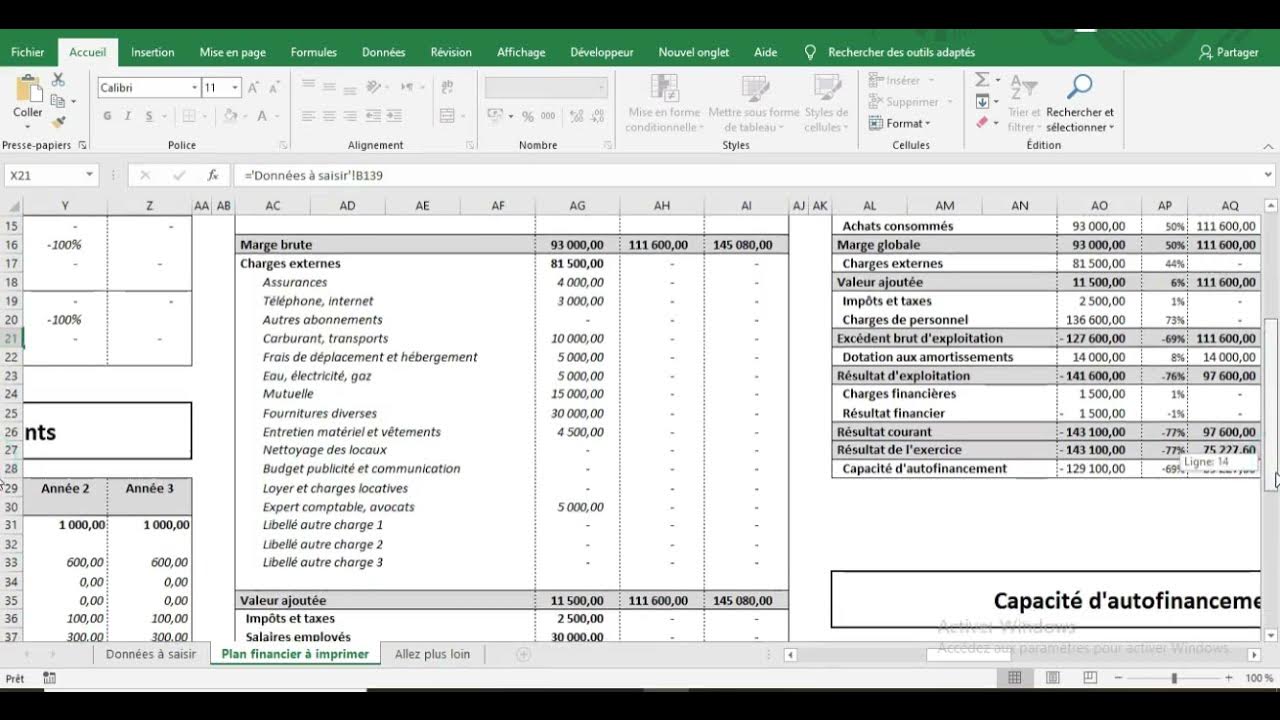

Business Plan : Plan Financier Prévisionnel sur 3 ans دراسة مالية لمشروع شرح مبسط جداا

Strategi Navigasi Menuju Profitabilitas Tinggi | Stanley Iriawan, CFO PT Elnusa Tbk.

2017-03-16-Intro-to-Java-1-what is java.mp4

5.0 / 5 (0 votes)