PKWU Kelas XII - Biaya Produksi, Harga jual dan Perhitungan laba Rugi || Seri Pembelajaran Daring

Summary

TLDRThe video script is a lesson from an Indonesian educator about the fundamentals of production costs, sales pricing, and profit-loss calculations. The instructor explains the concepts of fixed costs (like salaries, electricity, and equipment depreciation) and variable costs (like raw materials and packaging). The lesson emphasizes the importance of understanding these costs in both small and large-scale businesses. By providing examples and simple calculations, the instructor guides the audience on how to determine selling prices and calculate profits, making the content practical for students and aspiring entrepreneurs. The session ends with a Q&A to clarify any doubts.

Takeaways

- 📝 The lesson begins with a greeting and a reminder to start with a prayer, emphasizing the importance of starting the day positively.

- 📊 The topic of the lesson is the analysis of production costs, selling prices, and profit-loss calculations, which have been discussed in previous classes.

- 🏭 Key learning objectives include analyzing production costs, selling prices, and profit-loss statements for modified traditional foods.

- 📉 Production costs are divided into fixed costs (such as wages, electricity, and equipment depreciation) and variable costs (which depend on the amount produced).

- 🔧 Equipment depreciation is calculated over its useful life, with a simple method dividing the cost by the number of months it is expected to be used.

- 💼 Fixed costs, like wages and electricity, must be paid every month regardless of the production level, making them crucial to budget planning.

- 📦 Variable costs include raw materials and packaging, which vary depending on production volume.

- 💡 The selling price is determined by adding a desired profit margin to the production cost. For example, adding 20% profit to a cost of IDR 56,000 results in a selling price of IDR 67,200.

- 📈 Profit or loss is calculated by subtracting total costs from total revenue. A positive result indicates profit, while a negative result indicates a loss.

- 📚 The lesson ends with a practical exercise where students calculate profit or loss based on given data, reinforcing the concepts learned.

Q & A

What is the first step before starting the lesson according to the transcript?

-The first step is to begin the lesson with a prayer.

What main topic is being discussed in this lesson?

-The lesson focuses on production costs, selling prices, and profit-loss calculations in the context of food processing businesses.

What are the components of fixed costs in production?

-Fixed costs include salaries or wages, electricity costs, and depreciation of equipment.

How is the depreciation of equipment calculated?

-Depreciation is calculated using the straight-line method, where the total cost of the equipment is divided by the number of months it is expected to be used.

Why is it important to set aside money for equipment depreciation?

-Setting aside money for depreciation is important because it ensures that funds are available to replace equipment when it is no longer usable.

What is the difference between fixed costs and variable costs?

-Fixed costs remain constant each month regardless of production levels, while variable costs change depending on the quantity of goods produced.

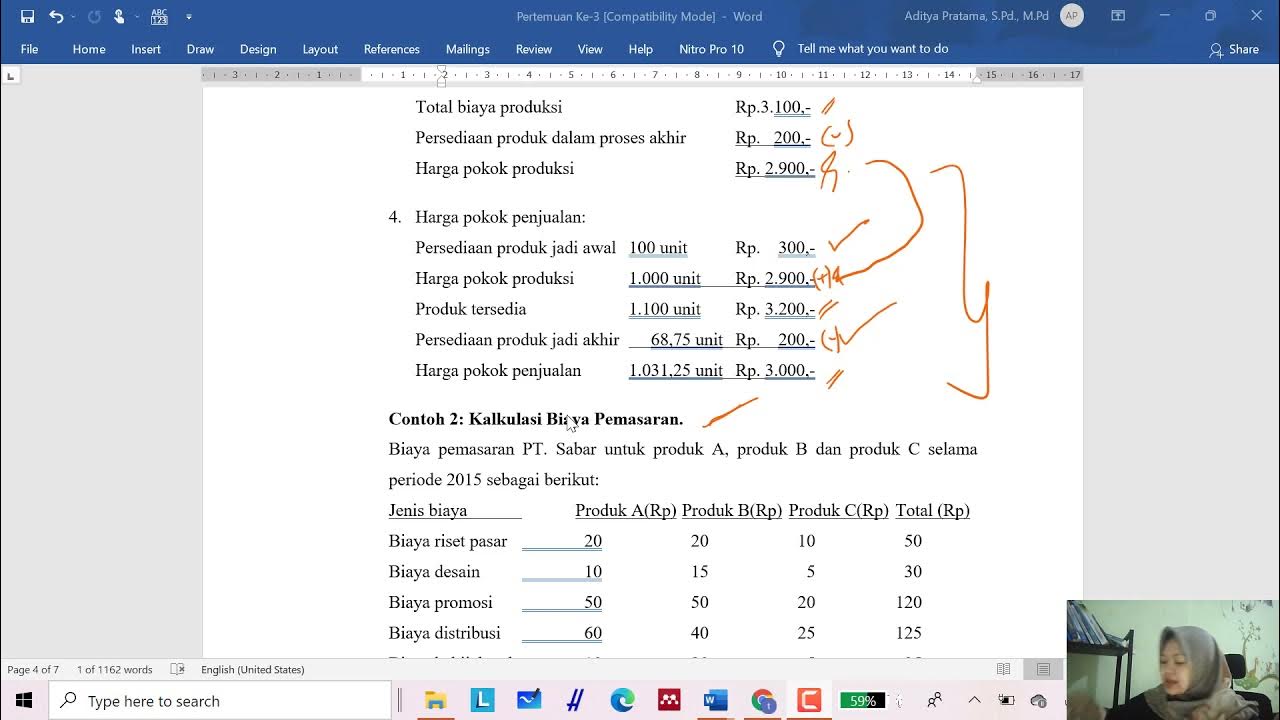

How do you calculate the cost of goods sold (COGS)?

-COGS is calculated by adding the fixed costs and variable costs, then dividing by the total number of units produced.

How do you determine the selling price of a product?

-The selling price is determined by adding a desired profit margin to the cost of goods sold (COGS).

What is the definition of gross revenue?

-Gross revenue is the total income generated from sales before any costs or expenses are deducted.

What is the significance of calculating profit and loss?

-Calculating profit and loss helps determine whether a business is making money or incurring a loss, which is crucial for evaluating the business's financial health.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Titik Impas (Break Even Point) Usaha Makanan Internasional- Prakarya dan Kewirausahaan Kelas 11

PKWU X | PERHITUNGAN BIAYA PRODUKSI PRODUK KERAJINAN

KALKULASI BIAYA DAN LABA RUGI / AKUNTANSI MANAJEMEN PERTEMUAN 3

Perhitungan BEP (Break Even Point) - Materi PKWU

Biaya Produksi - Materi PKK Kelas XI || Production Cost

[MEET 7] PENGANGGARAN - ANGGARAN LABA RUGI

5.0 / 5 (0 votes)